Attorney-Approved Real Estate Purchase Agreement Form for South Dakota

Dos and Don'ts

When filling out the South Dakota Real Estate Purchase Agreement form, it is essential to approach the task with care and attention to detail. Below are some important guidelines to follow, as well as some common pitfalls to avoid.

Things You Should Do:

- Read the entire form carefully before starting to fill it out.

- Ensure that all parties involved in the transaction are accurately identified.

- Provide complete and precise information regarding the property being purchased.

- Review the agreement thoroughly for any errors or omissions before signing.

Things You Shouldn't Do:

- Do not rush through the form; take your time to understand each section.

- Avoid using vague language or leaving any fields blank.

- Do not sign the agreement without ensuring all terms are clear and agreeable to all parties.

- Refrain from making any alterations or changes without proper guidance.

Common mistakes

-

Incomplete Information: Failing to provide all necessary details, such as the names of the buyer and seller, can lead to confusion and potential disputes later on.

-

Incorrect Property Description: Not accurately describing the property can result in legal complications. Ensure that the legal description matches the property records.

-

Missing Signatures: All parties involved must sign the agreement. Omitting a signature can render the contract unenforceable.

-

Ignoring Contingencies: Not including necessary contingencies, such as financing or inspection clauses, can expose buyers to unforeseen risks.

-

Neglecting to Specify Closing Date: Failing to clearly state the closing date can lead to misunderstandings about when the transaction will be finalized.

-

Overlooking Earnest Money Details: Not specifying the amount of earnest money or the terms for its return can create disputes if the deal falls through.

-

Not Addressing Repairs: Failing to outline who is responsible for repairs can lead to disagreements after the sale.

-

Using Vague Language: Ambiguous terms can lead to different interpretations. Clear and precise language is essential for all parties.

-

Forgetting to Review Local Laws: Not being aware of local real estate laws and regulations can result in non-compliance, which may affect the transaction.

Documents used along the form

When entering into a real estate transaction in South Dakota, several documents complement the Real Estate Purchase Agreement. Understanding these forms can help ensure a smoother process and protect the interests of all parties involved. Here’s a brief overview of some commonly used documents:

- Seller's Disclosure Statement: This document provides buyers with essential information about the property’s condition. It outlines any known issues or defects, helping buyers make informed decisions.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about the potential presence of lead-based paint. It’s crucial for protecting health and safety.

- Title Commitment: This document outlines the terms of the title insurance policy. It ensures that the buyer receives clear ownership of the property, free from any liens or disputes.

- Closing Statement: Also known as a HUD-1 Settlement Statement, this form itemizes all closing costs and fees associated with the transaction. It provides transparency about the financial aspects of the sale.

- Deed: This legal document transfers ownership of the property from the seller to the buyer. It must be signed and recorded to be effective.

- Financing Documents: If the buyer is obtaining a mortgage, various documents will be needed, such as loan applications, credit reports, and promissory notes. These outline the terms of the financing agreement.

Each of these documents plays a vital role in the real estate transaction process. Familiarizing yourself with them can help ensure a successful and legally sound purchase. Always consider seeking guidance from a real estate professional or attorney for any specific questions or concerns.

File Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The South Dakota Real Estate Purchase Agreement is governed by South Dakota state law. |

| Parties Involved | The agreement typically involves a buyer and a seller, both of whom must be clearly identified. |

| Property Description | The form requires a detailed description of the property, including the address and legal description. |

| Purchase Price | The total purchase price must be stated clearly, along with any deposit amount. |

| Contingencies | Buyers may include contingencies, such as financing or inspection, which must be explicitly outlined. |

| Closing Date | The agreement should specify a closing date, which is the date when the property transfer occurs. |

| Signatures Required | Both parties must sign the agreement to make it legally binding, along with the date of signing. |

Key takeaways

When filling out and using the South Dakota Real Estate Purchase Agreement form, keep these key takeaways in mind:

- Ensure all parties involved are clearly identified. This includes the buyer, seller, and any agents.

