Attorney-Approved Real Estate Purchase Agreement Form for Maryland

Dos and Don'ts

When filling out the Maryland Real Estate Purchase Agreement form, it’s important to be thorough and accurate. Here are some key do's and don'ts to consider:

- Do read the entire agreement carefully before filling it out.

- Do provide accurate information about the property and the parties involved.

- Do include all necessary details, such as the purchase price and closing date.

- Do consult a real estate professional if you have questions about any part of the agreement.

- Don't leave any sections blank; incomplete forms can lead to confusion or disputes.

- Don't rush through the process; take your time to ensure everything is correct.

- Don't sign the agreement until you fully understand its terms and conditions.

Common mistakes

-

Incomplete Information: Buyers and sellers often forget to fill in all required fields. Missing details can lead to confusion or disputes later on.

-

Incorrect Property Description: It's crucial to accurately describe the property being sold. Errors in the address or legal description can create significant issues.

-

Omitting Contingencies: Buyers sometimes overlook important contingencies, such as financing or inspection clauses. These protect the buyer's interests and should not be ignored.

-

Not Specifying the Purchase Price: Failing to clearly state the purchase price can lead to misunderstandings. Ensure that the agreed amount is prominently displayed.

-

Ignoring Closing Date: The closing date should be clearly defined. Without it, both parties may have different expectations about when the sale will finalize.

-

Neglecting Signatures: Both parties must sign the agreement. An unsigned document is not legally binding, which can jeopardize the transaction.

-

Forgetting to Include Earnest Money: Buyers often forget to mention earnest money deposits. This shows good faith and commitment to the purchase.

-

Not Consulting a Professional: Some individuals attempt to fill out the form without professional guidance. Legal or real estate experts can provide valuable insight and help avoid mistakes.

Documents used along the form

When entering into a real estate transaction in Maryland, several important documents accompany the Real Estate Purchase Agreement. These documents help ensure clarity and protect the interests of all parties involved. Below are five key forms that are commonly used in conjunction with the purchase agreement.

- Property Disclosure Statement: This document provides buyers with essential information about the property's condition. Sellers are required to disclose known issues, such as structural problems or environmental hazards, helping buyers make informed decisions.

- Lead-Based Paint Disclosure: For homes built before 1978, this form is mandatory. It informs buyers of potential lead hazards and requires sellers to provide any known lead-based paint information, ensuring safety for all occupants.

- Financing Addendum: This addendum outlines the terms of the buyer's financing arrangements. It details the type of loan, interest rates, and contingencies related to financing, ensuring both parties understand the financial aspects of the transaction.

- Home Inspection Contingency: This document allows buyers to have the property inspected by a professional. It outlines the process for addressing any issues discovered during the inspection, providing a safety net for buyers regarding the property's condition.

- Settlement Statement: Also known as a HUD-1 statement, this document summarizes all costs associated with the transaction. It details the financial aspects of the sale, including fees, taxes, and the final amount due at closing, ensuring transparency for both parties.

These documents play a vital role in the real estate transaction process in Maryland. Understanding their purpose can help ensure a smoother experience for both buyers and sellers, fostering trust and clarity throughout the process.

File Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | The Maryland Real Estate Purchase Agreement is governed by Maryland state law. |

| Purpose | This form outlines the terms and conditions for the sale of real estate in Maryland. |

| Parties Involved | The agreement includes the buyer(s) and seller(s) of the property. |

| Property Description | A detailed description of the property being sold must be included. |

| Contingencies | Buyers may include contingencies such as financing or inspection requirements. |

| Closing Date | The agreement specifies the closing date for the transaction, which is mutually agreed upon. |

Key takeaways

When filling out and using the Maryland Real Estate Purchase Agreement form, there are several important points to keep in mind. Understanding these key takeaways can help ensure a smoother transaction for both buyers and sellers.

- Clarity is Crucial: Ensure that all terms and conditions are clearly stated. Ambiguities can lead to misunderstandings later.

- Complete Information: Fill in all required fields accurately. Missing information can delay the process.

