Attorney-Approved Real Estate Purchase Agreement Form for Nevada

Dos and Don'ts

When filling out the Nevada Real Estate Purchase Agreement form, it's important to be careful and thorough. Here are some dos and don'ts to keep in mind:

- Do read the entire agreement carefully before filling it out. Understanding each section will help you avoid mistakes.

- Do provide accurate information. Ensure that all details, such as names, addresses, and property descriptions, are correct.

- Do consult with a real estate professional if you have questions. They can provide guidance and clarify any uncertainties.

- Do keep copies of all documents. This will help you track changes and maintain a record of the agreement.

- Don't rush through the form. Taking your time can prevent errors that might cause issues later.

- Don't leave any sections blank. If a section does not apply, indicate that clearly to avoid confusion.

- Don't ignore deadlines. Make sure to submit the agreement within the required timeframes to keep the process moving smoothly.

- Don't sign without understanding the terms. Ensure you are comfortable with all aspects of the agreement before signing.

Common mistakes

When filling out the Nevada Real Estate Purchase Agreement form, individuals often make several common mistakes. Here’s a list of eight mistakes to avoid:

- Incorrect Property Description: Failing to accurately describe the property can lead to confusion. Ensure the address and legal description are complete.

- Missing Signatures: Both the buyer and seller must sign the agreement. Omitting a signature can render the agreement invalid.

- Not Specifying the Purchase Price: Clearly state the purchase price. Leaving this blank can cause disputes later on.

- Ignoring Contingencies: Not including necessary contingencies, such as financing or inspection, can put buyers at risk.

- Incorrect Dates: Ensure that all dates are accurate. This includes the date of the agreement and any deadlines for contingencies.

- Failure to Include Earnest Money: Specify the amount of earnest money and how it will be handled. This shows commitment and can protect the buyer's interests.

- Not Reviewing the Terms: Skimming over the terms and conditions can lead to misunderstandings. Review everything carefully.

- Omitting Additional Terms: If there are any special requests or additional agreements, include them in the contract. Leaving these out can create problems later.

By avoiding these mistakes, individuals can help ensure a smoother transaction process.

Documents used along the form

When engaging in a real estate transaction in Nevada, several key documents complement the Real Estate Purchase Agreement. Understanding these forms can help ensure a smooth process and protect the interests of all parties involved. Below is a list of commonly used documents in conjunction with the purchase agreement.

- Property Disclosure Statement: This document outlines any known issues or defects with the property. Sellers must disclose material facts that could affect the buyer's decision.

- Title Report: A title report provides information about the property’s ownership history, liens, and encumbrances. It helps ensure that the buyer receives clear title to the property.

- Home Inspection Report: After a home inspection, this report details the condition of the property. It can highlight repairs needed and inform the buyer's decision-making process.

- Loan Estimate: For buyers financing their purchase, a loan estimate outlines the terms of the mortgage, including interest rates, monthly payments, and closing costs.

- Closing Disclosure: This document is provided before closing and summarizes the final terms of the loan and closing costs. It allows buyers to review their financial obligations before the transaction is finalized.

- Earnest Money Agreement: This agreement outlines the amount of earnest money the buyer will provide to demonstrate their serious intent to purchase the property.

- Addenda: These are additional documents that may modify or add terms to the purchase agreement. They can address specific contingencies or special conditions agreed upon by both parties.

- Deed: The deed is the legal document that transfers ownership of the property from the seller to the buyer. It must be recorded with the county to establish legal ownership.

Being familiar with these documents can help facilitate a successful real estate transaction. Each form plays a vital role in ensuring transparency and protecting the rights of both buyers and sellers. Always consider consulting with a professional to navigate these important steps effectively.

File Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The Nevada Real Estate Purchase Agreement is governed by Nevada state law. |

| Purpose | This form outlines the terms and conditions for buying and selling real estate in Nevada. |

| Parties Involved | The agreement identifies the buyer(s) and seller(s) involved in the transaction. |

| Property Description | A detailed description of the property being sold is included in the agreement. |

| Purchase Price | The form specifies the total purchase price and payment terms. |

| Contingencies | Common contingencies, such as financing and inspections, can be included in the agreement. |

| Closing Date | The agreement typically states a closing date for the transaction. |

| Earnest Money | Details about earnest money deposits are outlined in the form. |

| Signatures | Both parties must sign the agreement for it to be legally binding. |

Key takeaways

Ensure that all parties involved in the transaction are clearly identified. This includes full names and contact information for both the buyer and the seller. Clarity helps prevent misunderstandings later on.

Pay close attention to the terms of the sale, including the purchase price and any contingencies. Contingencies might include financing, inspections, or the sale of another property. These terms can significantly impact the agreement.

Be mindful of the closing date and any deadlines outlined in the agreement. Timely completion of necessary steps is crucial for a smooth transaction.

Consider having the agreement reviewed by a legal professional. This can provide additional peace of mind and ensure that all legal obligations are met.

Example - Nevada Real Estate Purchase Agreement Form

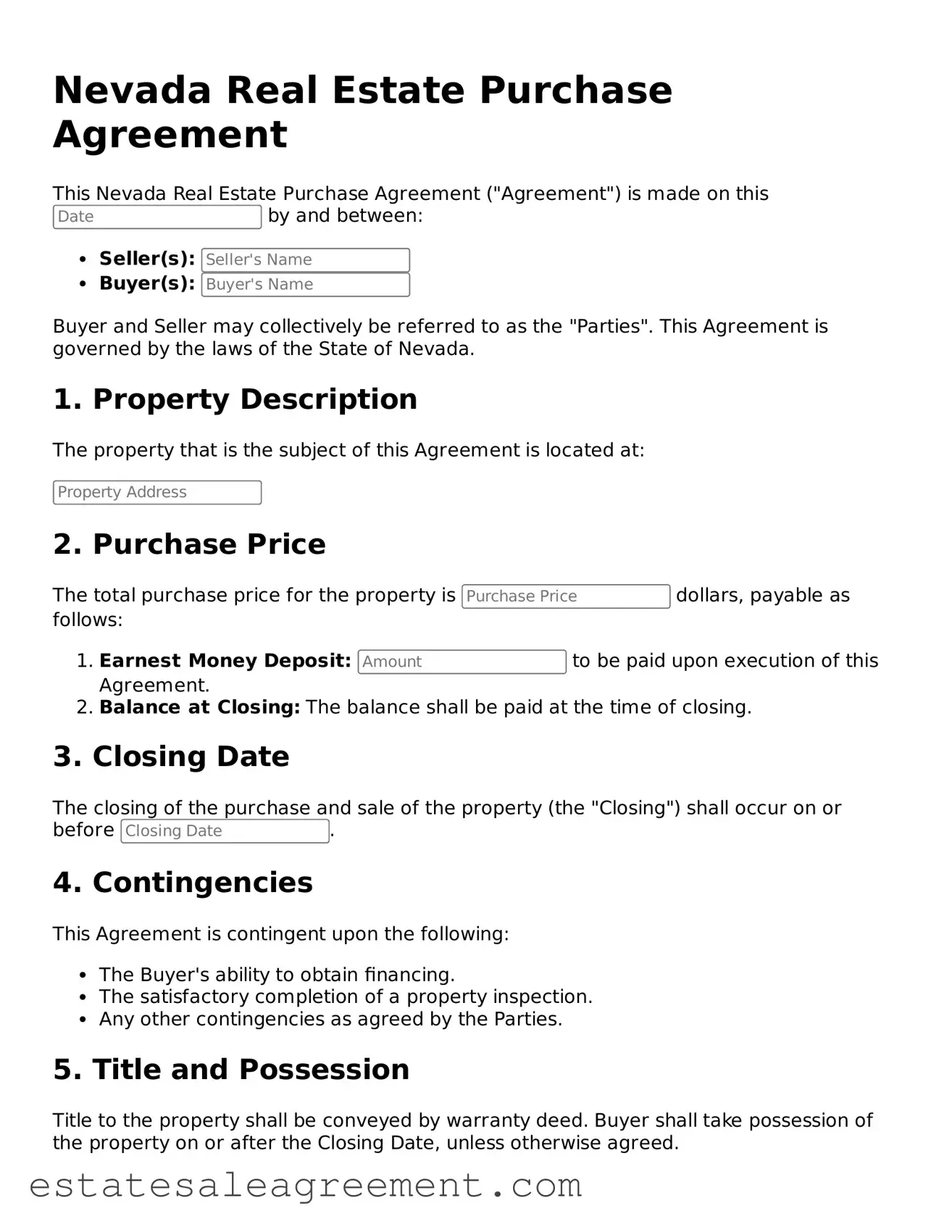

Nevada Real Estate Purchase Agreement

This Nevada Real Estate Purchase Agreement ("Agreement") is made on this by and between:

- Seller(s):

- Buyer(s):

Buyer and Seller may collectively be referred to as the "Parties". This Agreement is governed by the laws of the State of Nevada.

1. Property Description

The property that is the subject of this Agreement is located at:

2. Purchase Price

The total purchase price for the property is dollars, payable as follows:

- Earnest Money Deposit: to be paid upon execution of this Agreement.

- Balance at Closing: The balance shall be paid at the time of closing.

3. Closing Date

The closing of the purchase and sale of the property (the "Closing") shall occur on or before .

4. Contingencies

This Agreement is contingent upon the following:

- The Buyer's ability to obtain financing.

- The satisfactory completion of a property inspection.

- Any other contingencies as agreed by the Parties.

5. Title and Possession

Title to the property shall be conveyed by warranty deed. Buyer shall take possession of the property on or after the Closing Date, unless otherwise agreed.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Nevada.

7. Signatures

