Attorney-Approved Real Estate Purchase Agreement Form for Washington

Dos and Don'ts

When filling out the Washington Real Estate Purchase Agreement form, it’s essential to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do: Read the entire form carefully before starting.

- Do: Provide accurate and complete information about the property.

- Do: Include all necessary dates, such as the offer date and closing date.

- Do: Clearly outline any contingencies, such as financing or inspection.

- Do: Sign and date the agreement in the appropriate places.

- Don't: Leave any sections blank; incomplete forms can lead to issues.

- Don't: Use vague language; be specific in your terms.

- Don't: Forget to include any agreed-upon repairs or concessions.

- Don't: Assume all parties understand the terms; clarify where needed.

Following these guidelines will help ensure a smoother transaction process.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all necessary details. Buyers and sellers should ensure that their names, addresses, and contact information are fully completed. Omitting this information can lead to confusion and delays in the transaction.

-

Incorrect Property Description: The property must be accurately described. Errors in the address, legal description, or parcel number can create significant issues. Such inaccuracies can lead to disputes or even invalidate the agreement.

-

Missing Signatures: All parties involved in the transaction must sign the agreement. A common oversight is neglecting to obtain the necessary signatures. Without these, the contract may not be legally binding.

-

Ignoring Contingencies: Buyers often overlook the importance of contingencies, such as financing or inspection clauses. These contingencies protect buyers and should be clearly stated in the agreement to avoid future complications.

-

Failure to Specify Closing Date: A specific closing date should be included in the agreement. Without it, parties may have different expectations regarding when the transaction will be finalized, leading to misunderstandings.

-

Not Understanding Earnest Money: The earnest money deposit is a crucial aspect of the agreement. Buyers should be clear about the amount and the conditions under which it may be forfeited. Misunderstanding these terms can result in financial loss.

-

Neglecting to Review Terms: It is vital for all parties to thoroughly review the terms of the agreement. Rushing through this process can lead to missed clauses or unfavorable conditions. Taking the time to understand the terms is essential for a smooth transaction.

-

Assuming Standard Clauses are Sufficient: Many people assume that standard clauses in the agreement will cover their specific situation. However, each transaction is unique, and relying solely on generic language may not adequately protect one’s interests.

Documents used along the form

When engaging in a real estate transaction in Washington, several important forms and documents accompany the Real Estate Purchase Agreement. Each of these documents plays a crucial role in ensuring that the process runs smoothly and that both parties are protected. Below is a list of commonly used documents in conjunction with the Purchase Agreement.

- Seller's Disclosure Statement: This document provides potential buyers with information about the property's condition, including any known defects or issues. It is essential for transparency and helps buyers make informed decisions.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about the potential risks of lead-based paint. Sellers must disclose any known lead hazards to protect the health of future occupants.

- Financing Addendum: This document outlines the terms of the buyer's financing, including loan type, amount, and any contingencies related to securing a mortgage. It clarifies how the purchase will be funded.

- Inspection Contingency: This form allows buyers to conduct a home inspection within a specified timeframe. It protects buyers by enabling them to renegotiate or withdraw their offer based on the inspection results.

- Title Report: A title report provides information about the property's ownership history and any liens or encumbrances. This document is crucial for ensuring that the buyer receives clear title to the property.

- Closing Disclosure: This document outlines the final terms of the loan, including all closing costs. It must be provided to the buyer at least three days before closing to ensure transparency in the transaction.

- Deed: The deed is the legal document that transfers ownership of the property from the seller to the buyer. It must be signed and recorded to complete the sale.

- Escrow Agreement: This agreement outlines the terms under which an escrow agent will hold funds and documents until all conditions of the sale are met. It ensures that both parties fulfill their obligations before the transaction is finalized.

Understanding these documents is vital for anyone involved in a real estate transaction. Each one serves a specific purpose, contributing to a comprehensive and secure process for both buyers and sellers. Being well-informed can lead to a smoother transaction and better outcomes for all parties involved.

File Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The Washington Real Estate Purchase Agreement is governed by the laws of the State of Washington. |

| Purpose | This form outlines the terms and conditions for the sale of real estate in Washington. |

| Parties Involved | The agreement typically involves a buyer and a seller, both of whom must be identified in the document. |

| Property Description | A detailed description of the property being sold is required, including its address and legal description. |

| Purchase Price | The total purchase price must be clearly stated, along with any earnest money deposit. |

| Contingencies | Common contingencies include financing, inspections, and the sale of the buyer's current home. |

| Closing Date | The agreement should specify a closing date, which is the date when the transaction is finalized. |

| Disclosures | Sellers are required to provide certain disclosures about the property’s condition and history. |

| Signatures | Both parties must sign the agreement for it to be legally binding. |

| Amendments | Any changes to the agreement must be made in writing and signed by both parties. |

Key takeaways

When dealing with the Washington Real Estate Purchase Agreement form, it's essential to understand several key aspects to ensure a smooth transaction. Here are some important takeaways:

- The form outlines the terms and conditions of the sale, including the purchase price and closing date.

