Attorney-Approved Real Estate Purchase Agreement Form for North Carolina

Dos and Don'ts

When filling out the North Carolina Real Estate Purchase Agreement form, it’s important to approach the task with care. Here are five things you should and shouldn't do to ensure the process goes smoothly.

- Do read the entire agreement carefully before filling it out. Understanding each section will help you avoid mistakes.

- Do provide accurate and complete information. This includes names, addresses, and property details.

- Do consult with a real estate professional if you have questions. They can provide valuable insights and guidance.

- Don't leave any sections blank. Incomplete forms can lead to delays or complications in the transaction.

- Don't rush through the process. Take your time to ensure everything is filled out correctly.

Following these guidelines will help you navigate the Real Estate Purchase Agreement form with confidence. Making informed choices can lead to a smoother transaction and a successful purchase.

Common mistakes

-

Neglecting to provide complete property details: One common mistake is failing to accurately describe the property. Ensure you include the correct address, parcel number, and any relevant legal descriptions. Incomplete information can lead to confusion or disputes later on.

-

Omitting buyer and seller information: Always include the full names and contact information for both the buyer and the seller. This is crucial for clear communication and for any legal processes that may arise.

-

Incorrectly stating the purchase price: Double-check the purchase price. A simple typo can lead to significant misunderstandings. Make sure that the amount is clearly stated and matches any other related documents.

-

Forgetting to include contingencies: Contingencies are essential. They protect both parties in the agreement. Common contingencies include financing, inspections, and appraisal conditions. Failing to include these can leave you vulnerable.

-

Not specifying the closing date: A closing date is a critical component of any real estate transaction. Without it, both parties may have different expectations, leading to potential delays and frustrations.

-

Ignoring local laws and regulations: Real estate laws can vary significantly by state and locality. Familiarize yourself with North Carolina's specific requirements to avoid pitfalls that could derail your agreement.

-

Failing to sign and date the agreement: This might seem basic, but it’s essential. Both parties must sign and date the agreement for it to be legally binding. An unsigned document is not worth the paper it’s printed on.

Documents used along the form

In real estate transactions in North Carolina, several forms and documents complement the Real Estate Purchase Agreement. Each of these documents serves a specific purpose, ensuring that both buyers and sellers are protected and informed throughout the process.

- Due Diligence Agreement: This document outlines the buyer's right to inspect the property and conduct research before finalizing the purchase. It typically includes a due diligence fee and specifies the timeframe for inspections.

- Property Disclosure Statement: Sellers must provide this statement, which details the property's condition and any known issues. It helps buyers make informed decisions based on the property's history.

- Closing Disclosure: This document summarizes the final terms of the loan and all closing costs. It must be provided to the buyer at least three days before closing, allowing time for review.

- Title Search Report: A title search verifies the seller's legal ownership of the property and checks for any liens or claims against it. This report is crucial for ensuring a clear title transfer.

- Earnest Money Agreement: This document outlines the amount of earnest money the buyer will deposit to demonstrate their commitment to purchasing the property. It specifies conditions under which the deposit may be forfeited or returned.

- Home Inspection Report: After a home inspection, this report details the property's condition, highlighting any repairs needed. It can influence negotiations between the buyer and seller.

- Appraisal Report: An appraisal assesses the property's market value, ensuring that the buyer is not overpaying. Lenders often require this report before approving a mortgage.

- Settlement Statement: This document outlines all financial transactions related to the closing, including fees, credits, and debits for both the buyer and seller. It provides a clear picture of the final costs involved in the transaction.

Understanding these documents is essential for anyone involved in a real estate transaction in North Carolina. Each form plays a vital role in protecting the interests of both parties and facilitating a smooth transfer of property ownership.

File Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The North Carolina Real Estate Purchase Agreement is governed by the laws of North Carolina. |

| Parties Involved | The agreement typically includes the buyer(s) and seller(s) as the primary parties. |

| Property Description | A detailed description of the property being sold must be included, specifying the address and legal description. |

| Purchase Price | The total purchase price of the property is clearly stated in the agreement. |

| Earnest Money | The agreement often requires an earnest money deposit, which shows the buyer's commitment to the purchase. |

| Closing Date | A specific closing date is usually outlined, indicating when the transaction will be finalized. |

| Contingencies | Common contingencies include financing, inspections, and appraisal, which protect the buyer's interests. |

| Disclosures | The seller is required to provide disclosures about the property, including any known defects or issues. |

| Default Provisions | The agreement includes provisions outlining what happens if either party defaults on the contract. |

| Signatures | Both parties must sign the agreement for it to be legally binding, along with any necessary witnesses or notaries. |

Key takeaways

Ensure all parties involved in the transaction are clearly identified, including full names and contact information. This prevents any confusion later on.

Specify the purchase price and any earnest money deposits. This information is crucial for establishing the financial terms of the agreement.

Include any contingencies that may apply, such as inspections or financing. These conditions protect both the buyer and seller by outlining necessary steps before the sale is finalized.

Review the closing date and any other important timelines. Timely execution of these dates is essential for a smooth transaction.

Example - North Carolina Real Estate Purchase Agreement Form

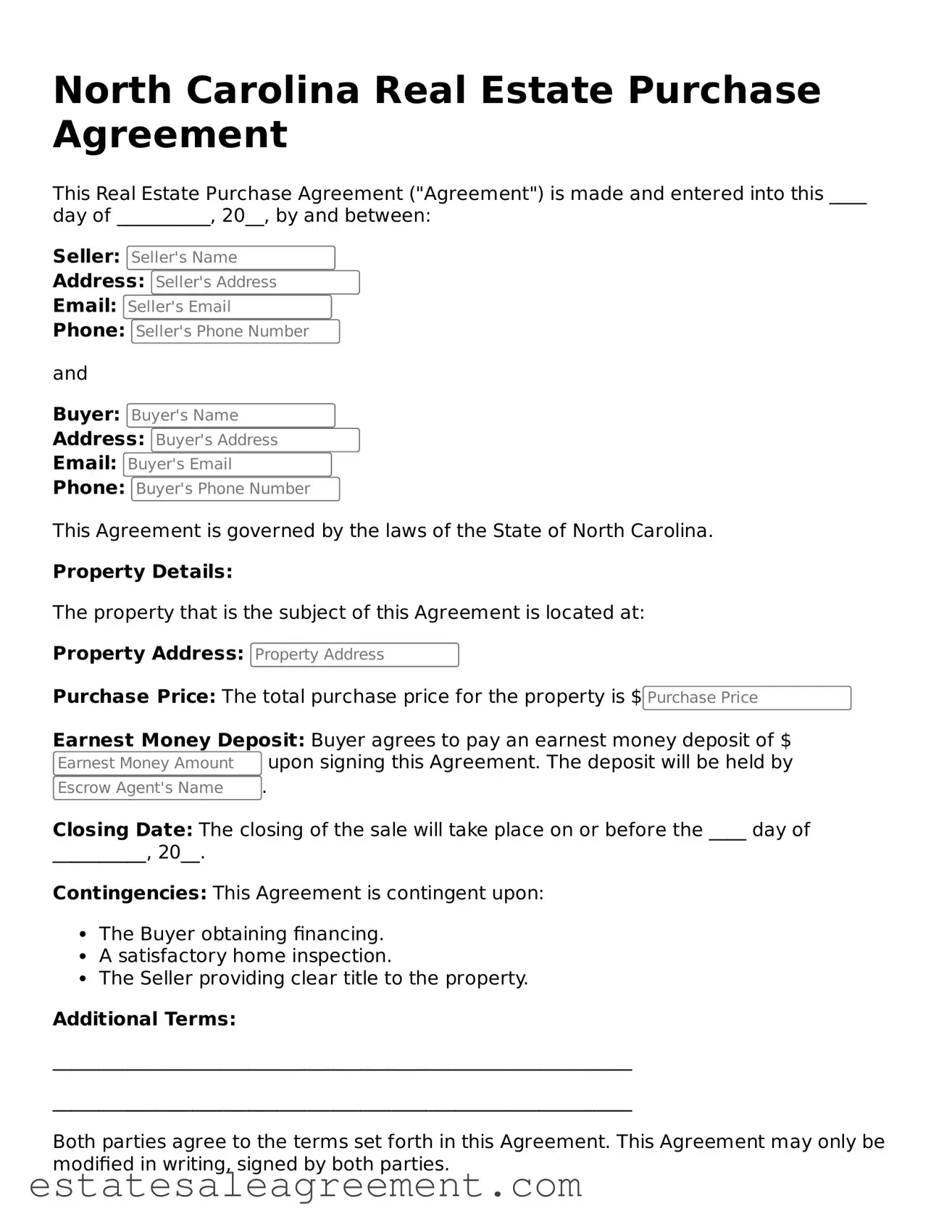

North Carolina Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made and entered into this ____ day of __________, 20__, by and between:

Seller:

Address:

Email:

Phone:

and

Buyer:

Address:

Email:

Phone:

This Agreement is governed by the laws of the State of North Carolina.

Property Details:

The property that is the subject of this Agreement is located at:

Property Address:

Purchase Price: The total purchase price for the property is $

Earnest Money Deposit: Buyer agrees to pay an earnest money deposit of $ upon signing this Agreement. The deposit will be held by .

Closing Date: The closing of the sale will take place on or before the ____ day of __________, 20__.

Contingencies: This Agreement is contingent upon:

- The Buyer obtaining financing.

- A satisfactory home inspection.

- The Seller providing clear title to the property.

Additional Terms:

______________________________________________________________

______________________________________________________________

Both parties agree to the terms set forth in this Agreement. This Agreement may only be modified in writing, signed by both parties.

Signatures:

Seller's Signature: ____________________________

Date: ____________

Buyer's Signature: ____________________________

Date: ____________

What to Know About This Form

What is a North Carolina Real Estate Purchase Agreement?

The North Carolina Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. It serves as a binding contract that details the obligations of both parties involved in the transaction, including the purchase price, financing terms, and closing date.

Who should use the Real Estate Purchase Agreement?

This agreement is intended for use by individuals or entities looking to buy or sell residential real estate in North Carolina. Whether you are a first-time homebuyer, an experienced investor, or a seller, this form provides a structured way to ensure that all necessary details are covered in the transaction.

What key elements are included in the agreement?

Several important components are typically included in the North Carolina Real Estate Purchase Agreement. These include the purchase price, earnest money deposit, financing details, property description, contingencies, closing date, and any additional terms specific to the transaction. Each of these elements helps clarify the expectations and responsibilities of both the buyer and seller.

Are there contingencies that can be included in the agreement?

Yes, contingencies are provisions that allow either party to back out of the agreement under certain conditions. Common contingencies include financing, inspection, and appraisal contingencies. These clauses protect the buyer by ensuring that they can withdraw if specific conditions are not met, thereby reducing their risk in the transaction.

Is it necessary to have a real estate agent when using this agreement?

While it is not mandatory to have a real estate agent, many buyers and sellers choose to work with one for guidance. An agent can help navigate the complexities of the transaction, ensure that the agreement is filled out correctly, and assist with negotiations. However, individuals can represent themselves if they feel comfortable doing so.

What happens after the agreement is signed?

Once both parties have signed the Real Estate Purchase Agreement, the next steps typically involve fulfilling any contingencies outlined in the document. This may include securing financing, conducting inspections, and obtaining necessary appraisals. After these steps are completed, a closing date will be scheduled, during which the ownership of the property will be transferred.

Can the agreement be modified after it is signed?

Yes, the agreement can be modified after it is signed, but both parties must agree to any changes. Modifications should be documented in writing and signed by both the buyer and seller to ensure that there is a clear record of the new terms. This process helps prevent misunderstandings and ensures that both parties are in agreement.

What should I do if I have questions about the agreement?

If you have questions or concerns about the North Carolina Real Estate Purchase Agreement, it is advisable to seek assistance from a qualified real estate professional or an attorney. They can provide valuable insights and help clarify any aspects of the agreement that may be confusing. It is important to fully understand the terms before proceeding with the transaction.

Fill out Other Real Estate Purchase Agreement Templates for Specific States

Gcaar Rental Application - Includes a clause about future disputes being settled in mediation.

Free South Carolina Real Estate Contract - Details any contingencies or conditions that must be met.

How to Write a Purchase and Sale Agreement - May address potential damages or penalties for breach of contract by either party.