Attorney-Approved Real Estate Purchase Agreement Form for Virginia

Dos and Don'ts

When filling out the Virginia Real Estate Purchase Agreement form, it’s crucial to approach the task with care. Here are five things you should do and five things you should avoid.

- Do read the entire agreement carefully before filling it out.

- Do provide accurate information regarding the property and parties involved.

- Do consult a real estate agent or attorney if you have questions.

- Do ensure all signatures are present and dated.

- Do keep a copy of the completed agreement for your records.

- Don't leave any sections blank; fill in all required fields.

- Don't use vague language; be specific in your terms.

- Don't rush through the process; take your time to review.

- Don't ignore deadlines for submissions or responses.

- Don't forget to disclose any known issues with the property.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to delays or even nullification of the agreement. Every section must be addressed to ensure clarity and enforceability.

-

Incorrect Property Description: Providing an inaccurate or vague description of the property can create confusion. It is essential to include the correct address, parcel number, and any relevant details about the property.

-

Missing Signatures: Both the buyer and seller must sign the agreement. Omitting a signature can render the document invalid, so it’s crucial to ensure that all parties have signed before submission.

-

Ignoring Contingencies: Not including necessary contingencies, such as financing or inspection clauses, can expose buyers to risks. These contingencies protect buyers by allowing them to back out under certain conditions.

-

Improper Dates: Failing to specify or miswriting important dates, such as the closing date or deadlines for contingencies, can lead to misunderstandings. Clear timelines are vital for a smooth transaction.

-

Confusing Terms: Using ambiguous language or failing to define terms can create confusion. It’s important to be clear and precise in wording to avoid misinterpretations.

-

Neglecting Earnest Money Details: Not specifying the amount of earnest money or the conditions under which it may be forfeited can lead to disputes. Clear terms regarding earnest money help protect both parties.

-

Forgetting to Attach Addenda: If there are additional agreements or disclosures, failing to attach them can result in incomplete terms. All relevant documents should be included to ensure a comprehensive agreement.

-

Not Consulting a Professional: Attempting to fill out the form without professional guidance can lead to errors. Consulting a real estate agent or attorney can provide valuable insights and help avoid pitfalls.

Documents used along the form

When engaging in real estate transactions in Virginia, several key documents often accompany the Virginia Real Estate Purchase Agreement. Each of these documents serves a specific purpose, ensuring clarity and protection for all parties involved. Understanding these forms can facilitate a smoother transaction process.

- Property Disclosure Statement: This document requires the seller to disclose any known issues or defects related to the property. It helps buyers make informed decisions and protects sellers from future claims regarding undisclosed problems.

- Lead-Based Paint Disclosure: For properties built before 1978, this form is mandatory. It informs buyers about the potential risks of lead-based paint and requires sellers to provide relevant information regarding any known lead hazards.

- Home Inspection Contingency: This clause allows buyers to have the property inspected within a specified timeframe. If significant issues are discovered, buyers may negotiate repairs or withdraw from the agreement without penalty.

- Closing Disclosure: This document outlines the final terms and costs of the mortgage. It must be provided to the buyer at least three days before closing, ensuring transparency about the financial aspects of the transaction.

By familiarizing yourself with these documents, you can navigate the real estate process with greater confidence. Each form plays a vital role in protecting the interests of both buyers and sellers, fostering a fair and equitable transaction environment.

File Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The Virginia Real Estate Purchase Agreement is governed by the laws of the Commonwealth of Virginia. |

| Essential Elements | This agreement typically includes essential elements such as the purchase price, property description, and closing date. |

| Contingencies | Common contingencies in the agreement may involve financing, inspections, and the sale of the buyer's current home. |

| Disclosures | Sellers are required to provide certain disclosures regarding the property's condition, including any known defects. |

Key takeaways

When filling out and using the Virginia Real Estate Purchase Agreement form, it is essential to keep several key points in mind. Understanding these aspects can help ensure a smoother transaction process.

- Clear Identification of Parties: Ensure that the names of both the buyer and seller are accurately listed. This helps avoid confusion later in the process.

- Property Description: Provide a detailed description of the property being purchased. Include the address and any relevant identifying information to confirm the property’s identity.

- Purchase Price: Clearly state the agreed-upon purchase price. This figure should be prominently displayed to prevent misunderstandings.

