Attorney-Approved Real Estate Purchase Agreement Form for New Jersey

Dos and Don'ts

When filling out the New Jersey Real Estate Purchase Agreement form, it's important to approach the task carefully. Here are five things you should do and five things you shouldn't do.

Things You Should Do:

- Read the entire agreement thoroughly before filling it out.

- Provide accurate and complete information about the property and parties involved.

- Consult with a real estate attorney if you have any questions.

- Sign and date the agreement in the appropriate sections.

- Keep a copy of the signed agreement for your records.

Things You Shouldn't Do:

- Don't rush through the form; take your time to ensure accuracy.

- Don't leave any blank spaces; if a section doesn't apply, indicate that clearly.

- Don't ignore deadlines for submitting the agreement.

- Don't use vague language; be specific in your descriptions.

- Don't forget to check local laws that may affect your agreement.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all necessary details. Buyers and sellers often overlook sections that require specific information, such as the legal description of the property or the correct names of all parties involved. This can lead to delays or complications during the transaction.

-

Incorrect Dates: Entering wrong dates can create confusion. It's crucial to ensure that all dates, including the offer date, closing date, and any deadlines for contingencies, are accurate. An incorrect date can lead to misunderstandings and potential legal issues.

-

Neglecting Contingencies: Buyers often forget to include important contingencies in the agreement. These may include home inspections, financing, or appraisal conditions. Omitting these can leave buyers vulnerable if issues arise after the agreement is signed.

-

Ignoring Local Regulations: Real estate transactions are subject to local laws and regulations. Failing to adhere to these can result in invalid agreements. It’s important to be aware of any specific requirements that New Jersey may impose on real estate contracts.

Documents used along the form

When engaging in a real estate transaction in New Jersey, several documents accompany the Real Estate Purchase Agreement. Each of these forms serves a specific purpose and helps ensure that both parties are protected and informed throughout the process. Below is a list of common forms used alongside the Purchase Agreement.

- Seller's Disclosure Statement: This document requires the seller to disclose any known issues or defects with the property. It provides buyers with crucial information about the condition of the home.

- Title Report: A title report outlines the legal ownership of the property and identifies any liens, encumbrances, or claims against it. This ensures that the buyer is aware of any potential issues before finalizing the sale.

- Lead-Based Paint Disclosure: For homes built before 1978, this disclosure informs buyers about the potential presence of lead-based paint. It is a requirement to protect the health of occupants, especially children.

- Mortgage Commitment Letter: This letter from a lender confirms that the buyer has been approved for a mortgage. It outlines the terms and conditions of the loan, providing assurance to both parties that financing is secured.

- Closing Statement (HUD-1): This document details all financial transactions involved in the sale, including fees, taxes, and the final amount the seller will receive. It is reviewed and signed at closing.

- Property Deed: The deed is the legal document that transfers ownership of the property from the seller to the buyer. It must be recorded with the county to ensure the buyer's ownership is recognized.

- Affidavit of Title: This sworn statement by the seller confirms their ownership of the property and asserts that there are no undisclosed liens or claims against it. It provides additional security for the buyer.

- Home Inspection Report: Conducted by a professional inspector, this report evaluates the property's condition. It helps buyers make informed decisions regarding repairs or negotiations before closing.

Understanding these documents can significantly enhance the real estate transaction experience. Each form plays a vital role in protecting the interests of both buyers and sellers, ensuring a smoother process from agreement to closing.

File Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The New Jersey Real Estate Purchase Agreement is governed by New Jersey state law, specifically the New Jersey Statutes Annotated (N.J.S.A.) Title 46. |

| Standard Form | This agreement is a standardized form used for residential real estate transactions in New Jersey, ensuring consistency and clarity in the buying process. |

| Deposit Requirements | The form outlines the required earnest money deposit, typically ranging from 1% to 10% of the purchase price, to demonstrate the buyer's serious intent. |

| Contingencies | Buyers can include various contingencies in the agreement, such as financing and inspection contingencies, which protect their interests during the transaction. |

Key takeaways

When filling out and using the New Jersey Real Estate Purchase Agreement form, keep these key takeaways in mind:

- Ensure all parties involved in the transaction are clearly identified. This includes the buyer, seller, and any agents representing them.

