Attorney-Approved Real Estate Purchase Agreement Form for Louisiana

Dos and Don'ts

When filling out the Louisiana Real Estate Purchase Agreement form, it’s essential to approach the process with care and attention. Here are seven important dos and don’ts to keep in mind:

- Do read the entire agreement thoroughly before filling it out. Understanding each section will help avoid confusion later.

- Do provide accurate information. Ensure that names, addresses, and other details are correct to prevent issues during the transaction.

- Do consult with a real estate agent or attorney if you have questions. Professional guidance can clarify complex terms and conditions.

- Do include all necessary contingencies. Addressing financing, inspections, and other conditions can protect your interests.

- Don’t leave any sections blank. Incomplete forms can lead to delays or complications in the sale process.

- Don’t rush through the agreement. Take your time to ensure that all details are correct and that you understand your obligations.

- Don’t ignore deadlines. Be aware of important dates related to offers, inspections, and closing to ensure a smooth transaction.

Common mistakes

-

Incomplete Information: One common mistake is failing to fill out all required fields. Buyers and sellers should ensure that names, addresses, and other essential details are fully completed to avoid any delays in the transaction.

-

Incorrect Property Description: Accurately describing the property is crucial. Errors in the legal description can lead to disputes later on. Always double-check the address and any specific identifiers.

-

Neglecting to Specify Contingencies: Buyers often forget to include contingencies, such as financing or inspection. These clauses protect the buyer's interests and should be clearly stated in the agreement.

-

Ignoring Deadlines: The agreement includes various deadlines for inspections, financing, and closing. Missing these dates can jeopardize the deal. It’s essential to be aware of and adhere to all timelines.

-

Overlooking Signatures: Both parties must sign the agreement for it to be legally binding. A missing signature can invalidate the contract, so it’s important to confirm that all required signatures are present.

-

Failure to Review Terms: Not thoroughly reviewing the terms and conditions can lead to misunderstandings. It’s advisable for both parties to read the entire document and seek clarification on any confusing sections.

Documents used along the form

When engaging in a real estate transaction in Louisiana, several documents may accompany the Real Estate Purchase Agreement. Each document serves a specific purpose and helps ensure a smooth process for all parties involved.

- Property Disclosure Statement: This document outlines any known issues or defects with the property. Sellers are required to disclose material facts that may affect the property's value or desirability.

- Lead-Based Paint Disclosure: For homes built before 1978, this form informs buyers about potential lead-based paint hazards. It is a federal requirement to protect buyers, especially families with young children.

- Closing Statement: Also known as a HUD-1 Settlement Statement, this document details all financial transactions involved in the closing process. It includes costs, fees, and the final amounts due from both the buyer and seller.

- Title Commitment: This document outlines the conditions under which a title insurance policy will be issued. It provides information about the property’s ownership history and any existing liens or encumbrances.

- Home Inspection Report: Buyers often obtain this report after an inspection of the property. It identifies any structural or mechanical issues that may need to be addressed before finalizing the purchase.

- Appraisal Report: This document provides an estimate of the property's market value. Lenders typically require an appraisal to ensure the property is worth the amount being financed.

- Earnest Money Agreement: This document outlines the terms regarding the earnest money deposit. It specifies the amount, conditions for return, and how it will be applied toward the purchase price.

Understanding these documents can help buyers and sellers navigate the real estate transaction more effectively. Each form plays a crucial role in ensuring clarity and protection for all parties involved.

File Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | The Louisiana Real Estate Purchase Agreement is governed by the Louisiana Civil Code. |

| Purpose | This form is used to outline the terms and conditions of a real estate transaction in Louisiana. |

| Parties Involved | The agreement typically involves a buyer and a seller, each represented by their respective agents or attorneys. |

| Contingencies | Common contingencies include financing, inspections, and appraisal conditions that must be satisfied for the sale to proceed. |

| Signature Requirement | Both parties must sign the agreement for it to be legally binding, indicating their acceptance of the terms. |

Key takeaways

When filling out and using the Louisiana Real Estate Purchase Agreement form, keep these key takeaways in mind:

- Understand the purpose of the form. It outlines the terms of the sale between the buyer and seller.

