Attorney-Approved Real Estate Purchase Agreement Form for Kentucky

Dos and Don'ts

When filling out the Kentucky Real Estate Purchase Agreement form, it's essential to approach the process with care and attention. Here’s a list of things to do and avoid to ensure a smooth transaction.

- Do read the entire agreement thoroughly before filling it out. Understanding every section is crucial.

- Do provide accurate and complete information. Mistakes or omissions can lead to complications later.

- Do consult a real estate agent or attorney if you have questions. Professional guidance can clarify complex terms.

- Do include all necessary attachments, such as disclosures and addendums. These documents support your agreement.

- Don't rush through the form. Taking your time helps prevent errors that could derail the sale.

- Don't leave any sections blank unless instructed. Missing information can cause delays or misunderstandings.

- Don't ignore deadlines. Timely submission is critical to keeping the transaction on track.

- Don't sign without reviewing the final document. Ensure everything is correct before you commit.

By following these guidelines, you can navigate the Kentucky Real Estate Purchase Agreement process with confidence and clarity.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all necessary details. Buyers and sellers must ensure that names, addresses, and property descriptions are filled out completely. Missing information can lead to delays or disputes later on.

-

Incorrect Property Description: Accurately describing the property is crucial. Using vague terms or failing to include the correct legal description can create confusion. Always double-check that the property’s address and parcel number are correct.

-

Neglecting Contingencies: Many people overlook the importance of contingencies. These are conditions that must be met for the sale to proceed. Common contingencies include financing, inspections, and appraisal. Without them, buyers may find themselves locked into a deal that doesn’t suit their needs.

-

Forgetting Signatures: It’s easy to forget signatures, especially when multiple parties are involved. All required parties must sign the agreement for it to be valid. Missing a signature can invalidate the entire contract.

-

Ignoring Deadlines: Real estate transactions often come with specific deadlines. Failing to adhere to these timelines can jeopardize the deal. It’s essential to note important dates, such as the closing date and any deadlines for contingencies.

Documents used along the form

When engaging in a real estate transaction in Kentucky, several documents accompany the Real Estate Purchase Agreement to ensure a smooth process. Each document serves a specific purpose, helping both buyers and sellers understand their rights and obligations.

- Disclosure Statement: This document outlines any known issues with the property, such as structural problems or environmental hazards. Sellers must provide this to buyers to promote transparency.

- Title Search Report: A title search confirms the seller's ownership of the property and identifies any liens or encumbrances. This report is crucial for ensuring a clear title transfer.

- Deed: The deed is the legal document that transfers ownership from the seller to the buyer. It includes details about the property and must be recorded with the county clerk.

- Financing Addendum: If the buyer is obtaining a mortgage, this addendum outlines the terms of the financing, including loan type, amount, and contingencies.

- Home Inspection Report: This report results from a professional inspection of the property. It details the condition of the home and can affect negotiations between the buyer and seller.

- Closing Statement: This document summarizes all financial transactions involved in the sale, including closing costs, fees, and the final purchase price. It is provided at the closing meeting.

- Earnest Money Agreement: This agreement details the earnest money deposit made by the buyer to demonstrate their serious intent to purchase. It outlines how the deposit is handled if the deal does not close.

- Property Survey: A survey defines the property boundaries and identifies any encroachments or easements. Buyers often request this to ensure they understand the exact limits of their new property.

These documents collectively facilitate a successful real estate transaction in Kentucky. It's essential for both parties to understand each form and its implications to avoid potential disputes down the line.

File Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | The Kentucky Real Estate Purchase Agreement is governed by Kentucky state law, specifically KRS Chapter 381. |

| Standard Format | This agreement typically follows a standard format, which includes sections for buyer and seller information, property details, and terms of sale. |

| Earnest Money | In Kentucky, the agreement often requires an earnest money deposit, which demonstrates the buyer's commitment to the purchase. |

| Contingencies | Buyers and sellers can include contingencies, such as financing or inspection, to protect their interests during the transaction. |

| Disclosure Requirements | Kentucky law mandates specific disclosure requirements, including information about lead-based paint and property condition, to ensure transparency in real estate transactions. |

Key takeaways

When filling out and using the Kentucky Real Estate Purchase Agreement form, keep these key takeaways in mind:

- Accuracy is essential. Ensure that all information, including names, addresses, and property details, is correct to avoid disputes later.

