Attorney-Approved Real Estate Purchase Agreement Form for Utah

Dos and Don'ts

When filling out the Utah Real Estate Purchase Agreement form, attention to detail is crucial. Here are some important dos and don'ts to consider:

- Do read the entire agreement carefully before filling it out.

- Do provide accurate and complete information about all parties involved.

- Do specify the purchase price clearly and ensure it matches any verbal agreements.

- Do include any contingencies that are important to the transaction.

- Don't leave any sections blank; if a section is not applicable, indicate that clearly.

- Don't rush through the process; take the time to review your entries for accuracy.

Common mistakes

-

Incomplete Information: Failing to provide all required details, such as names, addresses, and contact information, can delay the process.

-

Incorrect Property Description: Not accurately describing the property can lead to disputes. Always double-check the address and legal description.

-

Omitting Contingencies: Forgetting to include important contingencies, such as financing or inspection, can put buyers at risk.

-

Not Specifying Earnest Money: Failing to indicate the amount of earnest money can create confusion. Clearly state this amount to avoid misunderstandings.

-

Ignoring Closing Dates: Leaving the closing date blank or not agreeing on a timeline can lead to complications later. It's essential to set a clear date.

-

Inadequate Signatures: Not having all necessary parties sign the agreement can invalidate it. Ensure everyone involved signs where required.

-

Misunderstanding Terms: Not fully understanding the terms and conditions can lead to future issues. Take the time to read and comprehend each section.

-

Neglecting to Review Local Laws: Failing to consider local real estate laws may result in non-compliance. Research relevant regulations in Utah.

-

Not Seeking Professional Help: Attempting to fill out the agreement without legal or real estate guidance can lead to errors. Consulting a professional is always a wise choice.

Documents used along the form

When engaging in a real estate transaction in Utah, several forms and documents complement the Real Estate Purchase Agreement. These documents help clarify terms, outline responsibilities, and protect the interests of all parties involved. Below are four commonly used documents that accompany the purchase agreement.

- Seller's Disclosure Statement: This document requires the seller to disclose any known issues with the property, such as structural problems or past pest infestations. It ensures that buyers are aware of potential concerns before finalizing the sale.

- Lead-Based Paint Disclosure: For homes built before 1978, this form informs buyers about the potential presence of lead-based paint. Federal law mandates this disclosure to protect buyers, especially families with young children.

- Earnest Money Agreement: This document outlines the amount of money a buyer provides to demonstrate their serious intent to purchase the property. It details how the earnest money will be handled and under what conditions it may be returned or forfeited.

- Closing Disclosure: Provided to buyers at least three days before closing, this document itemizes the final loan terms and closing costs. It ensures that buyers understand their financial obligations and the total cost of the transaction.

Utilizing these documents alongside the Real Estate Purchase Agreement helps facilitate a smoother transaction process. They provide essential information and protections for both buyers and sellers, contributing to a transparent real estate experience.

File Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | The Utah Real Estate Purchase Agreement is governed by the laws of the State of Utah. |

| Purpose | This form is used to outline the terms and conditions of a real estate transaction between a buyer and a seller. |

| Key Components | The agreement typically includes details such as purchase price, financing terms, and closing date. |

| Disclosure Requirements | Utah law mandates that sellers must disclose certain information about the property, including known defects. |

Key takeaways

When filling out and using the Utah Real Estate Purchase Agreement form, there are several important considerations to keep in mind. Here are some key takeaways:

- Accuracy is essential. Ensure that all information, including names, addresses, and property details, is correct to avoid potential disputes.

- Understand the terms. Familiarize yourself with the various clauses and conditions in the agreement to know your rights and obligations.

- Include all necessary disclosures. Sellers must provide required disclosures about the property's condition, which can impact the buyer's decision.

- Consider contingencies. Including contingencies, such as financing or inspection, can protect both parties and provide an exit strategy if issues arise.