- Contingencies: Include any contingencies that are part of the agreement. Common contingencies may involve inspections, financing, or the sale of another property.

- Closing Date: Specify the anticipated closing date. This date marks when the transaction will be finalized and ownership transferred.

- Signatures: Ensure that all parties sign the agreement. Signatures validate the document and confirm that all parties agree to the terms outlined.

By paying attention to these key takeaways, individuals can navigate the Virginia Real Estate Purchase Agreement with greater confidence and clarity.

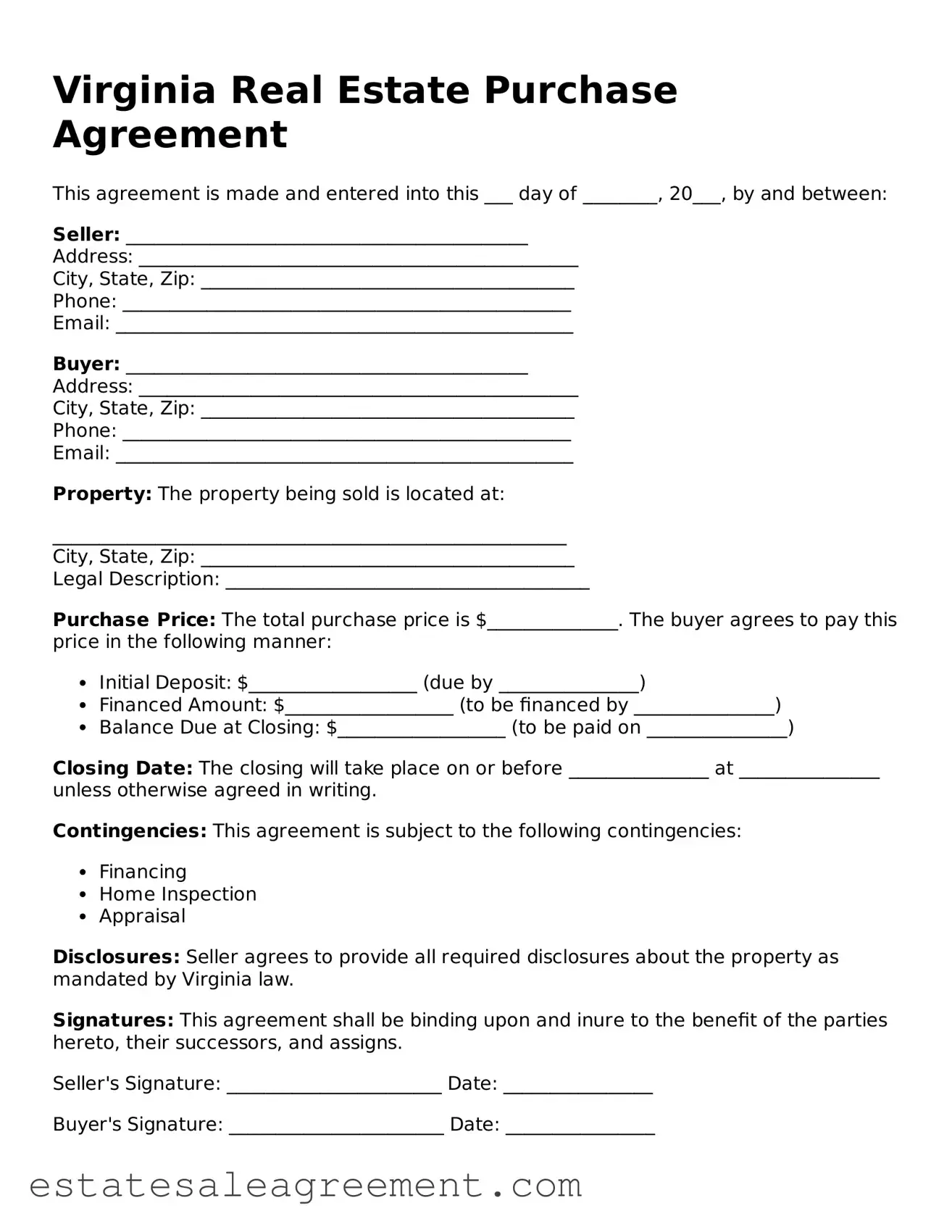

Example - Virginia Real Estate Purchase Agreement Form

Virginia Real Estate Purchase Agreement

This agreement is made and entered into this ___ day of ________, 20___, by and between:

Seller: ___________________________________________

Address: _______________________________________________

City, State, Zip: ________________________________________

Phone: ________________________________________________

Email: _________________________________________________

Buyer: ___________________________________________

Address: _______________________________________________

City, State, Zip: ________________________________________

Phone: ________________________________________________

Email: _________________________________________________

Property: The property being sold is located at:

_______________________________________________________

City, State, Zip: ________________________________________

Legal Description: _______________________________________

Purchase Price: The total purchase price is $______________. The buyer agrees to pay this price in the following manner:

- Initial Deposit: $__________________ (due by _______________)

- Financed Amount: $__________________ (to be financed by _______________)

- Balance Due at Closing: $__________________ (to be paid on _______________)

Closing Date: The closing will take place on or before _______________ at _______________ unless otherwise agreed in writing.

Contingencies: This agreement is subject to the following contingencies:

- Financing

- Home Inspection

- Appraisal

Disclosures: Seller agrees to provide all required disclosures about the property as mandated by Virginia law.

Signatures: This agreement shall be binding upon and inure to the benefit of the parties hereto, their successors, and assigns.

Seller's Signature: _______________________ Date: ________________

Buyer's Signature: _______________________ Date: ________________

What to Know About This Form

What is a Virginia Real Estate Purchase Agreement?

The Virginia Real Estate Purchase Agreement is a legal document used in real estate transactions. It outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This agreement includes details such as the purchase price, closing date, and any contingencies that must be met before the sale is finalized.

Who uses the Virginia Real Estate Purchase Agreement?

This agreement is used by buyers and sellers of real estate in Virginia. Real estate agents often assist in drafting and negotiating the terms of the agreement. However, individuals can also use it without an agent, provided they understand the legal implications of the document.

What are the key components of the agreement?

Key components include the names of the parties involved, property description, purchase price, earnest money deposit, closing date, and any contingencies such as financing or inspection requirements. Each section is crucial for protecting the interests of both the buyer and seller.

Is the agreement legally binding?

Yes, once both parties sign the Virginia Real Estate Purchase Agreement, it becomes a legally binding contract. This means that both the buyer and seller are obligated to adhere to the terms outlined in the agreement. Failure to do so can lead to legal consequences.

Can the agreement be modified after signing?

Yes, modifications can be made to the agreement after it is signed, but both parties must agree to any changes. It is advisable to document these changes in writing and have both parties sign the revised agreement to avoid future disputes.

What happens if the buyer backs out of the agreement?

If the buyer backs out without a valid reason as outlined in the agreement, they may lose their earnest money deposit. The seller may also have the option to pursue legal action for breach of contract, depending on the circumstances.

What contingencies can be included in the agreement?

Common contingencies include financing, home inspections, and appraisal requirements. These clauses allow the buyer to back out of the agreement without penalty if certain conditions are not met, providing a layer of protection during the buying process.

How is the earnest money deposit handled?

The earnest money deposit is typically held in an escrow account until the closing of the sale. This deposit shows the seller that the buyer is serious about the purchase. If the transaction proceeds as planned, the deposit is applied to the purchase price. If it falls through due to contingencies, the buyer usually gets their money back.

What is the closing process?

The closing process involves finalizing the sale of the property. Both parties will review and sign various documents, including the deed and settlement statement. The buyer will pay the remaining balance of the purchase price, and the seller will transfer ownership of the property. This process typically takes place at a title company or attorney's office.

Do I need a lawyer to complete the agreement?

While it is not legally required to have a lawyer, it is highly recommended. A lawyer can help ensure that the agreement is properly drafted and that your rights are protected throughout the transaction. If you are unfamiliar with real estate law, having legal assistance can prevent costly mistakes.

Fill out Other Real Estate Purchase Agreement Templates for Specific States

How to Write a Purchase and Sale Agreement - Specifies how to handle unforeseen circumstances that might delay the process.

Tennessee Real Estate Forms Free - The agreement often includes a clause for termination under certain circumstances.

Home Contract Template - Provides essential legal protections and rights for both buyer and seller.