Attorney-Approved Real Estate Purchase Agreement Form for Nebraska

Dos and Don'ts

When filling out the Nebraska Real Estate Purchase Agreement form, it's important to follow certain guidelines to ensure everything is done correctly. Here are ten things to consider:

- Do read the entire form carefully before starting.

- Do provide accurate information about the property and parties involved.

- Do include all necessary details, such as purchase price and closing date.

- Do consult with a real estate agent or attorney if you have questions.

- Do sign and date the agreement in the appropriate places.

- Don't leave any blank spaces; fill in all required fields.

- Don't use unclear language or abbreviations that could cause confusion.

- Don't rush through the process; take your time to ensure accuracy.

- Don't ignore any contingencies that may need to be included.

- Don't forget to keep a copy of the signed agreement for your records.

Common mistakes

-

Inaccurate Property Description: One common mistake is failing to provide a precise description of the property being sold. This includes not specifying the correct address, parcel number, or legal description. A vague description can lead to disputes later on.

-

Neglecting to Include Contingencies: Buyers often forget to include necessary contingencies, such as financing or inspection clauses. These contingencies protect the buyer by allowing them to back out of the agreement if certain conditions are not met.

-

Overlooking Earnest Money Details: The earnest money deposit is a critical part of the agreement. Failing to specify the amount or terms regarding the deposit can create confusion and potential legal issues down the line.

-

Not Addressing Closing Costs: Closing costs can be a significant part of the transaction. If the agreement does not clearly outline who is responsible for these costs, it can lead to misunderstandings and disputes at the closing table.

-

Ignoring Signatures and Dates: Lastly, one of the simplest yet most overlooked mistakes is neglecting to sign and date the agreement. Without proper signatures, the contract may not be legally binding, leaving both parties vulnerable.

Documents used along the form

When engaging in a real estate transaction in Nebraska, several documents often accompany the Real Estate Purchase Agreement. Each document serves a specific purpose and helps ensure a smooth process for both the buyer and the seller. Below is a list of common forms and documents used in conjunction with the purchase agreement.

- Disclosure Statement: This document informs buyers about the condition of the property. It includes details about any known issues, such as structural problems or past repairs.

- Earnest Money Agreement: This agreement outlines the amount of earnest money the buyer will deposit. It shows the buyer's commitment to purchasing the property.

- Title Commitment: This document provides information about the property's title status. It shows whether the title is clear or if there are any liens or claims against it.

- Property Inspection Report: An inspection report details the findings from a professional inspection of the property. It helps buyers understand any potential repairs needed.

- Appraisal Report: This report assesses the property's market value. Lenders often require it to ensure the property's value aligns with the loan amount.

- Closing Statement: Also known as a HUD-1, this document outlines all the final costs involved in the transaction. It details fees, commissions, and adjustments.

- Deed: The deed transfers ownership of the property from the seller to the buyer. It is a crucial document for establishing legal ownership.

- Loan Documents: If the buyer is financing the purchase, various loan documents will be required. These include the mortgage agreement and promissory note.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents outline the rules and regulations governing the community.

Understanding these documents is essential for anyone involved in a real estate transaction. They help clarify responsibilities and protect the interests of all parties involved. Having all the necessary paperwork in order contributes to a smoother buying or selling experience.

File Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The Nebraska Real Estate Purchase Agreement is governed by the Nebraska Revised Statutes, specifically Chapter 76, which deals with real estate transactions. |

| Parties Involved | The agreement typically involves two main parties: the buyer and the seller of the property. |

| Property Description | A detailed description of the property being sold is included in the agreement. This usually encompasses the address and legal description. |

| Purchase Price | The total purchase price for the property must be clearly stated in the agreement, including any deposit amounts. |

| Contingencies | Common contingencies such as financing, inspections, and appraisal are often included to protect the buyer's interests. |

| Closing Date | The agreement specifies a closing date, which is the date when the ownership of the property will officially transfer from the seller to the buyer. |

| Earnest Money | Earnest money is typically required to demonstrate the buyer's commitment to the purchase. The amount and handling of this money are outlined in the agreement. |

| Disclosures | Sellers are required to provide certain disclosures about the property, such as known defects or issues, to inform the buyer. |

| Default Provisions | The agreement includes provisions outlining what happens if either party defaults on the terms of the contract. |

| Signatures | Finally, the agreement must be signed by both parties to be legally binding, indicating their acceptance of the terms outlined in the document. |

Key takeaways

When filling out and using the Nebraska Real Estate Purchase Agreement form, it is essential to keep several key points in mind to ensure a smooth transaction.