- Specify the property details accurately. Include the address, lot number, and any relevant descriptions to avoid confusion.

- Understand the terms of the agreement, including the purchase price, deposit amount, and any contingencies that may apply.

- Review the closing timeline and responsibilities. Clearly outline who will handle the closing costs and when the transaction will take place.

Example - New Jersey Real Estate Purchase Agreement Form

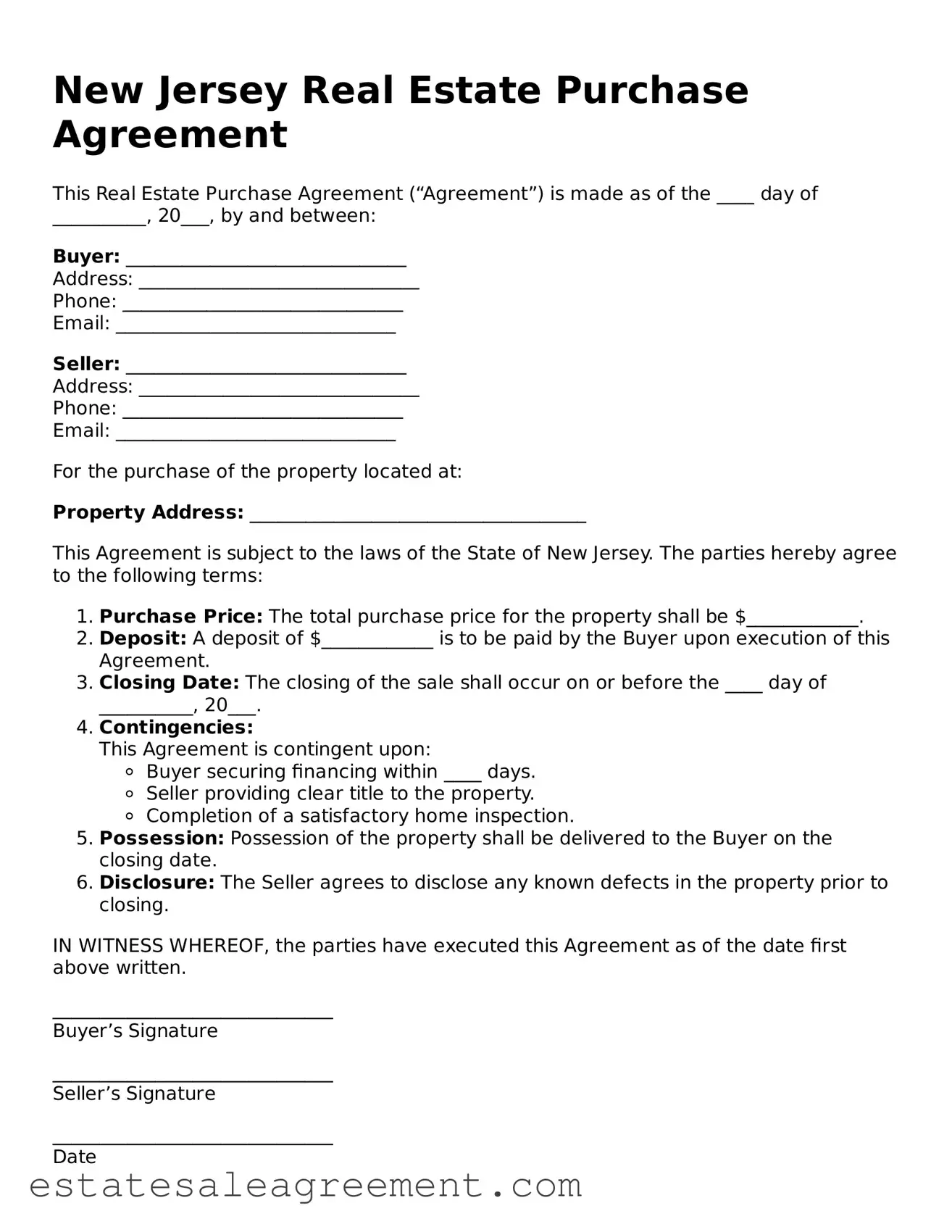

New Jersey Real Estate Purchase Agreement

This Real Estate Purchase Agreement (“Agreement”) is made as of the ____ day of __________, 20___, by and between:

Buyer: ______________________________

Address: ______________________________

Phone: ______________________________

Email: ______________________________

Seller: ______________________________

Address: ______________________________

Phone: ______________________________

Email: ______________________________

For the purchase of the property located at:

Property Address: ____________________________________

This Agreement is subject to the laws of the State of New Jersey. The parties hereby agree to the following terms:

- Purchase Price: The total purchase price for the property shall be $____________.

- Deposit: A deposit of $____________ is to be paid by the Buyer upon execution of this Agreement.

- Closing Date: The closing of the sale shall occur on or before the ____ day of __________, 20___.

- Contingencies:

This Agreement is contingent upon:

- Buyer securing financing within ____ days.

- Seller providing clear title to the property.

- Completion of a satisfactory home inspection.

- Possession: Possession of the property shall be delivered to the Buyer on the closing date.

- Disclosure: The Seller agrees to disclose any known defects in the property prior to closing.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

______________________________

Buyer’s Signature

______________________________

Seller’s Signature

______________________________

Date

What to Know About This Form

What is a New Jersey Real Estate Purchase Agreement?

The New Jersey Real Estate Purchase Agreement is a legal document that outlines the terms and conditions of a property sale. It serves as a binding contract between the buyer and the seller, detailing essential elements like the purchase price, closing date, and any contingencies that must be met before the sale is finalized.

What should be included in the Purchase Agreement?

A comprehensive Purchase Agreement typically includes the names of the parties involved, a description of the property, the sale price, earnest money deposit, financing terms, and any contingencies, such as inspections or appraisals. It may also cover the closing process and any obligations of the buyer and seller.

Is the Purchase Agreement legally binding?

Yes, once both parties sign the Purchase Agreement, it becomes a legally binding contract. This means that both the buyer and the seller are obligated to adhere to the terms outlined in the agreement. If either party fails to fulfill their obligations, the other party may seek legal remedies.

Can the Purchase Agreement be modified after signing?

Modifications can be made to the Purchase Agreement after it has been signed, but both parties must agree to any changes. This typically requires a written amendment that is signed by both the buyer and the seller. Verbal agreements or informal changes are generally not enforceable.

What happens if the buyer backs out of the agreement?

If the buyer decides to back out of the agreement without a valid reason, they may forfeit their earnest money deposit. However, if the buyer has a contingency in place, such as failing a home inspection, they may be able to cancel the agreement without penalty.

Are there any contingencies that can be included in the Purchase Agreement?

Yes, contingencies are common in Purchase Agreements. They can include conditions such as obtaining financing, completing a satisfactory home inspection, or the sale of the buyer's current home. These contingencies protect the buyer and allow them to back out if the conditions are not met.

How long does the closing process take?

The closing process can vary but typically takes between 30 to 60 days after the Purchase Agreement is signed. This timeframe allows for necessary inspections, appraisals, and financing arrangements to be completed. Both parties should be prepared for potential delays.

What is an earnest money deposit?

An earnest money deposit is a sum of money that the buyer provides to demonstrate their serious intent to purchase the property. This deposit is usually held in escrow and is applied toward the purchase price at closing. If the buyer backs out without a valid reason, the seller may keep the deposit.

Do I need a lawyer to draft or review the Purchase Agreement?

While it is not legally required to have a lawyer involved, it is highly recommended. A lawyer can help ensure that the agreement is properly drafted, protect your interests, and clarify any legal terms. This can be especially important in complex transactions or when disputes arise.

Fill out Other Real Estate Purchase Agreement Templates for Specific States

House Contract - It may also include clauses about occupancy and possession dates.

Maine Real Estate Purchase and Sale Agreement - It includes timelines for closing the sale and transferring ownership.

Georgia Purchase and Sale Agreement 2023 - The terms of the Real Estate Purchase Agreement can impact negotiations during the sale.