- Understand the terms. Familiarize yourself with the terms and conditions outlined in the agreement, including contingencies, closing dates, and payment structures.

- Consult a professional. Consider seeking advice from a real estate agent or attorney to navigate the complexities of the agreement and protect your interests.

- Document everything. Keep copies of the signed agreement and any related correspondence for your records, as these may be important in future transactions.

Example - Kentucky Real Estate Purchase Agreement Form

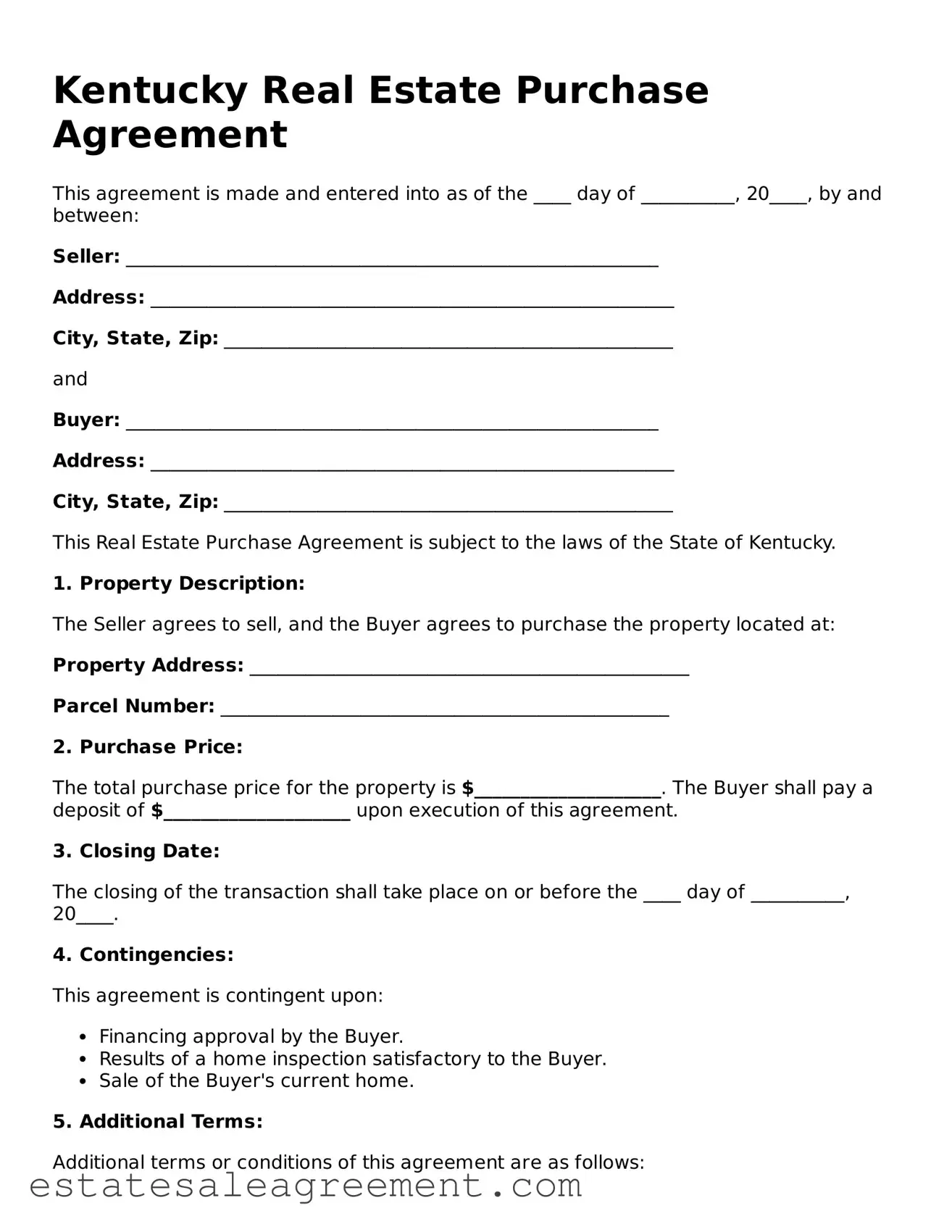

Kentucky Real Estate Purchase Agreement

This agreement is made and entered into as of the ____ day of __________, 20____, by and between:

Seller: _________________________________________________________

Address: ________________________________________________________

City, State, Zip: ________________________________________________

and

Buyer: _________________________________________________________

Address: ________________________________________________________

City, State, Zip: ________________________________________________

This Real Estate Purchase Agreement is subject to the laws of the State of Kentucky.

1. Property Description:

The Seller agrees to sell, and the Buyer agrees to purchase the property located at:

Property Address: _______________________________________________

Parcel Number: ________________________________________________

2. Purchase Price:

The total purchase price for the property is $____________________. The Buyer shall pay a deposit of $____________________ upon execution of this agreement.

3. Closing Date:

The closing of the transaction shall take place on or before the ____ day of __________, 20____.

4. Contingencies:

This agreement is contingent upon:

- Financing approval by the Buyer.

- Results of a home inspection satisfactory to the Buyer.

- Sale of the Buyer's current home.

5. Additional Terms:

Additional terms or conditions of this agreement are as follows:

____________________________________________________________________

____________________________________________________________________

6. Signatures:

By signing below, both parties agree to the terms and conditions outlined in this Real Estate Purchase Agreement.

Seller Signature: _______________________________ Date: _______________

Buyer Signature: _______________________________ Date: _______________

What to Know About This Form

What is a Kentucky Real Estate Purchase Agreement?

