Attorney-Approved Real Estate Purchase Agreement Form for New York

Dos and Don'ts

When filling out the New York Real Estate Purchase Agreement form, it’s essential to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do read the entire agreement carefully before filling it out.

- Do provide accurate information regarding the property and parties involved.

- Do ensure all required signatures are present before submitting the form.

- Do keep a copy of the completed agreement for your records.

- Don't leave any sections blank; fill in all required fields.

- Don't use abbreviations or shorthand that could lead to confusion.

By adhering to these guidelines, you can help facilitate a smoother transaction process.

Common mistakes

-

Incorrect Property Description: Failing to provide a complete and accurate description of the property can lead to confusion and disputes. Make sure to include the full address, lot number, and any other identifying details.

-

Missing Signatures: All parties involved in the transaction must sign the agreement. Omitting a signature can render the contract unenforceable.

-

Not Specifying Purchase Price: Clearly state the purchase price in the agreement. Leaving this blank or vague can create misunderstandings later.

-

Ignoring Contingencies: Failing to include necessary contingencies, such as financing or inspection, can put buyers at risk. Always outline any conditions that must be met for the sale to proceed.

-

Inaccurate Closing Date: Listing an incorrect closing date can lead to delays. Ensure that the date is realistic and agreed upon by all parties.

-

Overlooking Earnest Money Deposit: Specify the amount of earnest money and the conditions for its return. This protects both parties and clarifies expectations.

-

Neglecting to Include Personal Property: If any personal property is included in the sale, such as appliances or fixtures, list them clearly in the agreement.

-

Not Reviewing the Agreement: Skipping a thorough review of the agreement before signing can lead to oversight of important details. Take the time to read everything carefully.

Documents used along the form

When engaging in a real estate transaction in New York, several important documents accompany the Real Estate Purchase Agreement. These forms help clarify terms, protect both parties, and ensure a smooth transaction. Here are five key documents that are often used alongside the Purchase Agreement:

- Disclosure Statements: Sellers are typically required to provide disclosure statements that inform buyers of any known issues with the property. This could include information about lead paint, structural problems, or other significant defects.

- Title Report: A title report outlines the legal ownership of the property and identifies any liens or encumbrances. This document is crucial for ensuring that the buyer receives clear title to the property.

- Property Inspection Report: Buyers often obtain a property inspection report to assess the condition of the home. This report highlights any repairs needed and can influence the buyer's decision or negotiation strategy.

- Financing Documents: If the buyer is securing a mortgage, various financing documents will be necessary. These include loan applications, pre-approval letters, and other paperwork required by the lender.

- Closing Statement: The closing statement, also known as the HUD-1 Settlement Statement, details all financial transactions related to the sale. It includes costs, fees, and the final amounts due at closing.

These documents play a vital role in the real estate transaction process. Each serves a specific purpose, ensuring that both buyers and sellers are informed and protected throughout the process.

File Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | The New York Real Estate Purchase Agreement is governed by New York State law. |

| Purpose | This form serves as a legally binding contract between a buyer and seller for the purchase of real estate. |

| Key Components | It typically includes details such as purchase price, property description, and closing date. |

| Contingencies | Buyers often include contingencies, such as financing or inspection, to protect their interests. |

| Deposit Requirements | A deposit, often called earnest money, is usually required to demonstrate the buyer's commitment. |

| Disclosure Obligations | Sellers are required to disclose known issues with the property, ensuring transparency in the transaction. |

Key takeaways

When filling out and using the New York Real Estate Purchase Agreement form, consider the following key takeaways:

- Ensure all parties involved are clearly identified. This includes the buyer and seller, along with their contact information.

- Specify the property details accurately. Include the address, legal description, and any relevant property identifiers.

- Outline the purchase price and payment terms. This section should detail the amount being offered and how it will be paid.

- Include any contingencies. Common contingencies may involve financing, inspections, or the sale of another property.

- Pay attention to deadlines. Clearly state any important dates, such as the closing date or deadlines for contingencies.

- Review the section on disclosures. Sellers are required to provide certain information about the property's condition and history.

- Consider legal advice. Consulting with a real estate attorney can help ensure that the agreement meets all legal requirements and protects your interests.