- Include a detailed description of the property. This should cover the address, legal description, and any fixtures included in the sale.

- Specify the purchase price and payment terms. Clearly state how much the buyer will pay and the method of payment.

- Understand the contingencies. These are conditions that must be met for the sale to proceed, such as financing or inspections.

- Review all terms before signing. Both parties should understand their rights and obligations to avoid disputes later.

Example - South Dakota Real Estate Purchase Agreement Form

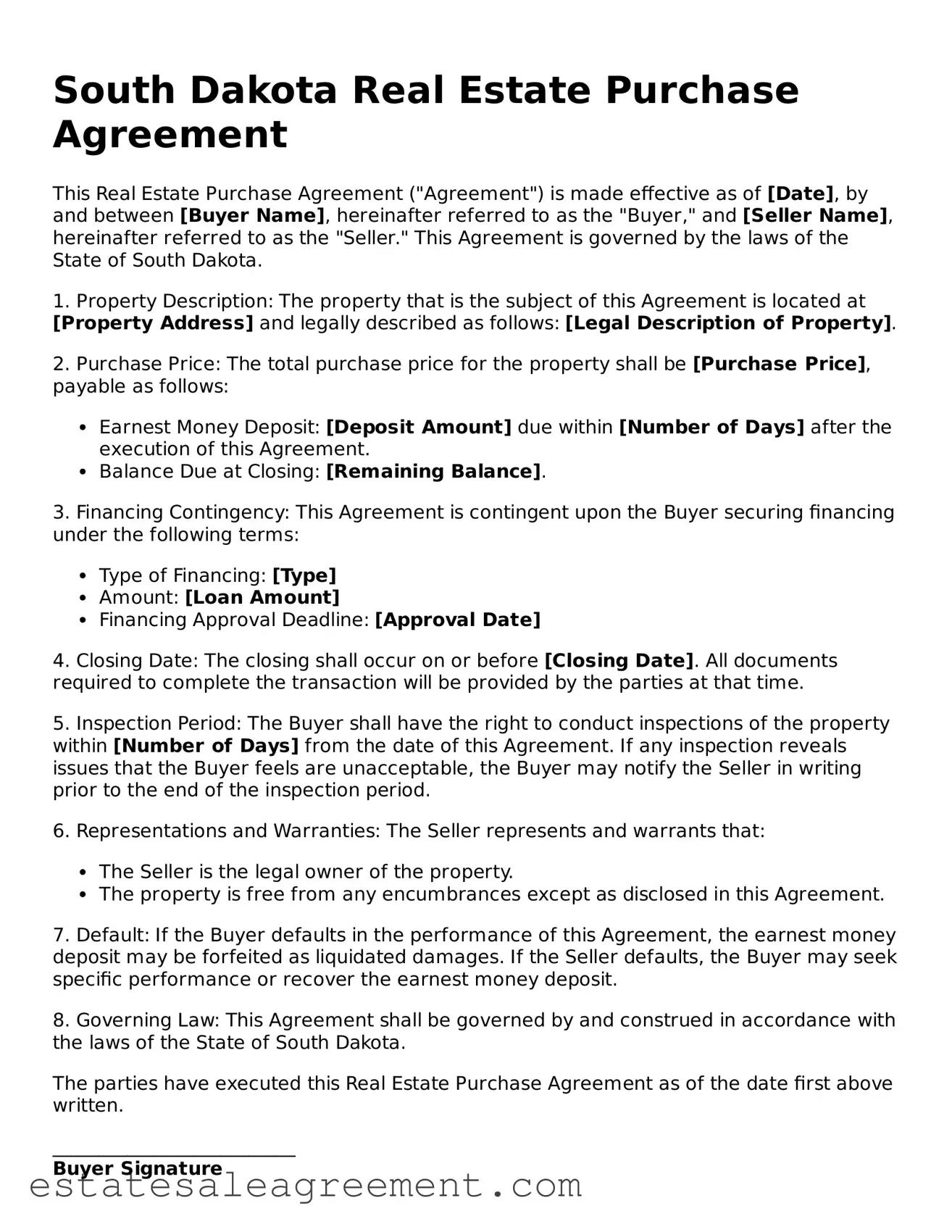

South Dakota Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made effective as of [Date], by and between [Buyer Name], hereinafter referred to as the "Buyer," and [Seller Name], hereinafter referred to as the "Seller." This Agreement is governed by the laws of the State of South Dakota.

