Attorney-Approved Real Estate Purchase Agreement Form for New Hampshire

Dos and Don'ts

When filling out the New Hampshire Real Estate Purchase Agreement form, it is essential to follow certain guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do.

- Do read the entire form carefully before starting.

- Do provide accurate information about the property and parties involved.

- Do include all necessary signatures and dates.

- Do consult with a real estate professional if you have questions.

- Do keep a copy of the completed agreement for your records.

- Don't leave any sections blank unless instructed to do so.

- Don't use vague language; be specific in your descriptions.

- Don't rush through the process; take your time to ensure accuracy.

- Don't forget to review local laws and regulations that may apply.

Common mistakes

-

Failing to include all necessary parties. Every person involved in the transaction should be listed, including spouses or business partners.

-

Not specifying the property address clearly. The complete address, including unit numbers if applicable, must be accurately stated to avoid confusion.

-

Overlooking the purchase price. It's crucial to clearly write the agreed-upon price in both numerical and written form.

-

Ignoring contingencies. Buyers often forget to include contingencies, such as financing or inspection, which protect their interests.

-

Not addressing closing costs. The agreement should specify who is responsible for various closing costs to prevent disputes later.

-

Leaving out the earnest money deposit details. This deposit shows the buyer's commitment and should be clearly outlined in the agreement.

-

Failing to set a closing date. A specific closing date should be included to provide a timeline for all parties involved.

-

Neglecting to include the legal description of the property. This description provides clarity and should be detailed in the agreement.

-

Not reviewing the form for accuracy. Mistakes can happen easily, so it's important to double-check all entries before submitting the agreement.

-

Forgetting to sign and date the agreement. An unsigned or undated document may not be enforceable, so signatures must be included.

Documents used along the form

When engaging in real estate transactions in New Hampshire, several forms and documents are commonly utilized alongside the Real Estate Purchase Agreement. These documents help clarify terms, protect interests, and ensure compliance with state regulations. Below is a list of essential documents often associated with the purchase agreement.

- Seller's Disclosure Statement: This document provides potential buyers with important information about the property's condition, including any known issues or defects. It helps buyers make informed decisions.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about the potential presence of lead-based paint and any associated risks.

- Financing Addendum: This addendum outlines the terms of the buyer's financing, including the type of loan, interest rates, and contingencies related to securing financing.

- Inspection Contingency: This document allows the buyer to conduct a home inspection and outlines the process for addressing any issues discovered during the inspection.

- Title Commitment: This document provides information about the property's title status and any liens or encumbrances that may affect ownership. It is essential for ensuring clear title transfer.

- Closing Disclosure: This document outlines the final terms of the mortgage loan, including all closing costs and fees. It must be provided to the buyer at least three days before closing.

- Deed: The deed is the legal document that transfers ownership of the property from the seller to the buyer. It must be properly executed and recorded to be valid.

Understanding these documents can significantly enhance the buying or selling experience in real estate transactions. Each plays a crucial role in ensuring transparency, protecting rights, and facilitating a smooth transfer of property ownership.

File Characteristics

| Fact Name | Description |

|---|---|

| Document Purpose | The New Hampshire Real Estate Purchase Agreement form is used to outline the terms and conditions under which a buyer agrees to purchase property from a seller. |

| Governing Law | This agreement is governed by the laws of the State of New Hampshire, specifically under the New Hampshire Revised Statutes Annotated (RSA) Chapter 477. |

| Essential Elements | The agreement typically includes details such as the purchase price, property description, closing date, and any contingencies that must be met. |

| Contingencies | Common contingencies in the agreement may include financing, inspections, and the sale of the buyer's current home. |

| Signatures Required | Both the buyer and the seller must sign the agreement to make it legally binding, along with any necessary witnesses or notaries. |

| Modification Process | Any changes to the agreement must be made in writing and signed by both parties to ensure clarity and enforceability. |

Key takeaways

When filling out and using the New Hampshire Real Estate Purchase Agreement form, it is essential to understand the following key points:

- Ensure all parties involved are clearly identified. This includes the buyer(s) and seller(s).

- Specify the property details accurately. Include the address and any relevant parcel numbers.

- Outline the purchase price clearly. This should reflect the agreed-upon amount for the property.