- Contingencies Matter: Include any contingencies that are important to you, such as financing or inspection contingencies. These protect your interests.

- Review Deadlines: Pay attention to any deadlines outlined in the agreement. Timely actions are essential to keep the transaction on track.

- Legal Review: Consider having a lawyer review the agreement before signing. This can help identify potential issues or clarify terms.

- Understand Your Obligations: Be aware of your responsibilities as a buyer or seller. This includes adhering to timelines and fulfilling contractual obligations.

- Keep Copies: After signing, keep copies of the agreement for your records. This can be helpful for future reference.

By keeping these key points in mind, you can navigate the Maryland Real Estate Purchase Agreement more effectively and with greater confidence.

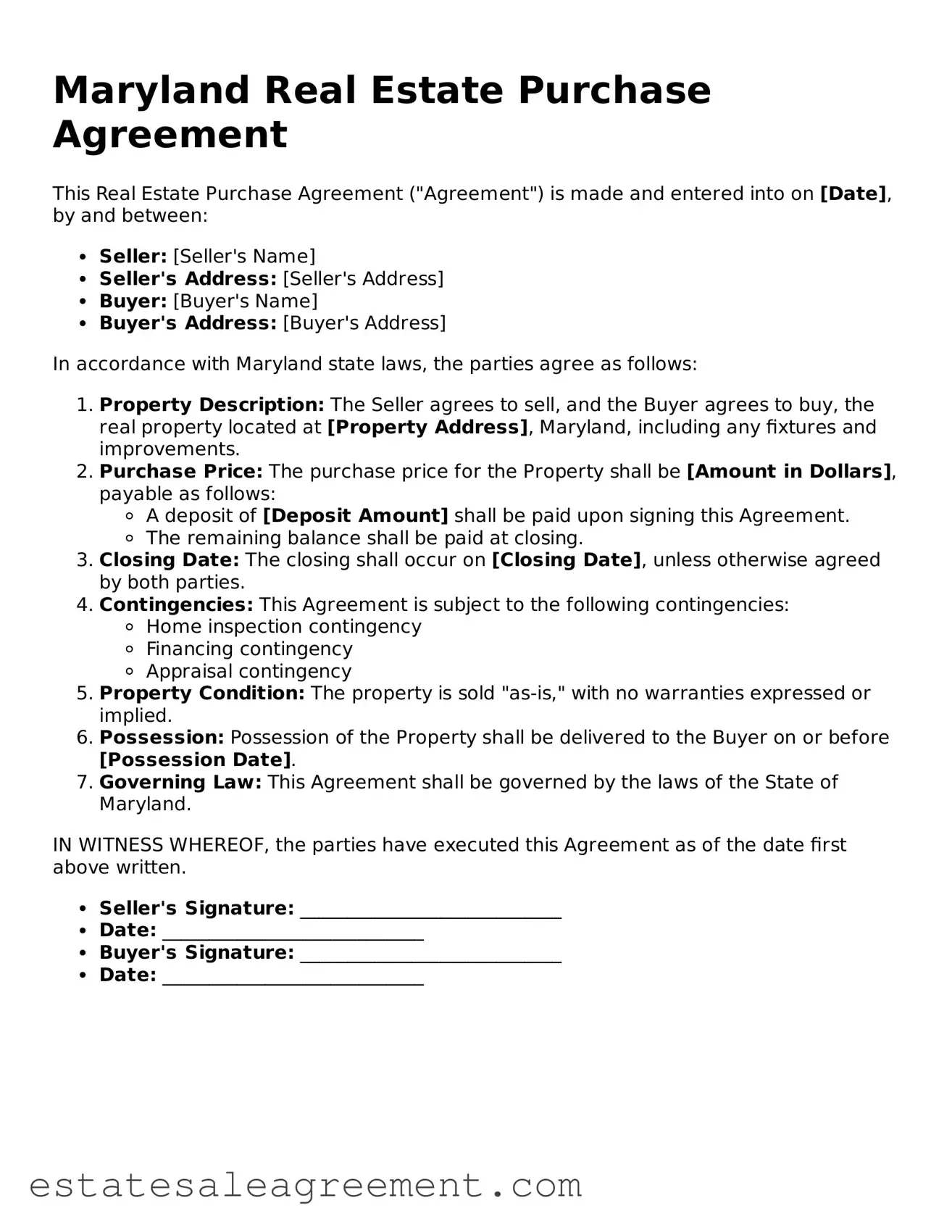

Example - Maryland Real Estate Purchase Agreement Form

Maryland Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made and entered into on [Date], by and between:

