Attorney-Approved Real Estate Purchase Agreement Form for Pennsylvania

Dos and Don'ts

When filling out the Pennsylvania Real Estate Purchase Agreement form, it's important to approach the process with care. Here are some key dos and don'ts to keep in mind:

- Do read the entire agreement thoroughly before signing. Understanding each section will help you avoid potential issues later.

- Do provide accurate information. Ensure that names, addresses, and property details are correct to prevent misunderstandings.

- Do consult with a real estate professional or attorney if you have questions. Their expertise can provide valuable insights.

- Do keep copies of all documents. Having a record of what you submitted is essential for future reference.

- Don't rush through the form. Take your time to ensure that everything is filled out properly.

- Don't leave any sections blank unless instructed. Missing information can lead to delays or complications.

- Don't ignore deadlines. Be aware of any time-sensitive requirements to avoid losing your opportunity.

- Don't sign without reviewing all terms. Ensure that you are comfortable with all conditions before finalizing the agreement.

Common mistakes

-

Incomplete Information: Many buyers and sellers fail to fill out all required fields. Missing information can lead to delays or complications in the transaction.

-

Incorrect Property Description: It's crucial to provide an accurate and complete description of the property. Errors in the address or legal description can create legal issues later.

-

Not Specifying Contingencies: Buyers often forget to include contingencies, such as financing or inspection. These clauses protect the buyer's interests and should not be overlooked.

-

Ignoring Deadlines: Missing deadlines for offers, inspections, or closing can jeopardize the deal. It’s important to be aware of and adhere to all timelines specified in the agreement.

-

Forgetting to Sign: A common mistake is neglecting to sign the document. Without signatures from all parties, the agreement is not legally binding.

-

Overlooking Earnest Money Details: Failing to specify the amount and terms of the earnest money deposit can lead to misunderstandings. Clear terms help ensure both parties are on the same page.

-

Not Reviewing the Entire Agreement: Some individuals rush through the document without reading it fully. Every section is important, and understanding all terms is essential for a smooth transaction.

-

Misunderstanding the Closing Costs: Buyers and sellers sometimes overlook the details regarding who pays for what at closing. Clarity on these costs can prevent disputes later on.

Documents used along the form

When engaging in a real estate transaction in Pennsylvania, several forms and documents accompany the Pennsylvania Real Estate Purchase Agreement. These documents help clarify terms, protect parties involved, and ensure a smooth process. Below is a list of commonly used documents in conjunction with the Purchase Agreement.

- Seller's Disclosure Statement: This document provides potential buyers with important information about the property's condition. Sellers must disclose known issues, such as structural problems or pest infestations, to avoid future disputes.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about potential lead hazards. It ensures that buyers are aware of the risks associated with lead paint and provides them with relevant information.

- Property Inspection Report: After a buyer has the property inspected, this report details the findings. It helps buyers understand the property's condition and can influence negotiations regarding repairs or price adjustments.

- Financing Addendum: If a buyer is obtaining a mortgage, this document outlines the terms of the financing. It includes details about the loan amount, interest rate, and any contingencies related to the buyer's ability to secure financing.

- Title Search Report: This report verifies the ownership of the property and checks for any liens or encumbrances. It is crucial for ensuring that the seller has the legal right to sell the property without any outstanding claims.

- Closing Disclosure: This document is provided to the buyer at least three days before closing. It outlines the final terms of the mortgage, including loan costs, closing costs, and the total amount due at closing.

Each of these documents plays a vital role in the real estate transaction process. They help protect the interests of both buyers and sellers, ensuring that all parties are informed and prepared for the responsibilities involved in the sale. Understanding these documents can lead to a more efficient and successful transaction.

File Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The Pennsylvania Real Estate Purchase Agreement is governed by Pennsylvania state law. |

| Parties Involved | The agreement typically involves a buyer and a seller, both of whom must be legally capable of entering into a contract. |

| Property Description | The form requires a detailed description of the property, including the address and any relevant legal descriptions. |

| Purchase Price | The agreement specifies the purchase price and outlines how it will be paid, including any deposits. |

| Contingencies | Buyers can include contingencies, such as financing or inspection, which must be satisfied before the sale is finalized. |

| Closing Date | The form includes a section to specify the closing date, which is the date when the property transfer occurs. |

| Disclosure Requirements | Sellers are required to disclose any known defects or issues with the property, as per Pennsylvania law. |

| Default Provisions | The agreement outlines what happens in the event of a default by either party, including potential remedies. |

| Signatures | Both parties must sign the agreement for it to be legally binding, indicating their acceptance of the terms. |

| Amendments | The form allows for amendments, which must be documented in writing and signed by both parties to be valid. |

Key takeaways

When filling out and using the Pennsylvania Real Estate Purchase Agreement form, keep these key takeaways in mind:

- Understand the importance of all parties' signatures. The agreement is not valid until all required signatures are present.

- Clearly identify the property. Include the full address and any relevant details to avoid confusion.

- Specify the purchase price. Ensure that the amount is clearly stated and agreed upon by both the buyer and seller.

- Outline the terms of the sale. Include any contingencies, such as financing or inspection, to protect both parties.

- Review the closing timeline. Establish a clear timeline for closing to ensure a smooth transaction.

- Consider including an earnest money deposit. This shows the seller that the buyer is serious and can help secure the deal.

- Seek legal advice if needed. If you have questions or concerns, consulting with a real estate attorney can provide clarity.