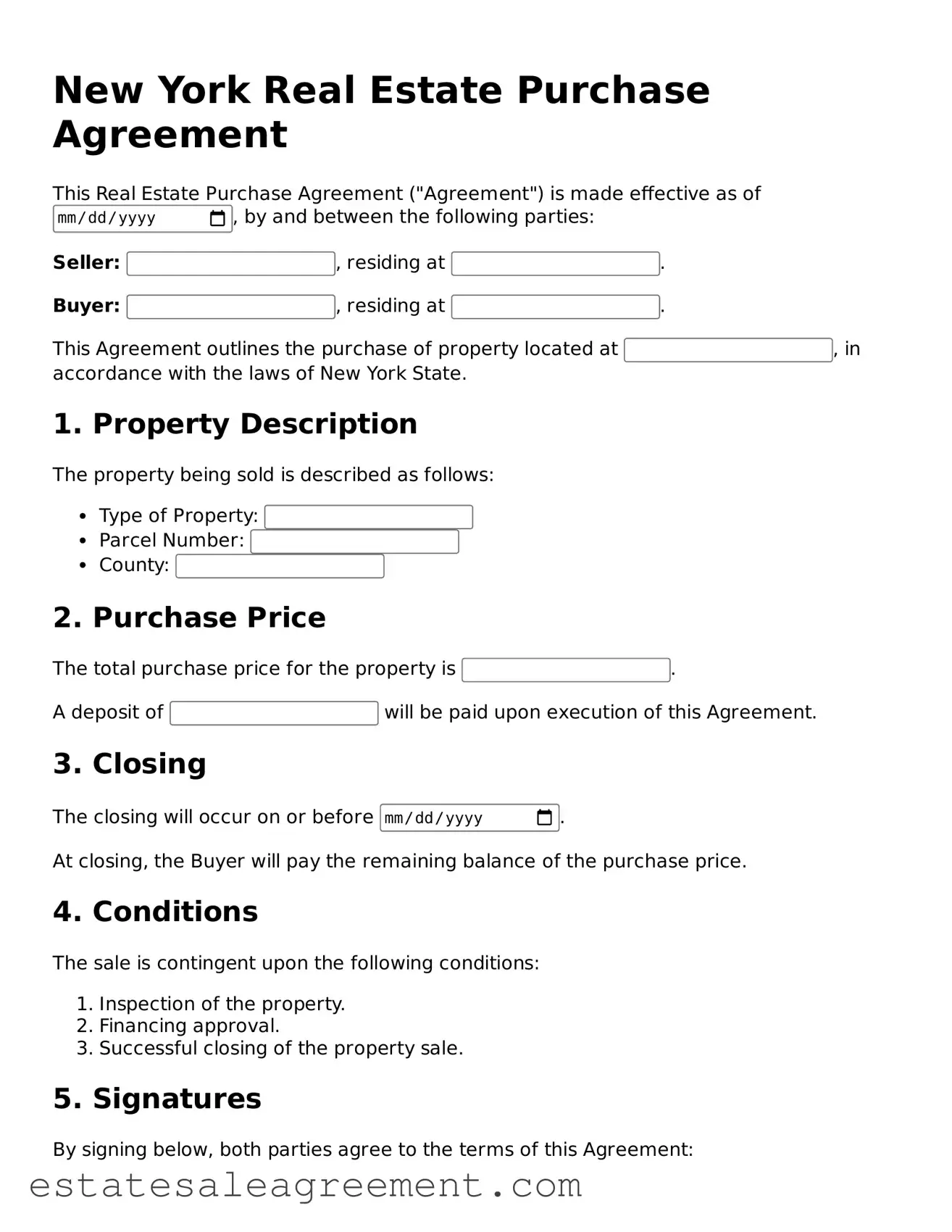

Example - New York Real Estate Purchase Agreement Form

New York Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made effective as of , by and between the following parties:

Seller: , residing at .

Buyer: , residing at .

This Agreement outlines the purchase of property located at , in accordance with the laws of New York State.

1. Property Description

The property being sold is described as follows:

- Type of Property:

- Parcel Number:

- County:

2. Purchase Price

The total purchase price for the property is .

A deposit of will be paid upon execution of this Agreement.

3. Closing

The closing will occur on or before .

At closing, the Buyer will pay the remaining balance of the purchase price.

4. Conditions

The sale is contingent upon the following conditions:

- Inspection of the property.

- Financing approval.

- Successful closing of the property sale.

5. Signatures

By signing below, both parties agree to the terms of this Agreement:

Seller's Signature: _________________________ Date: ______________

Buyer's Signature: _________________________ Date: ______________

This Agreement is governed by the laws of New York State.

What to Know About This Form

What is a New York Real Estate Purchase Agreement?

The New York Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This agreement includes details such as the purchase price, financing terms, and contingencies, ensuring that both parties understand their rights and obligations during the transaction.

What are the key components of the agreement?

Key components of the New York Real Estate Purchase Agreement include the identification of the parties involved, a description of the property, the purchase price, earnest money deposit, closing date, and any contingencies such as inspections or financing. Additional clauses may address repairs, title issues, and other specific conditions relevant to the transaction.

Is the agreement required for all real estate transactions in New York?

While it is not legally required to use a Real Estate Purchase Agreement for every transaction, it is highly recommended. This document provides legal protection for both the buyer and seller, clearly outlining the terms of the sale and minimizing potential disputes. Without a written agreement, parties may face challenges in enforcing verbal agreements.

Can the agreement be modified after it is signed?

Yes, the New York Real Estate Purchase Agreement can be modified after it is signed, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both the buyer and seller to ensure enforceability. It is essential to keep a record of all amendments to avoid confusion later in the transaction.

What happens if one party breaches the agreement?

If one party breaches the agreement, the other party may have several options. They can seek specific performance, which compels the breaching party to fulfill their obligations, or they can pursue damages for any losses incurred due to the breach. Legal remedies may vary depending on the specific terms of the agreement and the nature of the breach.

Are there any contingencies typically included in the agreement?

Yes, contingencies are common in a New York Real Estate Purchase Agreement. These may include financing contingencies, inspection contingencies, and appraisal contingencies. Each of these allows the buyer to back out of the agreement without penalty if certain conditions are not met, providing an additional layer of protection during the transaction.

How can I ensure that my agreement is legally binding?

To ensure that the New York Real Estate Purchase Agreement is legally binding, it must be in writing and signed by both parties. Additionally, all essential terms should be clearly defined within the document. It is advisable to consult with a real estate attorney or a qualified professional to review the agreement before signing, ensuring compliance with state laws and regulations.

Fill out Other Real Estate Purchase Agreement Templates for Specific States

Wisconsin Offer to Purchase Form - The importance of maintaining open lines of communication is highlighted in the process outlined.

North Dakota House Purchase Agreement - Special provisions may be added according to the uniqueness of the property.

Illinois Real Estate Contract - Provides definitions of terms used throughout the document for clarity.