- Include contingencies. Common contingencies may involve financing, inspections, or the sale of another property.

- Set a timeline for important dates. Include deadlines for offers, acceptance, and closing.

- Review all terms carefully. Pay attention to details regarding deposits, closing costs, and any seller concessions.

- Signatures are crucial. Ensure all parties sign and date the agreement to make it legally binding.

- Keep copies of the agreement. Both the buyer and seller should retain a signed copy for their records.

Understanding these points will help ensure a smoother transaction and protect the interests of all parties involved.

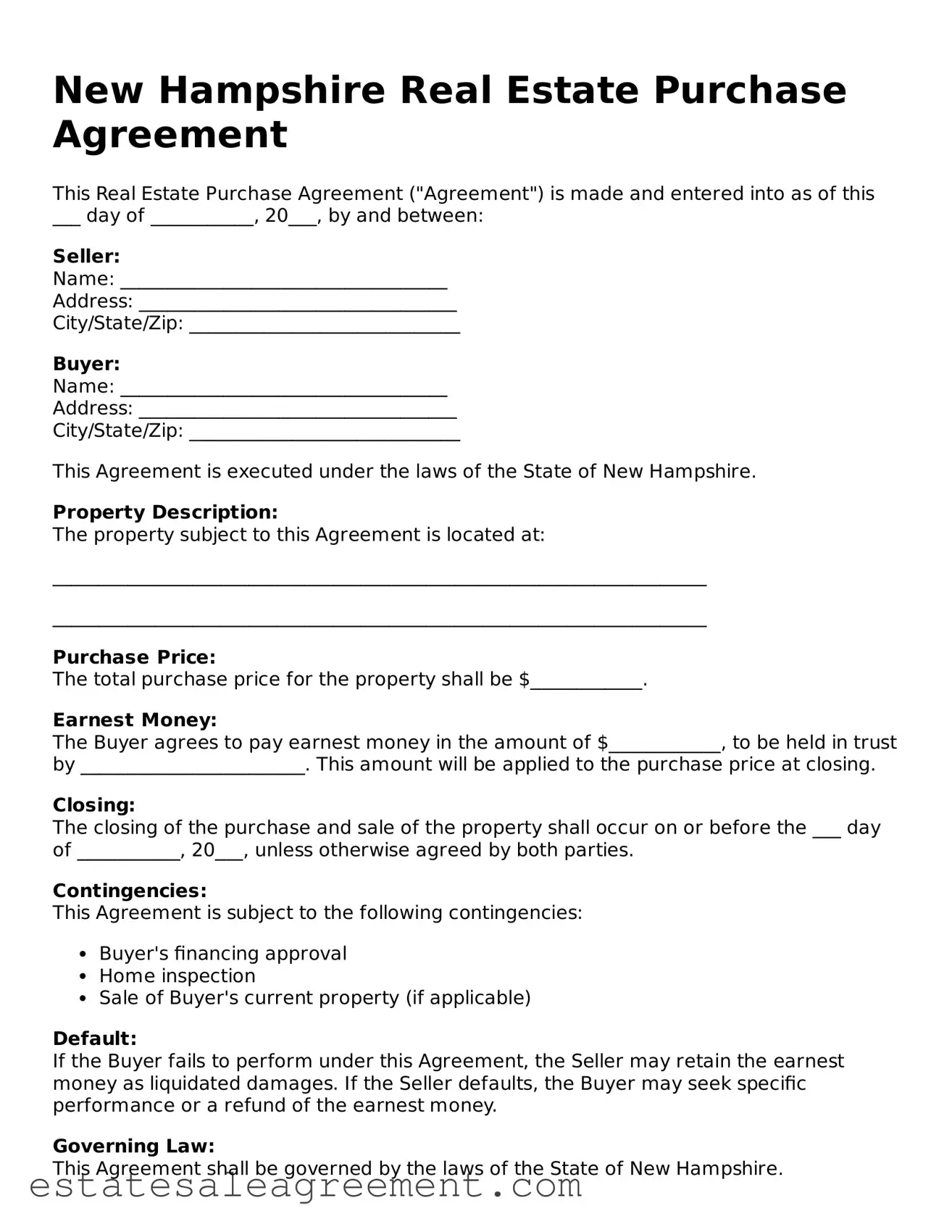

Example - New Hampshire Real Estate Purchase Agreement Form

New Hampshire Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made and entered into as of this ___ day of ___________, 20___, by and between:

Seller:

Name: ___________________________________

Address: __________________________________

City/State/Zip: _____________________________

Buyer:

Name: ___________________________________

Address: __________________________________

City/State/Zip: _____________________________

This Agreement is executed under the laws of the State of New Hampshire.