Example - Pennsylvania Real Estate Purchase Agreement Form

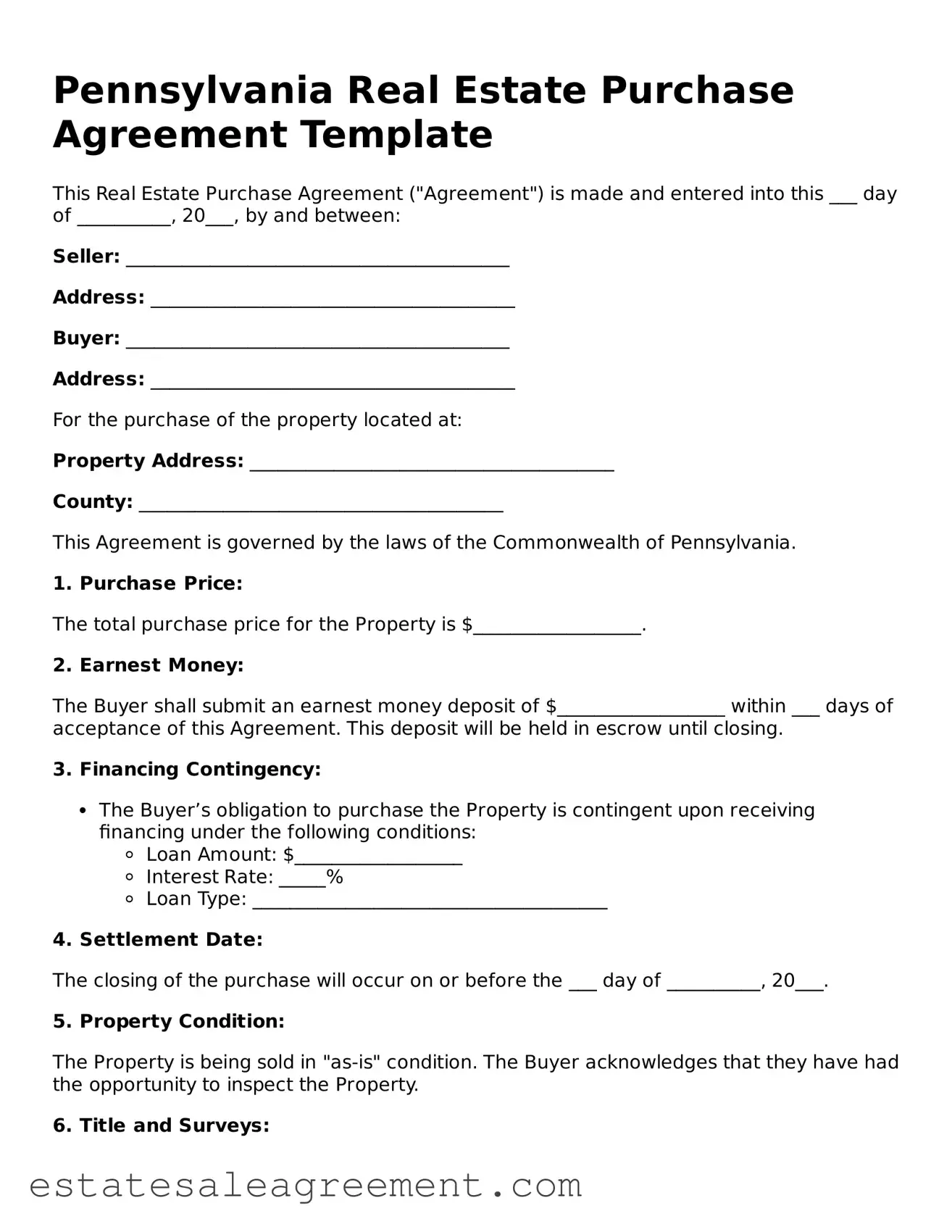

Pennsylvania Real Estate Purchase Agreement Template

This Real Estate Purchase Agreement ("Agreement") is made and entered into this ___ day of __________, 20___, by and between:

Seller: _________________________________________

Address: _______________________________________

Buyer: _________________________________________

Address: _______________________________________

For the purchase of the property located at:

Property Address: _______________________________________

County: _______________________________________

This Agreement is governed by the laws of the Commonwealth of Pennsylvania.

1. Purchase Price:

The total purchase price for the Property is $__________________.

2. Earnest Money:

The Buyer shall submit an earnest money deposit of $__________________ within ___ days of acceptance of this Agreement. This deposit will be held in escrow until closing.

3. Financing Contingency:

- The Buyer’s obligation to purchase the Property is contingent upon receiving financing under the following conditions:

- Loan Amount: $__________________

- Interest Rate: _____%

- Loan Type: ______________________________________

4. Settlement Date:

The closing of the purchase will occur on or before the ___ day of __________, 20___.

5. Property Condition:

The Property is being sold in "as-is" condition. The Buyer acknowledges that they have had the opportunity to inspect the Property.

6. Title and Surveys:

The Seller shall provide clear and marketable title at closing. A title search will be completed by a title company selected by the Buyer.

7. Default:

- If the Buyer defaults, the earnest money may be retained by the Seller as liquidated damages.

- If the Seller defaults, the Buyer may seek a refund of the earnest money and/or specific performance.

8. Governing Law:

This Agreement shall be governed by the laws of the Commonwealth of Pennsylvania.

9. Entire Agreement:

This Agreement constitutes the entire understanding between the parties regarding the subject matter and supersedes all prior agreements.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

Seller's Signature: ___________________________ Date: _______________

Buyer's Signature: ___________________________ Date: _______________

What to Know About This Form

What is a Pennsylvania Real Estate Purchase Agreement?

A Pennsylvania Real Estate Purchase Agreement is a legal document used when buying or selling property in Pennsylvania. It outlines the terms and conditions of the sale, including the purchase price, closing date, and any contingencies. This agreement protects both the buyer and the seller by clearly defining their rights and obligations throughout the transaction.

What key elements should be included in the agreement?

Several important elements should be included in a Pennsylvania Real Estate Purchase Agreement. These include the names of the buyer and seller, a detailed description of the property, the agreed-upon purchase price, and the closing date. Additionally, any contingencies, such as financing or inspections, should be clearly stated. This ensures that both parties understand what is expected before the sale is finalized.

How can I modify the agreement after it has been signed?

If changes are needed after the agreement has been signed, both the buyer and seller must agree to the modifications. This is typically done through an addendum, which is a separate document that outlines the changes. Both parties should sign the addendum to make it legally binding. It’s essential to keep a copy of the original agreement along with any modifications for your records.

What happens if one party does not fulfill their obligations?

If one party does not fulfill their obligations as outlined in the agreement, it may be considered a breach of contract. The other party has several options, including seeking legal remedies. This could involve negotiating a resolution or, in some cases, pursuing legal action to enforce the terms of the agreement. It’s always advisable to consult with a legal professional if a breach occurs to understand the best course of action.

Fill out Other Real Estate Purchase Agreement Templates for Specific States

Maine Real Estate Purchase and Sale Agreement - It may include provisions for property inspections and assessments.

Buying a House on Contract Template - It describes any personal property included in the sale.

Vermont Purchase and Sale Agreement - Includes contingency clauses for situations like financing failure or discovery of major defects.