- Buyers and sellers should provide accurate information to avoid misunderstandings or legal issues.

- Contingencies, such as financing or inspection, can be included to protect the buyer's interests.

- Both parties must sign the agreement for it to be legally binding.

- It is advisable to consult with a real estate agent or attorney when filling out the form.

- Amendments to the agreement can be made, but they should be documented in writing.

- Once the agreement is signed, it initiates the process of transferring ownership, so all parties should be prepared for the next steps.

Understanding these points can help ensure that the transaction proceeds smoothly and that both buyers and sellers are adequately protected throughout the process.

Example - Washington Real Estate Purchase Agreement Form

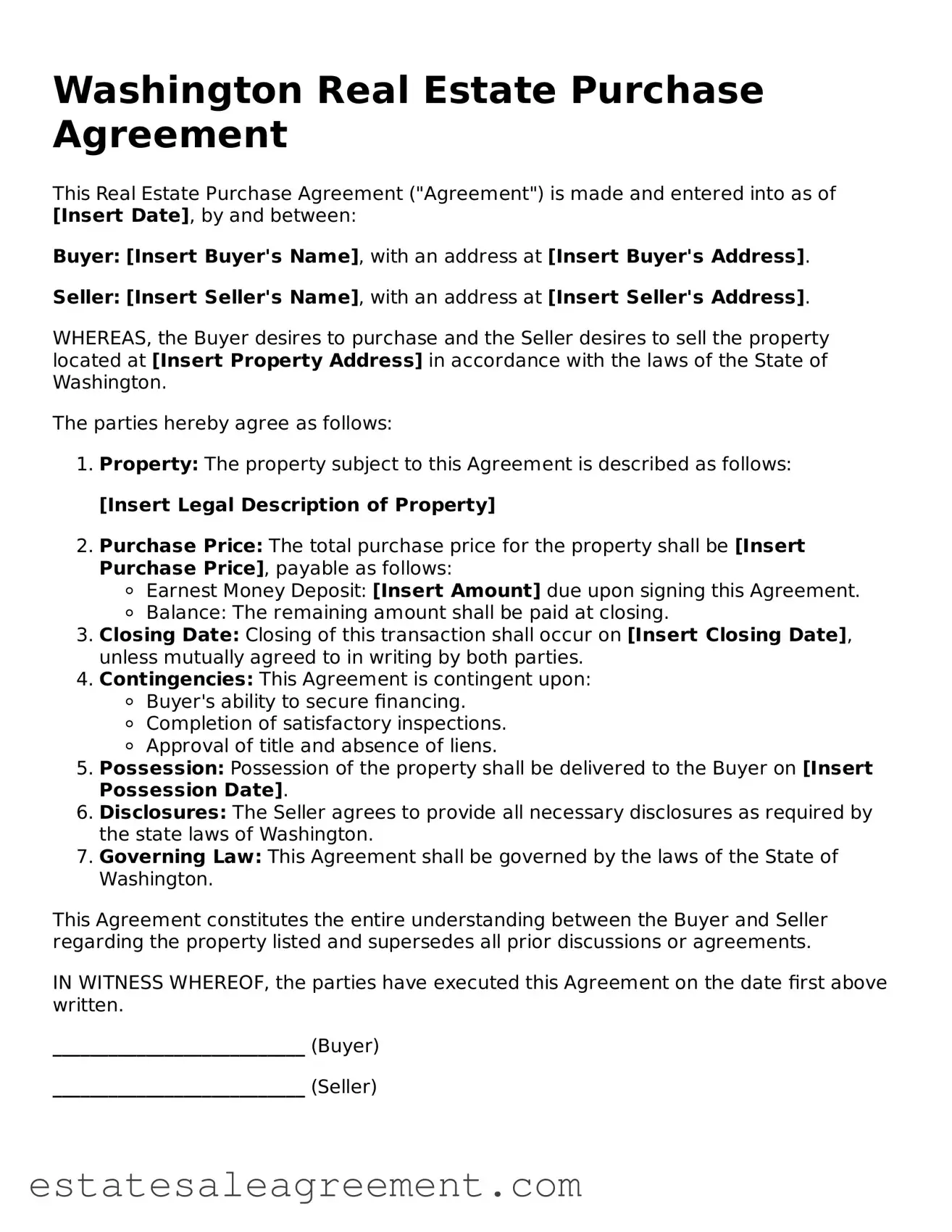

Washington Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made and entered into as of [Insert Date], by and between:

Buyer: [Insert Buyer's Name], with an address at [Insert Buyer's Address].

