Attorney-Approved Real Estate Purchase Agreement Form for West Virginia

Dos and Don'ts

When filling out the West Virginia Real Estate Purchase Agreement form, it's important to be thorough and accurate. Here’s a list of things you should and shouldn't do to ensure a smooth process.

- Do read the entire agreement carefully before starting.

- Do provide accurate and complete information about the property.

- Do include all necessary parties' names and contact information.

- Do specify the purchase price clearly.

- Do outline any contingencies, like financing or inspections.

- Don't leave any sections blank; incomplete forms can lead to delays.

- Don't use vague language; be specific about terms and conditions.

- Don't forget to include the closing date and location.

- Don't rush through the process; take your time to ensure accuracy.

Common mistakes

-

Inaccurate Property Description: Buyers and sellers often fail to provide a complete and precise description of the property. Omitting details such as the property address, legal description, or parcel number can lead to confusion and disputes later on.

-

Incorrect Names: It’s crucial to list the correct legal names of all parties involved in the transaction. Using nicknames or incorrect spellings can create issues with ownership and legal rights.

-

Missing Signatures: A common oversight is neglecting to sign the agreement. Without signatures from all parties, the contract may be deemed unenforceable.

-

Failure to Specify Terms: Vague terms regarding the purchase price, deposit amount, or closing date can lead to misunderstandings. Clear, specific terms help ensure that everyone is on the same page.

-

Ignoring Contingencies: Buyers often forget to include important contingencies, such as financing or inspection clauses. These contingencies protect buyers and should be clearly stated in the agreement.

-

Omitting Disclosure Requirements: Sellers must disclose certain information about the property, including known defects or issues. Failing to do so can result in legal repercussions and loss of trust.

-

Not Reviewing Deadlines: Missing deadlines for contingencies, inspections, or other critical steps can jeopardize the transaction. It’s important to keep track of all dates outlined in the agreement.

-

Neglecting to Seek Professional Help: Many individuals attempt to fill out the form without consulting a real estate agent or attorney. Professional guidance can help avoid mistakes and ensure compliance with state laws.

Documents used along the form

When engaging in real estate transactions in West Virginia, several important documents accompany the Real Estate Purchase Agreement. Each of these forms serves a specific purpose, ensuring that both buyers and sellers are protected and informed throughout the process. Below is a list of commonly used documents in conjunction with the purchase agreement.

- Property Disclosure Statement: This document requires the seller to disclose any known issues or defects with the property. It helps buyers make informed decisions by revealing the property's condition.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers of potential lead hazards. It ensures that buyers are aware of the risks associated with lead-based paint.

- Financing Addendum: If the buyer is obtaining a mortgage, this addendum outlines the terms of the financing. It includes details like loan type, interest rates, and any contingencies related to financing.

- Inspection Contingency: This clause allows the buyer to have the property inspected within a specified time frame. If significant issues are found, the buyer can negotiate repairs or back out of the deal.

- Title Commitment: This document outlines the condition of the title to the property. It ensures that the seller has the legal right to sell the property and identifies any liens or encumbrances.

- Closing Statement: Prepared by the closing agent, this document itemizes all costs associated with the transaction. It provides a clear breakdown of what each party owes at closing.

- Deed: The deed is the legal document that transfers ownership from the seller to the buyer. It must be signed and recorded to ensure the buyer's ownership rights.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents provide information about rules, fees, and regulations that govern the community.

Understanding these documents is crucial for anyone involved in a real estate transaction. Each form plays a vital role in protecting the interests of both buyers and sellers, ensuring a smooth and transparent process. Familiarity with these documents can lead to a more informed and confident experience in the real estate market.

File Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The West Virginia Real Estate Purchase Agreement is governed by the West Virginia Code, specifically Chapter 36. |

| Purpose | This form is used to outline the terms and conditions for the sale of real estate in West Virginia. |

| Parties Involved | The agreement identifies the buyer and seller, ensuring both parties are clearly defined. |

| Property Description | A detailed description of the property being sold is required, including address and legal description. |

| Purchase Price | The form specifies the purchase price and any deposit required to secure the agreement. |

| Contingencies | Common contingencies, such as financing or inspections, can be included to protect both parties. |

Key takeaways

When filling out and utilizing the West Virginia Real Estate Purchase Agreement form, several important considerations come into play. Understanding these key takeaways can facilitate a smoother transaction process.

- Accuracy is Essential: Ensure that all information entered into the form is accurate. This includes details about the property, buyer, and seller. Errors can lead to complications during the closing process.

- Contingencies Matter: Clearly outline any contingencies, such as financing or inspection requirements. These clauses protect the buyer and seller by establishing conditions under which the agreement remains valid.

- Review Deadlines: Pay close attention to deadlines specified in the agreement. Timely responses and actions are critical to maintaining the terms of the contract and avoiding potential disputes.

- Consult Professionals: It is advisable to seek guidance from real estate professionals or legal experts. Their insights can help navigate complex issues and ensure compliance with state laws.