- Review timelines carefully. Pay attention to deadlines for offers, inspections, and closing to ensure compliance with the agreement.

- Seek professional guidance. Consulting with a real estate agent or attorney can help clarify complex terms and ensure that the agreement meets legal standards.

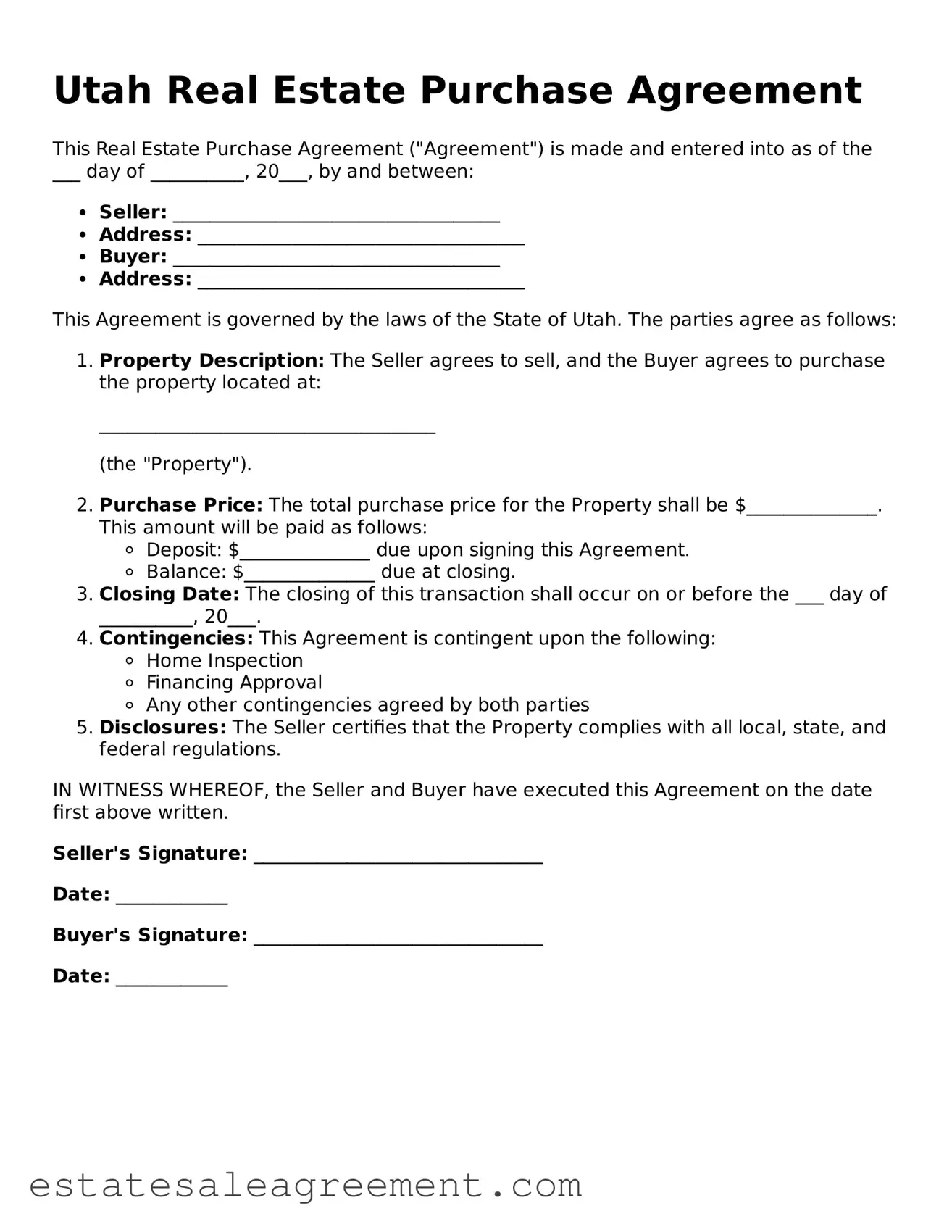

Example - Utah Real Estate Purchase Agreement Form

Utah Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made and entered into as of the ___ day of __________, 20___, by and between:

- Seller: ___________________________________

- Address: ___________________________________

- Buyer: ___________________________________

- Address: ___________________________________

This Agreement is governed by the laws of the State of Utah. The parties agree as follows:

- Property Description: The Seller agrees to sell, and the Buyer agrees to purchase the property located at:

- Purchase Price: The total purchase price for the Property shall be $______________. This amount will be paid as follows:

- Deposit: $______________ due upon signing this Agreement.

- Balance: $______________ due at closing.

- Closing Date: The closing of this transaction shall occur on or before the ___ day of __________, 20___.

- Contingencies: This Agreement is contingent upon the following:

- Home Inspection

- Financing Approval

- Any other contingencies agreed by both parties

- Disclosures: The Seller certifies that the Property complies with all local, state, and federal regulations.

____________________________________

(the "Property").

IN WITNESS WHEREOF, the Seller and Buyer have executed this Agreement on the date first above written.

Seller's Signature: _______________________________

Date: ____________

Buyer's Signature: _______________________________

Date: ____________

What to Know About This Form

What is a Utah Real Estate Purchase Agreement?

A Utah Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a property is bought and sold in Utah. This agreement serves as a contract between the buyer and the seller, detailing important aspects such as the purchase price, closing date, and any contingencies that may apply. It is crucial for both parties to understand this document, as it protects their rights and interests during the transaction.

What should be included in the agreement?

The agreement typically includes several key elements. These may consist of the names of the parties involved, a description of the property, the purchase price, the earnest money deposit, and the closing date. Additionally, any contingencies, such as financing or inspection requirements, should be clearly stated. It is important for both the buyer and seller to review these details carefully to ensure that they align with their expectations.

Do I need a lawyer to complete the agreement?

While it is not legally required to have a lawyer to complete a Real Estate Purchase Agreement in Utah, it is often advisable. A lawyer can help ensure that the terms are fair and that all necessary legal protections are in place. They can also assist in navigating any complex issues that may arise during the transaction. If you feel uncertain about the process, consulting a legal professional can provide peace of mind.

What happens if one party does not fulfill their obligations?

If one party fails to fulfill their obligations as outlined in the agreement, the other party may have legal recourse. This could involve seeking damages or enforcing the terms of the contract through legal action. It is essential for both parties to understand their responsibilities and the potential consequences of non-compliance. Open communication can often resolve issues before they escalate.

Can the agreement be modified after it is signed?

Yes, the agreement can be modified after it is signed, but both parties must agree to any changes. This is typically done through a written amendment that outlines the specific modifications. Verbal agreements or informal changes are generally not enforceable, so it is important to document any alterations to ensure clarity and legal validity.

What is earnest money, and why is it important?

Earnest money is a deposit made by the buyer to show their serious intent to purchase the property. This money is typically held in escrow and is applied to the purchase price at closing. If the buyer backs out of the deal without a valid reason, the seller may keep the earnest money as compensation for their time and effort. Therefore, earnest money plays a critical role in demonstrating commitment and protecting the interests of both parties.

How do I know if the agreement is fair?

Determining whether the agreement is fair involves evaluating several factors, including the market value of the property, the terms of the deal, and any contingencies included. It may also be beneficial to compare similar properties in the area. Consulting with a real estate agent or attorney can provide additional insights and help ensure that the agreement reflects a fair and equitable transaction.

Fill out Other Real Estate Purchase Agreement Templates for Specific States

Home Contract Template - Sets the groundwork for disclosures related to any known defects in the property.

Hawaii Real Estate Purchase Contract - This form can include any offers for seller financing or creative payment arrangements.