Seller: [Insert Seller's Name], with an address at [Insert Seller's Address].

WHEREAS, the Buyer desires to purchase and the Seller desires to sell the property located at [Insert Property Address] in accordance with the laws of the State of Washington.

The parties hereby agree as follows:

- Property: The property subject to this Agreement is described as follows:

- Purchase Price: The total purchase price for the property shall be [Insert Purchase Price], payable as follows:

- Earnest Money Deposit: [Insert Amount] due upon signing this Agreement.

- Balance: The remaining amount shall be paid at closing.

- Closing Date: Closing of this transaction shall occur on [Insert Closing Date], unless mutually agreed to in writing by both parties.

- Contingencies: This Agreement is contingent upon:

- Buyer's ability to secure financing.

- Completion of satisfactory inspections.

- Approval of title and absence of liens.

- Possession: Possession of the property shall be delivered to the Buyer on [Insert Possession Date].

- Disclosures: The Seller agrees to provide all necessary disclosures as required by the state laws of Washington.

- Governing Law: This Agreement shall be governed by the laws of the State of Washington.

[Insert Legal Description of Property]

This Agreement constitutes the entire understanding between the Buyer and Seller regarding the property listed and supersedes all prior discussions or agreements.

IN WITNESS WHEREOF, the parties have executed this Agreement on the date first above written.

___________________________ (Buyer)

___________________________ (Seller)

What to Know About This Form

What is the Washington Real Estate Purchase Agreement form?

The Washington Real Estate Purchase Agreement form is a legal document that outlines the terms and conditions of a real estate transaction in Washington State. It serves as a binding contract between the buyer and seller, detailing the purchase price, property description, and any contingencies that must be met for the sale to proceed.

Who needs to use this form?

This form is typically used by individuals or entities involved in the buying and selling of residential real estate in Washington. Both buyers and sellers should utilize the form to ensure that their rights and obligations are clearly defined and legally enforceable.

What information is required to complete the form?

To complete the Washington Real Estate Purchase Agreement, essential information must be included. This includes the names of the buyer and seller, the property address, the purchase price, earnest money details, and any contingencies, such as financing or inspection requirements. Additionally, closing dates and possession dates should be specified.

Are there contingencies I can include in the agreement?

Yes, contingencies can be included in the agreement. Common contingencies may involve financing, home inspections, and the sale of the buyer's current home. These conditions must be satisfied for the transaction to proceed. It is crucial to clearly outline these contingencies in the agreement to avoid misunderstandings later.

How is earnest money handled in the agreement?

Earnest money is a deposit made by the buyer to demonstrate their commitment to purchasing the property. The agreement should specify the amount of earnest money, how it will be held, and under what conditions it may be forfeited or refunded. Typically, earnest money is held in escrow until closing.

Can the agreement be modified after it is signed?

Yes, the Washington Real Estate Purchase Agreement can be modified after it is signed, but both parties must agree to any changes. Modifications should be documented in writing and signed by both the buyer and seller to ensure clarity and enforceability. Verbal agreements are not recommended.

What happens if either party breaches the agreement?

If either party breaches the agreement, the other party may have several options, including seeking damages, specific performance, or terminating the contract. The specific remedies available will depend on the nature of the breach and the terms outlined in the agreement. Legal advice may be necessary in such situations.

Is it advisable to have a real estate attorney review the agreement?

While it is not legally required, it is highly advisable to have a real estate attorney review the Washington Real Estate Purchase Agreement. An attorney can provide valuable insights, ensure that the agreement complies with state laws, and protect the interests of both the buyer and seller throughout the transaction.

Fill out Other Real Estate Purchase Agreement Templates for Specific States

North Dakota House Purchase Agreement - Funding sources can also be included as part of the purchase terms.

Alaska House Purchase Agreement - Ensures that all parties adhere to agreed-upon disclosures.

Purchasing Agreements - It may specify a closing date that works for both parties involved.

South Dakota Real Estate Purchase Agreement - Summarizes the penalties for non-compliance by either party.