Property Description:

The property subject to this Agreement is located at:

______________________________________________________________________

______________________________________________________________________

Purchase Price:

The total purchase price for the property shall be $____________.

Earnest Money:

The Buyer agrees to pay earnest money in the amount of $____________, to be held in trust by ________________________. This amount will be applied to the purchase price at closing.

Closing:

The closing of the purchase and sale of the property shall occur on or before the ___ day of ___________, 20___, unless otherwise agreed by both parties.

Contingencies:

This Agreement is subject to the following contingencies:

- Buyer's financing approval

- Home inspection

- Sale of Buyer's current property (if applicable)

Default:

If the Buyer fails to perform under this Agreement, the Seller may retain the earnest money as liquidated damages. If the Seller defaults, the Buyer may seek specific performance or a refund of the earnest money.

Governing Law:

This Agreement shall be governed by the laws of the State of New Hampshire.

Signatures:

By signing below, both parties agree to the terms of this Agreement.

_____________________________

Seller's Signature

_____________________________

Buyer's Signature

This document becomes effective upon the date signed by both parties.

What to Know About This Form

What is a New Hampshire Real Estate Purchase Agreement?

The New Hampshire Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a buyer agrees to purchase property from a seller. This agreement includes important details such as the purchase price, closing date, and any contingencies that must be met before the sale is finalized.

Who uses the Real Estate Purchase Agreement?

This agreement is used by both buyers and sellers in a real estate transaction. Buyers use it to formally express their intention to purchase a property, while sellers use it to outline their acceptance of the offer and the terms of the sale.

What key elements are included in the agreement?

Key elements of the agreement typically include the names of the parties involved, a description of the property, the purchase price, deposit information, contingencies (like financing or inspection), and the closing date. It may also address any repairs or improvements that need to be made prior to closing.

What is a contingency in a Real Estate Purchase Agreement?

A contingency is a condition that must be met for the sale to proceed. Common contingencies include the buyer securing financing, the completion of a satisfactory home inspection, or the sale of the buyer’s current home. If these conditions are not met, the buyer may have the right to withdraw from the agreement without penalty.

Can a buyer make changes to the agreement?

Yes, a buyer can propose changes to the agreement. This is often done during negotiations. However, any changes must be agreed upon by both parties and documented in the final version of the agreement to ensure clarity and enforceability.

What happens if the seller accepts the offer?

If the seller accepts the offer, the agreement becomes binding. Both parties are then obligated to follow the terms outlined in the document. This includes the buyer making the required deposit and the seller providing clear title to the property at closing.

What should a buyer do if they want to withdraw from the agreement?

If a buyer wishes to withdraw from the agreement, they should first review the terms of the document, especially any contingencies. If the buyer is within their rights to withdraw, they must provide written notice to the seller. If not, they may risk losing their deposit or facing other legal consequences.

Is it necessary to have a real estate attorney review the agreement?

While it is not legally required to have an attorney review the agreement, it is highly recommended. An attorney can provide valuable guidance, help ensure that your interests are protected, and clarify any legal language that may be confusing.

What is the typical timeline for closing after signing the agreement?

The timeline for closing can vary but generally occurs within 30 to 60 days after the agreement is signed. This timeframe allows for necessary inspections, financing arrangements, and other preparations to be completed before the final sale takes place.

What should a buyer do if issues arise during the process?

If issues arise, the buyer should communicate promptly with their real estate agent and, if applicable, their attorney. Open communication can often lead to solutions. Depending on the nature of the issue, it may be necessary to amend the agreement or negotiate new terms to address the concerns.

Fill out Other Real Estate Purchase Agreement Templates for Specific States

Connecticut House Purchase Agreement - Notes any pending litigation that could affect the property sale.

Montana Buy Sell Agreement - Provides terms for property taxes, utilities, and any shared expenses.