Attorney-Approved Real Estate Purchase Agreement Form for Texas

Dos and Don'ts

When filling out the Texas Real Estate Purchase Agreement form, it is essential to approach the task with care and attention to detail. Here are some important guidelines to follow:

- Do: Read the entire form carefully before starting to fill it out. Understanding each section will help you avoid mistakes.

- Do: Provide accurate information. Ensure that all names, addresses, and property details are correct to prevent future complications.

- Do: Consult with a real estate professional if you have questions. Their expertise can provide clarity and guidance.

- Do: Sign and date the agreement appropriately. Missing signatures can render the agreement invalid.

- Don't: Rush through the form. Taking your time will help you catch errors and ensure completeness.

- Don't: Leave any sections blank unless instructed. Incomplete forms can lead to misunderstandings and delays.

- Don't: Use unclear language or abbreviations. Clear and precise wording is crucial for legal documents.

- Don't: Ignore deadlines. Timely submission of the agreement is important for the transaction process.

Common mistakes

-

Incomplete Information: Many people fail to fill out all required fields. Missing details can lead to delays or even legal issues down the line.

-

Incorrect Property Description: Providing an inaccurate or vague description of the property can create confusion. It's crucial to include the correct address and legal description.

-

Omitting Contingencies: Buyers often forget to include important contingencies, such as financing or inspection. These clauses protect buyers and should not be overlooked.

-

Not Specifying Closing Costs: Failing to clarify who is responsible for closing costs can lead to disputes. Clearly outline these responsibilities in the agreement.

-

Ignoring Deadlines: Many overlook crucial deadlines for inspections or financing. Missing these dates can jeopardize the purchase.

-

Not Understanding Earnest Money: Buyers sometimes misunderstand the purpose and amount of earnest money. This deposit shows commitment and should be clearly defined.

-

Neglecting to Review the Agreement: Skipping a thorough review of the completed form is a common mistake. It's essential to read through the entire document to ensure accuracy and understanding.

Documents used along the form

When engaging in a real estate transaction in Texas, several documents accompany the Texas Real Estate Purchase Agreement. Each of these documents serves a specific purpose and helps ensure that all parties are protected and informed throughout the process.

- Seller's Disclosure Notice: This document provides potential buyers with important information about the property's condition. It outlines any known issues or defects, allowing buyers to make informed decisions.

- Title Commitment: This document is issued by a title company and outlines the terms under which the title will be conveyed. It also lists any liens or encumbrances on the property, ensuring that buyers understand their rights and obligations.

- Closing Disclosure: This form details the final terms and costs associated with the mortgage. It is provided to the buyer at least three days before closing, allowing them to review all financial aspects of the transaction.

- Property Inspection Report: This report is generated after a professional inspection of the property. It highlights any significant repairs or maintenance issues, providing buyers with a comprehensive understanding of the property's condition.

These documents collectively facilitate a smoother transaction process, ensuring that both buyers and sellers are adequately informed and protected. Understanding each of these forms can significantly enhance the experience of navigating a real estate deal in Texas.

File Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | The Texas Real Estate Purchase Agreement is governed by Texas state law. |

| Purpose | This form is used to outline the terms of a real estate transaction between a buyer and a seller. |

| Offer and Acceptance | The agreement includes sections for the buyer's offer and the seller's acceptance. |

| Property Description | A detailed description of the property being sold is required in the agreement. |

| Purchase Price | The total purchase price must be clearly stated in the agreement. |

| Earnest Money | The agreement typically includes a provision for earnest money, which shows the buyer's commitment. |

| Closing Date | A specific closing date is usually included, indicating when the transaction will be finalized. |

| Contingencies | Buyers may include contingencies, such as financing or inspection requirements. |

| Disclosure Requirements | Sellers must disclose certain information about the property, such as known defects. |

| Signatures | Both parties must sign the agreement for it to be legally binding. |

Key takeaways

When filling out and using the Texas Real Estate Purchase Agreement form, it is essential to consider the following key takeaways:

- Accuracy is crucial. Ensure that all information provided is correct. This includes details about the buyer, seller, property, and terms of the sale.