- Accuracy is crucial. All information, including names, addresses, and property details, must be correct to avoid complications later.

- Understand the terms. Familiarize yourself with the conditions outlined in the agreement, such as contingencies and closing dates, to ensure they meet your needs.

- Consult with professionals. It is advisable to work with a real estate agent or attorney to navigate any complexities in the agreement.

- Keep copies. Always retain a copy of the signed agreement for your records, as it serves as a vital reference throughout the buying process.

Being thorough and informed will help you manage the purchase effectively and protect your interests.

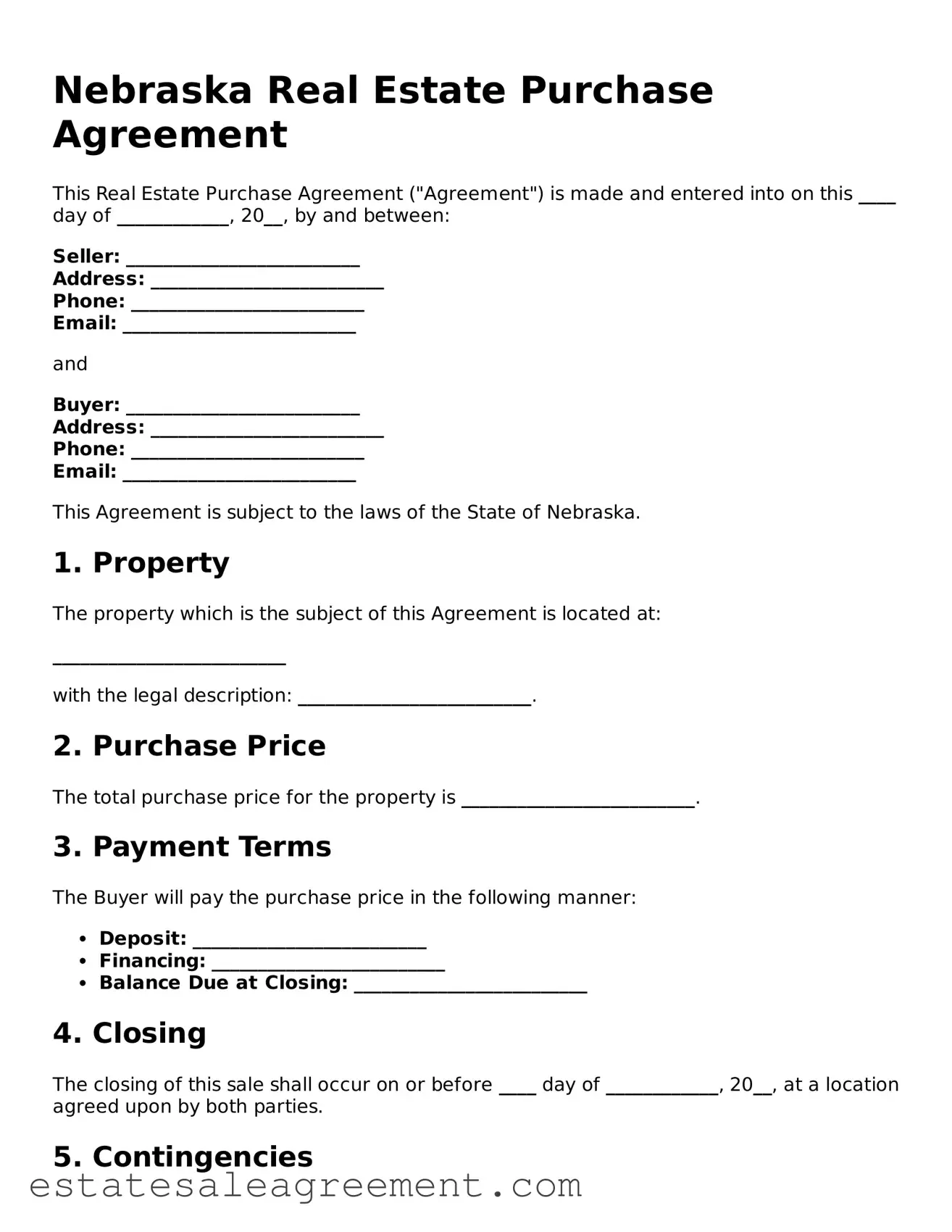

Example - Nebraska Real Estate Purchase Agreement Form

Nebraska Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made and entered into on this ____ day of ____________, 20__, by and between:

Seller: _________________________

Address: _________________________

Phone: _________________________

Email: _________________________

and

Buyer: _________________________

Address: _________________________

Phone: _________________________

Email: _________________________

This Agreement is subject to the laws of the State of Nebraska.

1. Property

The property which is the subject of this Agreement is located at:

_________________________with the legal description: _________________________.

2. Purchase Price

The total purchase price for the property is _________________________.

3. Payment Terms

The Buyer will pay the purchase price in the following manner:

- Deposit: _________________________

- Financing: _________________________

- Balance Due at Closing: _________________________

4. Closing

The closing of this sale shall occur on or before ____ day of ____________, 20__, at a location agreed upon by both parties.

5. Contingencies

This Agreement is contingent upon:

- Financing: Buyer securing financing acceptable to them.

- Inspection: A home inspection being satisfactory to the buyer.

- Appraisal: An appraisal valued at no less than the purchase price.

6. Signatures

The parties agree to the terms of this Agreement and shall provide their signatures below:

______________________________

(Seller Signature)

______________________________

(Buyer Signature)

Date of Signature: ____ day of ____________, 20__

What to Know About This Form

What is a Nebraska Real Estate Purchase Agreement?

The Nebraska Real Estate Purchase Agreement is a legal document used when buying or selling real estate in Nebraska. It outlines the terms and conditions of the sale, including the purchase price, property description, and any contingencies that must be met before the sale can be finalized. This agreement serves to protect both the buyer and the seller by clearly defining their rights and responsibilities throughout the transaction.

What are the key components of the agreement?

Key components of the Nebraska Real Estate Purchase Agreement include the identification of the parties involved, a detailed description of the property, the purchase price, the closing date, and any contingencies, such as financing or inspections. Additionally, it may include provisions regarding earnest money deposits, disclosures, and any agreed-upon repairs or improvements to the property.

Is an attorney required to complete this agreement?

While it is not legally required to have an attorney complete a Nebraska Real Estate Purchase Agreement, it is highly recommended. An attorney can help ensure that the agreement is properly drafted, protect your interests, and navigate any potential legal issues that may arise during the transaction.

Can the agreement be modified after it is signed?

Yes, the Nebraska Real Estate Purchase Agreement can be modified after it is signed, but both parties must agree to the changes. Modifications should be documented in writing and signed by both the buyer and the seller to ensure clarity and enforceability. Verbal agreements or informal changes may not hold up in case of disputes.

What happens if one party breaches the agreement?

If one party breaches the Nebraska Real Estate Purchase Agreement, the other party may have several options. These can include seeking damages, enforcing the contract, or terminating the agreement. The specific remedies available will depend on the nature of the breach and the terms outlined in the agreement. Legal counsel can provide guidance on the best course of action in such situations.

Are there any contingencies commonly included in the agreement?

Yes, common contingencies in a Nebraska Real Estate Purchase Agreement may include financing contingencies, inspection contingencies, and appraisal contingencies. These contingencies allow the buyer to back out of the agreement without penalty if certain conditions are not met, such as failing to secure financing or discovering significant issues during a property inspection.

How is earnest money handled in the agreement?

Earnest money is a deposit made by the buyer to demonstrate their serious intent to purchase the property. In the Nebraska Real Estate Purchase Agreement, the amount of earnest money and the conditions for its return or forfeiture are typically specified. If the transaction proceeds as planned, the earnest money is usually applied to the purchase price at closing. If the buyer fails to fulfill their obligations under the agreement, the seller may be entitled to keep the earnest money as compensation.

Fill out Other Real Estate Purchase Agreement Templates for Specific States

Tennessee Real Estate Forms Free - The purchase agreement can set deadlines for inspections and financing approvals.

Purchasing Agreement - This form is important for protecting the interests of both the buyer and the seller.