Attorney-Approved Real Estate Purchase Agreement Form for Maine

Dos and Don'ts

When filling out the Maine Real Estate Purchase Agreement form, it is essential to approach the process with care and attention to detail. Here are some important do's and don'ts to keep in mind:

- Do read the entire form thoroughly before starting. Understanding each section will help you provide accurate information.

- Do include all parties' full legal names. This ensures that everyone involved is properly identified in the agreement.

- Do specify the property address clearly. Providing complete details helps avoid any confusion regarding the property being sold.

- Do outline the purchase price and terms clearly. This includes the amount of earnest money and any contingencies.

- Do consult with a real estate professional or attorney if you have questions. Their expertise can guide you through complex areas.

- Don't leave any sections blank. Missing information can lead to delays or disputes later in the process.

- Don't rush through the form. Taking your time to ensure accuracy will help prevent issues down the line.

By following these guidelines, you can create a well-prepared Maine Real Estate Purchase Agreement that reflects the intentions of all parties involved.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to delays or complications. Ensure that all sections are addressed, including buyer and seller details.

-

Incorrect Property Description: Misidentifying the property can create confusion. Double-check the address and legal description to ensure accuracy.

-

Missing Signatures: Without the necessary signatures, the agreement may not be legally binding. Both parties should sign and date the document.

-

Neglecting Contingencies: Omitting important contingencies, such as financing or inspection, can lead to unexpected issues. Clearly outline any conditions that must be met.

-

Ignoring Dates: Failing to include key dates, like the closing date, can cause misunderstandings. Specify all relevant timelines in the agreement.

-

Overlooking Earnest Money: Not addressing the earnest money deposit can lead to disputes. Clearly state the amount and conditions for this deposit.

-

Inaccurate Price: Listing the wrong purchase price can create legal complications. Confirm that the price reflects the agreed-upon amount.

-

Failure to Review Terms: Skipping a thorough review of all terms and conditions can lead to misunderstandings. Take the time to read through the agreement carefully.

-

Not Seeking Professional Help: Attempting to fill out the form without guidance can result in errors. Consulting with a real estate professional can provide valuable insights.

Documents used along the form

When engaging in a real estate transaction in Maine, several important documents accompany the Real Estate Purchase Agreement. These documents help clarify the terms of the sale, protect the interests of both parties, and ensure a smooth transfer of property. Here are four commonly used forms:

- Disclosure Statement: This document provides essential information about the property's condition and any known defects. Sellers are required to disclose issues such as structural problems, pest infestations, or environmental hazards. This transparency helps buyers make informed decisions.

- Title Commitment: This is a document from a title company that outlines the current ownership of the property and any liens or encumbrances that may exist. It assures the buyer that the title is clear and can be transferred without legal complications.

- Lead Paint Disclosure: For homes built before 1978, this form is mandatory. It informs buyers about the potential risks of lead-based paint and requires sellers to provide information regarding any known lead hazards. This is crucial for the health and safety of residents, especially children.

- Closing Statement: Also known as a HUD-1 Settlement Statement, this document itemizes all the costs associated with the transaction. It includes details about the purchase price, closing costs, and any adjustments. Both buyers and sellers review this statement before finalizing the sale.

Understanding these documents is vital for anyone involved in a real estate transaction. They not only protect your interests but also facilitate a clearer and more efficient process. Being well-informed can lead to a more successful and satisfying real estate experience.

File Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The Maine Real Estate Purchase Agreement is governed by the laws of the State of Maine. |

| Parties Involved | The agreement typically involves a buyer and a seller, both of whom must be legally competent to enter into a contract. |

| Property Description | A detailed description of the property being sold is required, including its address and legal description. |

| Purchase Price | The agreement must specify the total purchase price, including any deposits or financing terms. |

| Contingencies | Common contingencies may include financing, inspection, and appraisal, which allow the buyer to withdraw under certain conditions. |

| Closing Date | The agreement should state the anticipated closing date, which is the date when the property transfer will occur. |

| Disclosure Requirements | Maine law requires sellers to disclose certain information about the property, including known defects and environmental hazards. |

| Signatures | Both parties must sign the agreement for it to be legally binding, indicating their acceptance of the terms. |

Key takeaways

When filling out and using the Maine Real Estate Purchase Agreement form, consider the following key takeaways:

- Ensure all parties' names and contact information are accurate. This establishes clear communication throughout the transaction.