- Ensure all parties' names are correctly spelled. This helps avoid confusion later.

- Clearly define the property being sold. Include the address and any relevant details.

- Specify the purchase price. Be clear about how much the buyer is willing to pay.

- Include important dates. This includes the closing date and any deadlines for contingencies.

- Review the contingencies. These are conditions that must be met for the sale to proceed.

- Make sure both parties sign the agreement. This confirms that everyone agrees to the terms.

- Keep a copy for your records. Having a signed copy is important for future reference.

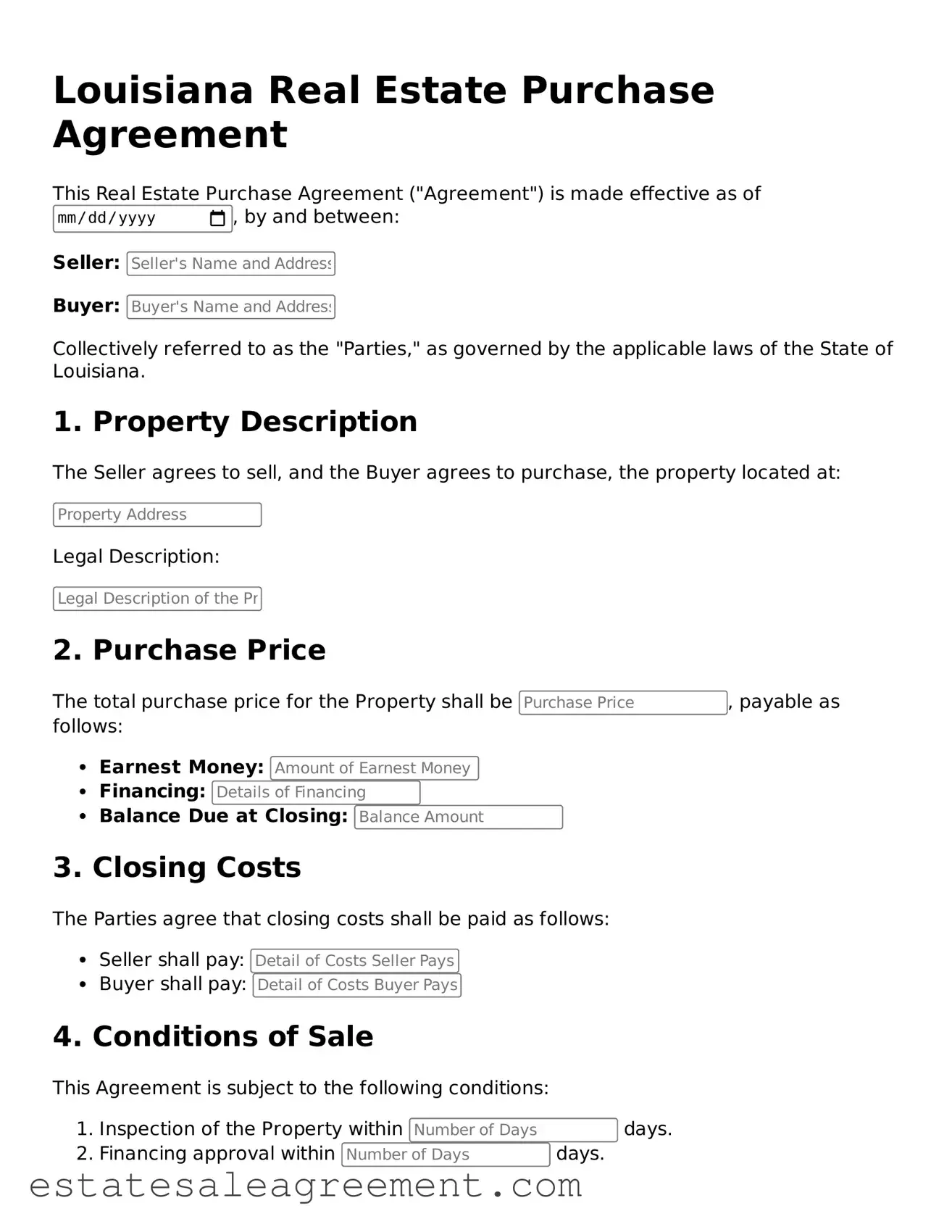

Example - Louisiana Real Estate Purchase Agreement Form

Louisiana Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made effective as of , by and between:

Seller:

Buyer:

Collectively referred to as the "Parties," as governed by the applicable laws of the State of Louisiana.

1. Property Description

The Seller agrees to sell, and the Buyer agrees to purchase, the property located at:

Legal Description:

2. Purchase Price

The total purchase price for the Property shall be , payable as follows:

- Earnest Money:

- Financing:

- Balance Due at Closing:

3. Closing Costs

The Parties agree that closing costs shall be paid as follows:

- Seller shall pay:

- Buyer shall pay:

4. Conditions of Sale

This Agreement is subject to the following conditions:

- Inspection of the Property within days.

- Financing approval within days.

- Any additional requirements:

5. Closing Date

The closing of the purchase and sale of the Property shall occur on or before .

6. Signatures

The Parties hereto warrant that they are authorized to enter into this Agreement.

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the date first above written:

Seller Signature: ______________________

Buyer Signature: ______________________

This template does not constitute legal advice. It is recommended that both Parties consult with a legal professional regarding the particulars of their transaction.

What to Know About This Form

What is the Louisiana Real Estate Purchase Agreement form?

The Louisiana Real Estate Purchase Agreement is a legal document used to outline the terms and conditions of a real estate transaction in Louisiana. It details the agreement between a buyer and a seller regarding the sale of a property, including the purchase price, financing terms, and any contingencies that may apply.