- Seller: [Seller's Name]

- Seller's Address: [Seller's Address]

- Buyer: [Buyer's Name]

- Buyer's Address: [Buyer's Address]

In accordance with Maryland state laws, the parties agree as follows:

- Property Description: The Seller agrees to sell, and the Buyer agrees to buy, the real property located at [Property Address], Maryland, including any fixtures and improvements.

- Purchase Price: The purchase price for the Property shall be [Amount in Dollars], payable as follows:

- A deposit of [Deposit Amount] shall be paid upon signing this Agreement.

- The remaining balance shall be paid at closing.

- Closing Date: The closing shall occur on [Closing Date], unless otherwise agreed by both parties.

- Contingencies: This Agreement is subject to the following contingencies:

- Home inspection contingency

- Financing contingency

- Appraisal contingency

- Property Condition: The property is sold "as-is," with no warranties expressed or implied.

- Possession: Possession of the Property shall be delivered to the Buyer on or before [Possession Date].

- Governing Law: This Agreement shall be governed by the laws of the State of Maryland.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

- Seller's Signature: ____________________________

- Date: ____________________________

- Buyer's Signature: ____________________________

- Date: ____________________________

What to Know About This Form

What is a Maryland Real Estate Purchase Agreement?

A Maryland Real Estate Purchase Agreement is a legal document used when buying or selling property in Maryland. It outlines the terms and conditions of the sale, including the price, closing date, and any contingencies that must be met before the sale is finalized.

Who uses the Real Estate Purchase Agreement?

This agreement is typically used by buyers and sellers of residential real estate. Real estate agents often assist in preparing the document, ensuring that all necessary details are included and that both parties understand their rights and responsibilities.

What key components are included in the agreement?

The agreement usually includes the purchase price, property description, closing date, earnest money deposit, contingencies (like financing or inspections), and any additional terms agreed upon by both parties. It's important to read each section carefully to understand what is being agreed to.

What are contingencies in a Real Estate Purchase Agreement?

Contingencies are conditions that must be met for the sale to proceed. Common contingencies include obtaining financing, passing a home inspection, or selling a current home. If these conditions are not met, the buyer may have the right to withdraw from the agreement without penalty.

How is the purchase price determined?

The purchase price is typically negotiated between the buyer and seller. Factors influencing this decision include the property's market value, condition, and comparable sales in the area. A real estate agent can provide insights and help both parties reach a fair price.

What happens after the agreement is signed?

Once both parties sign the agreement, it becomes legally binding. The buyer usually provides an earnest money deposit to show commitment. After that, the buyer will work on fulfilling any contingencies, and both parties will prepare for the closing process.

Can the agreement be modified after it is signed?

Yes, the agreement can be modified, but both parties must agree to any changes. Modifications should be documented in writing and signed by both the buyer and seller to ensure clarity and avoid misunderstandings.

What should I do if I have questions about the agreement?

If you have questions or concerns about the Real Estate Purchase Agreement, it’s best to consult a real estate attorney or a qualified real estate professional. They can provide guidance specific to your situation and help you understand your rights and obligations.

Fill out Other Real Estate Purchase Agreement Templates for Specific States

Vermont Purchase and Sale Agreement - Describes any unique clauses that pertain to specialized types of properties or situations.

How to Make a Purchase Agreement - It often includes details about any included fixtures or appliances.

Wyoming House Purchase Agreement - A binding contract between buyer and seller for a property sale.

Nebraska Purchase Agreement Pdf - Provides a framework for possession transfer post-closing.