- Detail the property description thoroughly. Include the address, parcel number, and any relevant features to avoid confusion.

- Specify the purchase price and payment terms clearly. This includes the amount of the deposit and any financing contingencies.

- Understand the contingencies included in the agreement. Common contingencies may involve inspections, financing, or sale of another property.

- Review the closing timeline carefully. Set clear expectations for when the transaction will be finalized to ensure all parties are aligned.

Example - Maine Real Estate Purchase Agreement Form

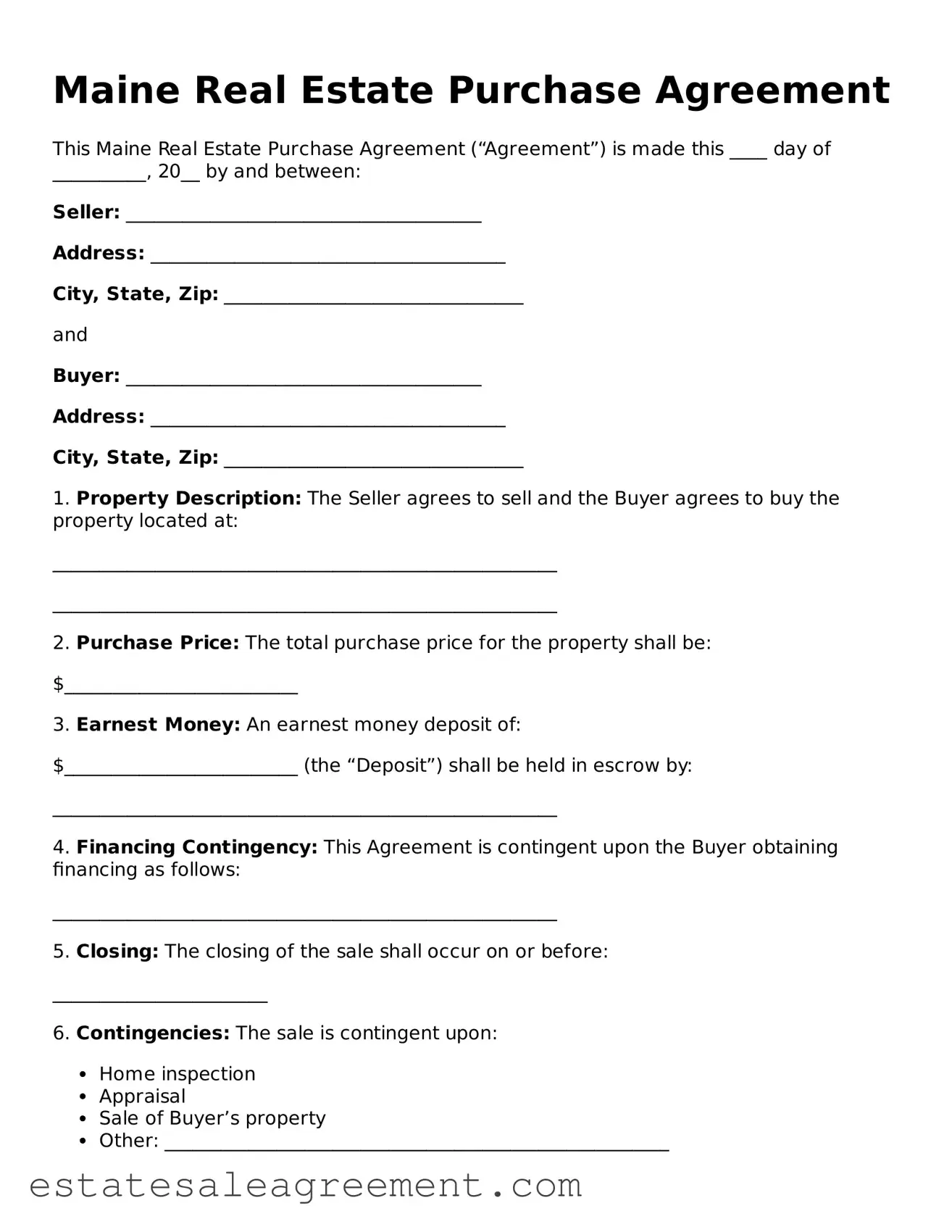

Maine Real Estate Purchase Agreement

This Maine Real Estate Purchase Agreement (“Agreement”) is made this ____ day of __________, 20__ by and between:

Seller: ______________________________________

Address: ______________________________________

City, State, Zip: ________________________________

and

Buyer: ______________________________________

Address: ______________________________________

City, State, Zip: ________________________________

1. Property Description: The Seller agrees to sell and the Buyer agrees to buy the property located at:

______________________________________________________

______________________________________________________

2. Purchase Price: The total purchase price for the property shall be:

$_________________________

3. Earnest Money: An earnest money deposit of:

$_________________________ (the “Deposit”) shall be held in escrow by:

______________________________________________________

4. Financing Contingency: This Agreement is contingent upon the Buyer obtaining financing as follows:

______________________________________________________

5. Closing: The closing of the sale shall occur on or before:

_______________________

6. Contingencies: The sale is contingent upon:

- Home inspection

- Appraisal

- Sale of Buyer’s property

- Other: ______________________________________________________

7. Possession: Possession of the property shall be delivered to the Buyer on:

_______________________

8. Additional Terms: Any additional terms applicable to this Agreement:

______________________________________________________

______________________________________________________

9. Governing Law: This Agreement shall be governed by the laws of the State of Maine.

10. Entire Agreement: This Agreement contains the entire understanding between the parties and supersedes any prior agreements or understandings.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement on the date first above written.

Seller’s Signature:_________________________ Date: _____________

Buyer’s Signature:_________________________ Date: _____________

What to Know About This Form

What is a Maine Real Estate Purchase Agreement?

The Maine Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions under which a buyer agrees to purchase property from a seller. This agreement serves as a crucial step in the real estate transaction process, detailing aspects such as the purchase price, closing date, and any contingencies that must be met before the sale can be finalized.

What key elements should be included in the agreement?

Essential components of the Maine Real Estate Purchase Agreement include the names of the buyer and seller, a description of the property, the purchase price, earnest money deposit details, contingencies (such as financing or inspection), and the closing date. Additionally, it should specify any inclusions or exclusions, such as appliances or fixtures, that come with the property.

Is the agreement required to be in writing?

Yes, in Maine, a Real Estate Purchase Agreement must be in writing to be enforceable. This requirement is in accordance with the Statute of Frauds, which mandates that certain contracts, including those for the sale of real estate, be documented in writing to protect the interests of all parties involved.

Can the agreement be modified after it is signed?

Yes, modifications to the agreement can be made after it is signed, but they must be documented in writing and agreed upon by both parties. This ensures that any changes are clear and legally binding. It is advisable to consult with a legal professional when making amendments to ensure that all modifications are properly recorded.

What happens if one party does not fulfill their obligations?

If one party fails to fulfill their obligations as outlined in the agreement, the other party may have the right to seek legal remedies. This could include enforcing the contract through specific performance, where the court orders the defaulting party to comply with the terms, or pursuing damages for any losses incurred due to the breach. It is essential to understand the implications of non-compliance before entering into the agreement.

Are there any contingencies that are commonly included?

Yes, common contingencies in a Maine Real Estate Purchase Agreement may include financing contingencies, which allow the buyer to back out if they cannot secure a mortgage, and inspection contingencies, which permit the buyer to withdraw if the property does not pass an inspection. These contingencies provide protection for the buyer and help ensure that the property meets their expectations.

What is earnest money, and how does it work?

Earnest money is a deposit made by the buyer to demonstrate their serious intent to purchase the property. Typically, this amount is held in escrow and is applied toward the purchase price at closing. If the transaction proceeds as planned, the earnest money is credited to the buyer. However, if the buyer backs out without a valid reason outlined in the agreement, they may forfeit this deposit.

How can I ensure the agreement is legally binding?

To ensure that the Maine Real Estate Purchase Agreement is legally binding, it should be signed by all parties involved, and the terms must be clear and unambiguous. It is also wise to have the agreement reviewed by a qualified attorney or real estate professional who can provide guidance and ensure that all legal requirements are met.

What should I do if I have more questions about the agreement?

If you have further questions about the Maine Real Estate Purchase Agreement or need assistance, it is advisable to consult with a real estate attorney or a licensed real estate agent. They can provide you with tailored advice and clarify any uncertainties you may have regarding the agreement or the home buying process.

Fill out Other Real Estate Purchase Agreement Templates for Specific States

Kentucky Real Estate Contract - It may contain clauses regarding property taxes and assessments post-sale.

Purchasing Agreement - Acceptance of the terms is necessary for the agreement to take effect.

Gcaar Rental Application - Clarifies communication processes throughout the transaction.