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the date first above written.

- Seller(s) Signature: _________________________

- Date: ________________

- Buyer(s) Signature: _________________________

- Date: ________________

What to Know About This Form

What is a Nevada Real Estate Purchase Agreement?

The Nevada Real Estate Purchase Agreement is a legal document used when buying or selling real estate in Nevada. This agreement outlines the terms and conditions of the sale, including the purchase price, closing date, and any contingencies. It serves to protect both the buyer and seller by clearly stating their obligations and rights during the transaction.

Who needs to sign the Real Estate Purchase Agreement?

Both the buyer and the seller must sign the Real Estate Purchase Agreement. This signature indicates that both parties agree to the terms laid out in the document. Additionally, if there are any agents involved in the transaction, they may also need to sign to acknowledge their role and the terms of their representation.

What are contingencies in a Real Estate Purchase Agreement?

Contingencies are specific conditions that must be met for the sale to proceed. Common contingencies include financing, home inspections, and appraisal conditions. For example, a buyer might include a contingency that allows them to back out of the agreement if the home inspection reveals significant issues. These contingencies help protect buyers from unforeseen problems.

How is the purchase price determined in the agreement?

The purchase price is typically negotiated between the buyer and seller before the agreement is signed. Factors influencing the price include the property’s market value, condition, location, and comparable sales in the area. Once both parties reach an agreement on the price, it is documented in the Real Estate Purchase Agreement.

What happens if one party wants to back out of the agreement?

If one party wants to back out, the consequences depend on the terms outlined in the agreement, particularly the contingencies. If a contingency is not met, the buyer can often cancel the agreement without penalty. However, if there are no valid contingencies, the party wishing to back out may face legal repercussions or financial penalties.

Can the Real Estate Purchase Agreement be modified after it is signed?

Yes, the Real Estate Purchase Agreement can be modified after it is signed, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both the buyer and seller. This ensures that everyone is on the same page and helps avoid misunderstandings later in the process.

Fill out Other Real Estate Purchase Agreement Templates for Specific States

Pa Real Estate Contract - Facilitates a smoother closing process for everyone involved.

Purchase Agreement Michigan for Sale by Owner - Defines the responsibilities of the real estate agents involved.

Buying a House on Contract Template - Buyers should consider the implications of repair contingencies.