- Understand the terms. Familiarize yourself with the terms and conditions outlined in the agreement. This knowledge will help prevent misunderstandings and disputes later.

- Review deadlines. Pay close attention to any deadlines specified in the agreement. Timely actions are critical to keeping the transaction on track.

- Consult professionals. If uncertain about any aspect of the agreement, seek advice from real estate professionals or legal experts. Their guidance can be invaluable in navigating the process.

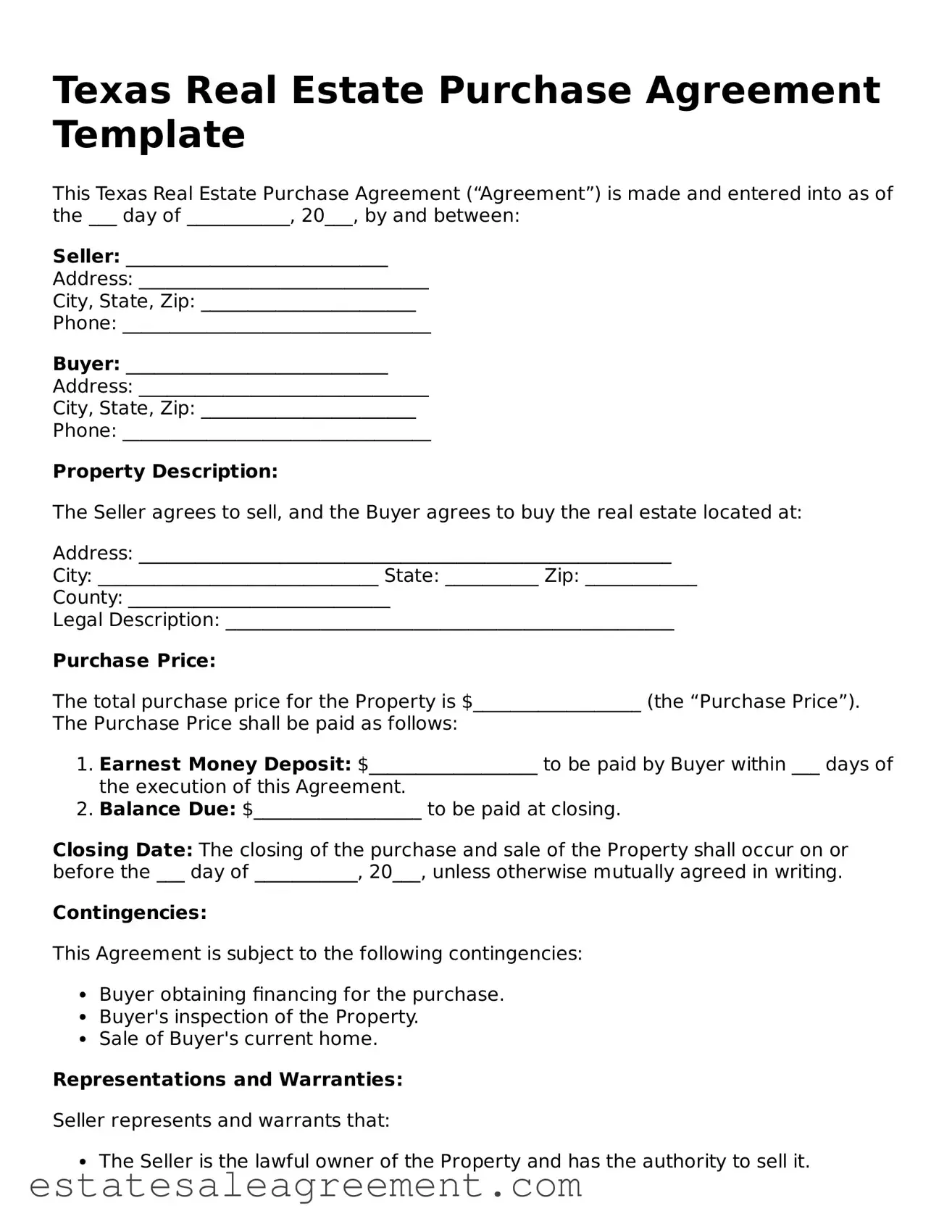

Example - Texas Real Estate Purchase Agreement Form

Texas Real Estate Purchase Agreement Template

This Texas Real Estate Purchase Agreement (“Agreement”) is made and entered into as of the ___ day of ___________, 20___, by and between:

Seller: ____________________________

Address: _______________________________

City, State, Zip: _______________________

Phone: _________________________________

Buyer: ____________________________

Address: _______________________________

City, State, Zip: _______________________

Phone: _________________________________

Property Description:

The Seller agrees to sell, and the Buyer agrees to buy the real estate located at:

Address: _________________________________________________________

City: ______________________________ State: __________ Zip: ____________

County: ____________________________

Legal Description: ________________________________________________

Purchase Price:

The total purchase price for the Property is $__________________ (the “Purchase Price”). The Purchase Price shall be paid as follows:

- Earnest Money Deposit: $__________________ to be paid by Buyer within ___ days of the execution of this Agreement.

- Balance Due: $__________________ to be paid at closing.

Closing Date: The closing of the purchase and sale of the Property shall occur on or before the ___ day of ___________, 20___, unless otherwise mutually agreed in writing.

Contingencies:

This Agreement is subject to the following contingencies:

- Buyer obtaining financing for the purchase.

- Buyer's inspection of the Property.

- Sale of Buyer's current home.

Representations and Warranties:

Seller represents and warrants that:

- The Seller is the lawful owner of the Property and has the authority to sell it.

- The Property is free from all liens and encumbrances, except as disclosed.

Governing Law: This Agreement shall be governed by the laws of the State of Texas.

Entire Agreement: This document constitutes the entire agreement between the parties concerning the subject matter herein. Any modifications must be in writing and signed by both parties.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first above written.

Seller Signature: __________________________ Date: _____________

Buyer Signature: __________________________ Date: _____________

What to Know About This Form

What is a Texas Real Estate Purchase Agreement?

The Texas Real Estate Purchase Agreement is a legally binding document used when buying or selling real estate in Texas. It outlines the terms and conditions of the sale, including the purchase price, financing details, and any contingencies. This agreement helps protect both the buyer and the seller by clearly stating their rights and obligations throughout the transaction.

What key elements should be included in the agreement?

A comprehensive Texas Real Estate Purchase Agreement should include several essential components. These include the names of the buyer and seller, a description of the property, the purchase price, earnest money details, financing terms, and any contingencies, such as inspections or appraisals. Additionally, the agreement should specify the closing date and any other relevant conditions that may affect the sale.

How does the earnest money work in the agreement?

Earnest money serves as a deposit to show the seller that the buyer is serious about purchasing the property. Typically, this amount is held in an escrow account until the transaction is completed. If the sale goes through, the earnest money is applied to the buyer's closing costs or down payment. However, if the buyer backs out without a valid reason outlined in the agreement, the seller may keep the earnest money as compensation for taking the property off the market.

Can the agreement be modified after it is signed?

Yes, the Texas Real Estate Purchase Agreement can be modified after it is signed, but both parties must agree to any changes. Modifications should be documented in writing and signed by both the buyer and the seller to ensure clarity and enforceability. It's important to communicate openly and promptly about any desired changes to avoid misunderstandings later in the process.

Fill out Other Real Estate Purchase Agreement Templates for Specific States

How to Write a Purchase and Sale Agreement - It may also detail timelines for submitting various disclosures required by law.

How to Make a Purchase Agreement - It is crucial for protecting investments in real estate transactions.

Maryland Real Estate Contract - Provisions for default or breach of contract are outlined within the document.

Wyoming House Purchase Agreement - Identifies any repairs to be completed before closing.