Attorney-Approved Real Estate Purchase Agreement Form for North Dakota

Dos and Don'ts

When filling out the North Dakota Real Estate Purchase Agreement form, it is essential to approach the task with care and attention to detail. Here are some guidelines to help you navigate the process effectively.

- Do read the entire form thoroughly before starting to fill it out. Understanding each section will help prevent mistakes.

- Do provide accurate and complete information. Ensure that names, addresses, and property details are correct.

- Do consult with a real estate professional if you have questions. Their expertise can clarify complex terms and conditions.

- Do keep a copy of the completed agreement for your records. Documentation is crucial for future reference.

- Don't rush through the form. Taking your time can help avoid errors that may lead to complications later.

- Don't leave any sections blank unless instructed. Incomplete forms may be rejected or cause delays.

- Don't use abbreviations or shorthand. Clear and complete language is essential for legal clarity.

- Don't forget to sign and date the agreement. An unsigned document is not legally binding.

Common mistakes

-

Incomplete Information: Buyers and sellers often leave sections blank. This can lead to misunderstandings and disputes later on. Every field must be filled out accurately to ensure clarity.

-

Incorrect Dates: Failing to enter the correct dates can cause confusion regarding deadlines. Make sure to double-check all dates related to the agreement.

-

Missing Signatures: Both parties must sign the agreement for it to be legally binding. Forgetting a signature can delay the process significantly.

-

Not Specifying Contingencies: Buyers often neglect to include contingencies, such as financing or inspection clauses. These protections are essential for safeguarding interests.

-

Ignoring Property Description: A vague or incorrect property description can create issues. It is crucial to provide a detailed and accurate description of the property being sold.

-

Overlooking Closing Costs: Buyers and sellers sometimes forget to address who will cover closing costs. Clarifying this in the agreement can prevent conflicts later.

Documents used along the form

When engaging in a real estate transaction in North Dakota, several documents accompany the Real Estate Purchase Agreement. Each document serves a specific purpose and helps ensure a smooth process for both buyers and sellers.

- Property Disclosure Statement: This document requires sellers to disclose any known defects or issues with the property. It protects buyers by providing essential information about the property's condition.

- Title Commitment: This is a report from a title company that outlines the legal status of the property. It confirms the seller's ownership and identifies any liens or encumbrances.

- Closing Statement: This document itemizes all the financial aspects of the transaction, including purchase price, closing costs, and any adjustments. It provides transparency for both parties at closing.

- Deed: The deed transfers ownership of the property from the seller to the buyer. It must be signed and recorded to be legally effective.

- Loan Agreement: If financing is involved, this document outlines the terms of the mortgage loan, including interest rates, repayment schedule, and any conditions required by the lender.

- Homeowner's Association (HOA) Documents: If the property is part of an HOA, these documents provide rules, regulations, and fees associated with the community. Buyers should review them to understand their obligations.

- Inspection Report: This report details the findings from a professional inspection of the property. It highlights any repairs needed and informs the buyer about the property's condition.

Each of these documents plays a crucial role in the real estate transaction process. Properly understanding and completing them helps protect the interests of all parties involved.

File Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The North Dakota Real Estate Purchase Agreement is governed by North Dakota Century Code, Title 47, which outlines property laws in the state. |

| Parties Involved | The agreement typically involves two main parties: the buyer and the seller, who must both be clearly identified in the document. |

| Property Description | A detailed description of the property being sold is essential. This includes the address and any legal descriptions necessary for identification. |

| Contingencies | The agreement may include various contingencies, such as financing or inspection, which must be satisfied before the sale can proceed. |

| Closing Date | The contract specifies a closing date, which is the day when the ownership of the property is officially transferred from the seller to the buyer. |

Key takeaways

When filling out and using the North Dakota Real Estate Purchase Agreement form, it is essential to keep several key points in mind to ensure a smooth transaction. Here are the main takeaways:

- Accuracy is Critical: Ensure that all information provided in the agreement is correct. Double-check names, addresses, and property details to avoid complications later.