Example - West Virginia Real Estate Purchase Agreement Form

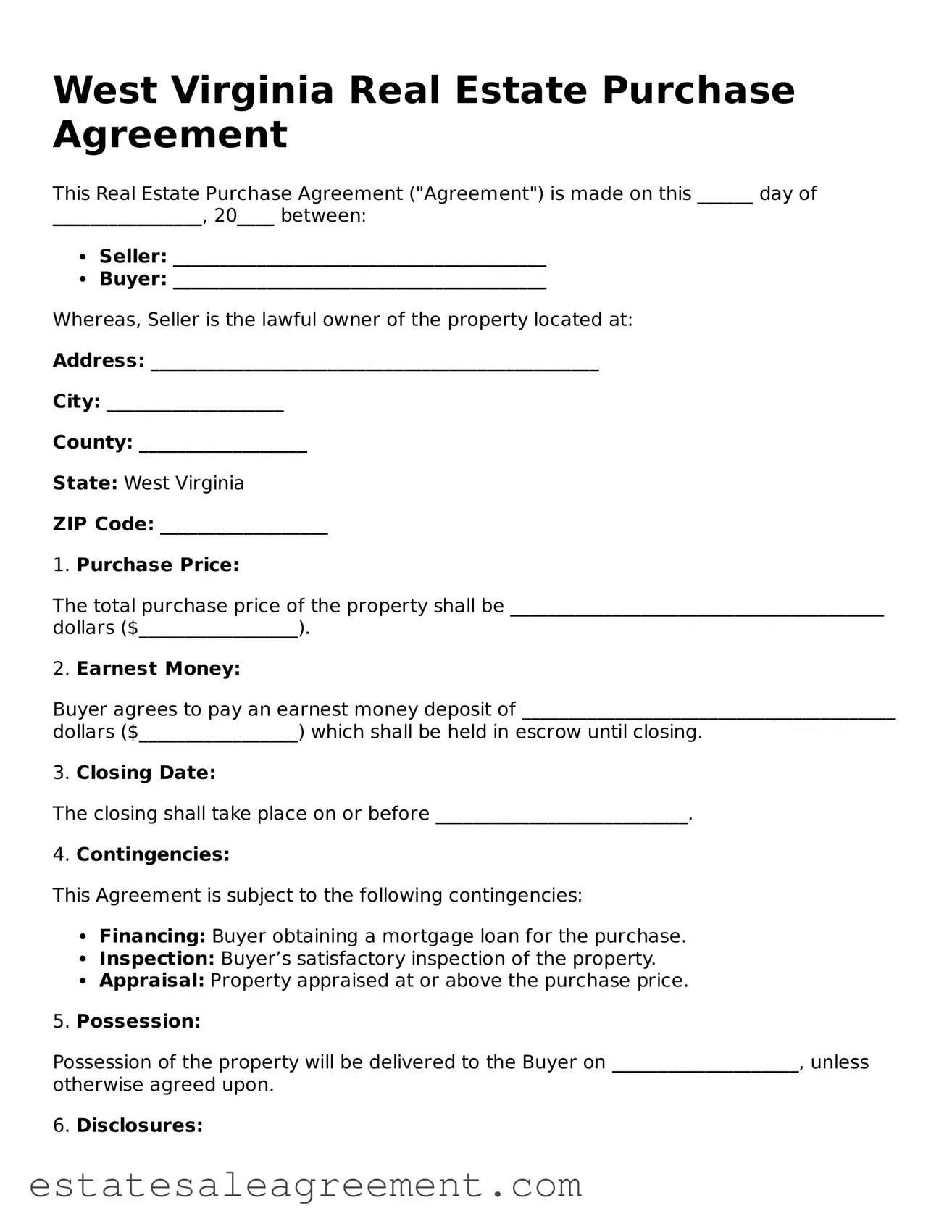

West Virginia Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made on this ______ day of ________________, 20____ between:

- Seller: ________________________________________

- Buyer: ________________________________________

Whereas, Seller is the lawful owner of the property located at:

Address: ________________________________________________

City: ___________________

County: __________________

State: West Virginia

ZIP Code: __________________

1. Purchase Price:

The total purchase price of the property shall be ________________________________________ dollars ($_________________).

2. Earnest Money:

Buyer agrees to pay an earnest money deposit of ________________________________________ dollars ($_________________) which shall be held in escrow until closing.

3. Closing Date:

The closing shall take place on or before ___________________________.

4. Contingencies:

This Agreement is subject to the following contingencies:

- Financing: Buyer obtaining a mortgage loan for the purchase.

- Inspection: Buyer’s satisfactory inspection of the property.

- Appraisal: Property appraised at or above the purchase price.

5. Possession:

Possession of the property will be delivered to the Buyer on ____________________, unless otherwise agreed upon.

6. Disclosures:

The Seller agrees to provide the Buyer with all necessary property disclosures as required by West Virginia law.

7. Applicable Law:

This Agreement shall be governed by the laws of the state of West Virginia.

IN WITNESS WHEREOF, the parties have executed this Agreement on the date first above written.

_____________________________

Seller's Signature

Date: ______________________

_____________________________

Buyer's Signature

Date: ______________________

What to Know About This Form

What is a West Virginia Real Estate Purchase Agreement?

A West Virginia Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This agreement typically includes essential details such as the purchase price, the property description, and the closing date. It serves as a roadmap for both parties, ensuring clarity and mutual understanding throughout the transaction process.

What key elements should be included in the agreement?

Several critical components must be present in a Real Estate Purchase Agreement. First, the names of both the buyer and seller should be clearly stated. Next, a thorough description of the property, including its address and any relevant legal descriptions, is necessary. The purchase price, along with the amount of earnest money, should be specified. Additionally, contingencies, such as financing or inspection requirements, must be outlined to protect both parties. Lastly, the agreement should detail the closing process, including the date and any obligations that need to be fulfilled prior to closing.

Can the agreement be modified after it is signed?

Yes, a Real Estate Purchase Agreement can be modified after it is signed, but both parties must agree to any changes. It is advisable to document these modifications in writing to avoid misunderstandings. This can be done through an addendum, which should be signed by both the buyer and the seller. Clear communication is essential to ensure that all parties are on the same page regarding any alterations to the original agreement.

What happens if one party does not fulfill their obligations?

If one party fails to meet their obligations as outlined in the agreement, the other party may have several options. Typically, the non-breaching party can seek to enforce the agreement, which may involve legal action. Alternatively, they may choose to negotiate a resolution with the other party. In some cases, the agreement may include specific remedies for breach, such as the forfeiture of earnest money or the right to seek damages. It is crucial for both parties to understand their rights and responsibilities to mitigate potential disputes.

Fill out Other Real Estate Purchase Agreement Templates for Specific States

Arkansas Real Estate Contract - States the purchase price and payment terms for the property.

Texas Real Estate Commision - Notes any contingencies for the sale of the buyer's existing property.