1. Property Description: The property that is the subject of this Agreement is located at [Property Address] and legally described as follows: [Legal Description of Property].

2. Purchase Price: The total purchase price for the property shall be [Purchase Price], payable as follows:

- Earnest Money Deposit: [Deposit Amount] due within [Number of Days] after the execution of this Agreement.

- Balance Due at Closing: [Remaining Balance].

3. Financing Contingency: This Agreement is contingent upon the Buyer securing financing under the following terms:

- Type of Financing: [Type]

- Amount: [Loan Amount]

- Financing Approval Deadline: [Approval Date]

4. Closing Date: The closing shall occur on or before [Closing Date]. All documents required to complete the transaction will be provided by the parties at that time.

5. Inspection Period: The Buyer shall have the right to conduct inspections of the property within [Number of Days] from the date of this Agreement. If any inspection reveals issues that the Buyer feels are unacceptable, the Buyer may notify the Seller in writing prior to the end of the inspection period.

6. Representations and Warranties: The Seller represents and warrants that:

- The Seller is the legal owner of the property.

- The property is free from any encumbrances except as disclosed in this Agreement.

7. Default: If the Buyer defaults in the performance of this Agreement, the earnest money deposit may be forfeited as liquidated damages. If the Seller defaults, the Buyer may seek specific performance or recover the earnest money deposit.

8. Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of South Dakota.

The parties have executed this Real Estate Purchase Agreement as of the date first above written.

__________________________

Buyer Signature

[Buyer Name]

__________________________

Seller Signature

[Seller Name]

What to Know About This Form

What is a South Dakota Real Estate Purchase Agreement?

The South Dakota Real Estate Purchase Agreement is a legal document that outlines the terms and conditions of a real estate transaction between a buyer and a seller. This agreement typically includes details such as the purchase price, property description, contingencies, and timelines for closing. It serves as a binding contract that protects the interests of both parties involved in the sale of the property.

What are the key components of this agreement?

Key components of the South Dakota Real Estate Purchase Agreement include the identification of the parties involved, a detailed description of the property, the purchase price, earnest money deposit, financing details, contingencies such as inspections or appraisals, and the closing date. Additionally, it may include disclosures about the property's condition and any other relevant terms agreed upon by both parties. Each of these elements plays a crucial role in ensuring a smooth transaction.

How does the agreement protect both buyers and sellers?

The agreement offers protection by clearly defining the rights and responsibilities of both the buyer and the seller. For buyers, it ensures that they have the right to conduct inspections and secure financing before finalizing the purchase. For sellers, it provides a framework for the sale, including timelines for offers and acceptance, which helps to prevent misunderstandings. By outlining these details, the agreement minimizes potential disputes and fosters a transparent transaction process.

Can the South Dakota Real Estate Purchase Agreement be modified?

Yes, the South Dakota Real Estate Purchase Agreement can be modified, but any changes must be agreed upon by both parties. Modifications should be documented in writing and signed by both the buyer and the seller to ensure that they are legally enforceable. It is advisable to consult with a real estate professional or attorney when making changes to ensure that all modifications comply with state laws and protect the interests of both parties.

Fill out Other Real Estate Purchase Agreement Templates for Specific States

Purchase Agreement Michigan for Sale by Owner - May detail any seller concessions or incentives.

Missouri Real Estate Purchase Agreement - It can provide both parties with clear expectations regarding the sale process.

Nebraska Purchase Agreement Pdf - Informs parties about possible penalties for breach of contract.

Alaska House Purchase Agreement - Specifies closing dates and possession timelines for the property.