- Understand the Terms: Familiarize yourself with the terms and conditions outlined in the agreement. Knowing your obligations and rights is vital for both buyers and sellers.

- Include All Necessary Details: Make sure to fill in all required sections of the form. Missing information can lead to delays or disputes.

- Contingencies Matter: Clearly state any contingencies, such as financing or inspection requirements. This protects both parties and sets clear expectations.

- Consult Professionals: If you have questions or uncertainties, consider seeking advice from a real estate agent or attorney. Their expertise can help you navigate the process effectively.

- Review Before Signing: Always review the completed agreement thoroughly before signing. This ensures that all parties agree to the terms and conditions as stated.

By keeping these takeaways in mind, you can facilitate a more efficient and successful real estate transaction in North Dakota.

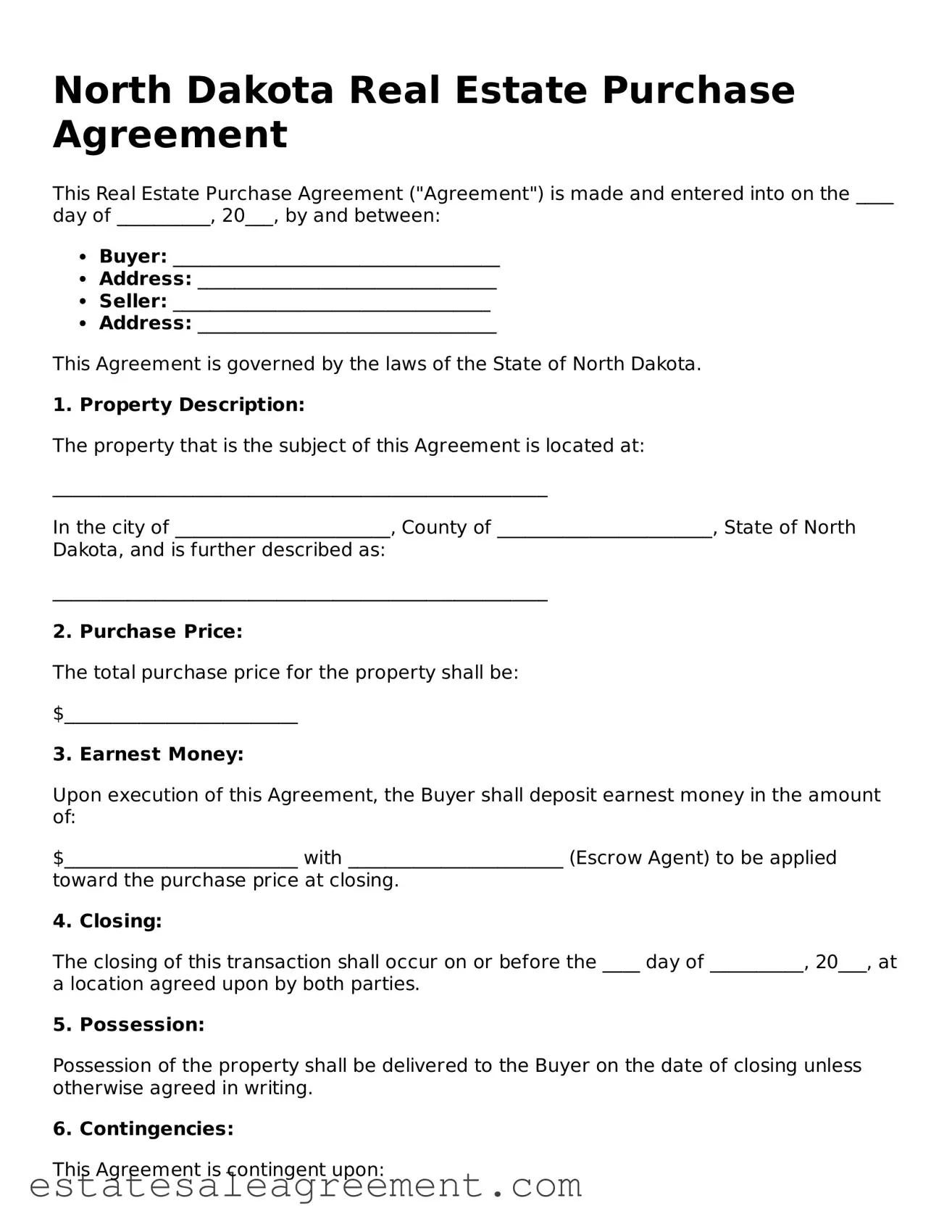

Example - North Dakota Real Estate Purchase Agreement Form

North Dakota Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made and entered into on the ____ day of __________, 20___, by and between:

- Buyer: ___________________________________

- Address: ________________________________

- Seller: __________________________________

- Address: ________________________________

This Agreement is governed by the laws of the State of North Dakota.

1. Property Description:

The property that is the subject of this Agreement is located at:

_____________________________________________________

In the city of _______________________, County of _______________________, State of North Dakota, and is further described as:

_____________________________________________________

2. Purchase Price:

The total purchase price for the property shall be:

$_________________________

3. Earnest Money:

Upon execution of this Agreement, the Buyer shall deposit earnest money in the amount of:

$_________________________ with _______________________ (Escrow Agent) to be applied toward the purchase price at closing.

4. Closing:

The closing of this transaction shall occur on or before the ____ day of __________, 20___, at a location agreed upon by both parties.

5. Possession:

Possession of the property shall be delivered to the Buyer on the date of closing unless otherwise agreed in writing.

6. Contingencies:

This Agreement is contingent upon:

- Financing Approval

- Home Inspection

- Clear Title

- Other: ________________________________________

7. Default:

If either party defaults in performance of this Agreement, the non-defaulting party may pursue legal remedies as provided by North Dakota law.