What are the key components of the form?

This form typically includes the names of the buyer and seller, the property address, the purchase price, earnest money details, financing information, and any conditions that must be met before the sale can proceed. Additionally, it may cover inspection rights, closing dates, and any other relevant terms agreed upon by both parties.

Is the form required for all real estate transactions in Louisiana?

Can I modify the Louisiana Real Estate Purchase Agreement form?

What happens if one party does not fulfill their obligations?

If one party fails to meet their obligations as outlined in the agreement, the other party may have legal options available. This could include seeking damages, enforcing the contract, or even terminating the agreement, depending on the specific circumstances and the terms laid out in the contract.

How does earnest money work in this agreement?

Earnest money is a deposit made by the buyer to demonstrate their commitment to purchasing the property. This amount is typically held in escrow and is applied to the purchase price at closing. If the transaction falls through due to the buyer's fault, the seller may keep the earnest money as compensation.

What contingencies can be included in the agreement?

Contingencies are conditions that must be met for the sale to proceed. Common contingencies include financing approval, home inspections, and the sale of the buyer's current home. If these conditions are not met, the buyer can usually back out of the agreement without penalty.

How long does the agreement remain valid?

Do I need a lawyer to complete the Louisiana Real Estate Purchase Agreement?

Where can I obtain a Louisiana Real Estate Purchase Agreement form?

The form can be obtained through various sources, including real estate agents, legal professionals, or online legal document services. It is important to ensure that the version used is up-to-date and complies with current Louisiana laws.

Fill out Other Real Estate Purchase Agreement Templates for Specific States

Connecticut House Purchase Agreement - Includes any current liens or encumbrances on the property.

Free South Carolina Real Estate Contract - Describes procedures for handling earnest money if the deal falls through.

Purchase Agreement Minnesota - Buyers can specify their intent to obtain financing within the agreement framework.

Free Real Estate Forms - It acts as a roadmap for moving forward, detailing every necessary step leading up to closing day.