8. Governing Law:

This Agreement shall be governed by and construed under the laws of the State of North Dakota.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first above written.

Buyer Signature: ___________________________ Date: _______________

Seller Signature: ___________________________ Date: _______________

What to Know About This Form

What is the North Dakota Real Estate Purchase Agreement?

The North Dakota Real Estate Purchase Agreement is a legal document used to outline the terms and conditions of a real estate transaction. It serves as a binding contract between the buyer and seller, detailing the property being sold, the purchase price, and other essential terms. This agreement helps ensure that both parties understand their rights and obligations throughout the transaction process.

What key elements are included in the agreement?

The agreement typically includes the following key elements: the names of the buyer and seller, a description of the property, the purchase price, earnest money deposit details, contingencies (such as financing or inspections), closing date, and any additional terms specific to the transaction. Each of these components is crucial for ensuring clarity and preventing misunderstandings.

Is it necessary to have a real estate agent when using this agreement?

While it is not legally required to have a real estate agent when using the North Dakota Real Estate Purchase Agreement, having one can be beneficial. Agents bring expertise in navigating the complexities of real estate transactions. They can help ensure that the agreement is filled out correctly and that all necessary terms are included, reducing the risk of disputes later on.

Can the agreement be modified after it is signed?

What happens if one party breaches the agreement?

If one party breaches the agreement, the other party may have several options. They can seek to enforce the terms of the contract, request damages, or, in some cases, terminate the agreement. It's important to review the specific terms outlined in the contract regarding breaches and remedies. Consulting a legal professional can provide guidance on the best course of action in such situations.

Fill out Other Real Estate Purchase Agreement Templates for Specific States

How to Write a Purchase Agreement - It may include clauses that allow either party to back out under specific circumstances without penalty.

Purchasing Agreements - The document encourages transparency about property history, with a focus on community and neighborhood conditions.

Free South Carolina Real Estate Contract - Details the buyer's right to independent appraisals.