The Kentucky Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. It serves as a binding contract once both parties sign it. This agreement includes important details such as the purchase price, closing date, and any contingencies that must be met before the sale can proceed.

What are the key components of the agreement?

Key components of the Kentucky Real Estate Purchase Agreement include the names of the buyer and seller, a description of the property, the purchase price, payment terms, contingencies (like financing or inspection), and the closing date. Additionally, it may outline any personal property included in the sale, such as appliances or fixtures.

Is the agreement legally binding?

Yes, once both parties sign the Kentucky Real Estate Purchase Agreement, it becomes a legally binding contract. This means that both the buyer and seller are obligated to follow the terms outlined in the agreement. If either party fails to comply, they may face legal consequences.

What contingencies can be included in the agreement?

Contingencies are conditions that must be met for the sale to go through. Common contingencies in Kentucky include financing contingencies, which allow the buyer to back out if they cannot secure a loan, and inspection contingencies, which give the buyer the right to inspect the property before finalizing the sale. Other contingencies may involve the sale of the buyer's current home or appraisal conditions.

How does the closing process work?

The closing process involves several steps. First, both parties review the final documents. Next, the buyer typically secures financing and conducts a final walk-through of the property. On the closing date, the buyer and seller meet to sign the necessary paperwork, transfer funds, and officially transfer ownership of the property. After closing, the buyer receives the keys and can take possession of the home.

Can the agreement be modified after signing?

Yes, the Kentucky Real Estate Purchase Agreement can be modified after signing, but both parties must agree to any changes. This typically involves drafting an addendum that outlines the new terms. It’s important to ensure that any modifications are documented in writing to avoid misunderstandings.

What happens if the seller receives another offer?

If the seller receives another offer after signing a purchase agreement, they are generally obligated to honor the existing contract with the first buyer. However, if the first buyer has not yet met their contingencies or if the agreement allows for it, the seller may be able to accept the new offer. This situation can become complex, so it’s advisable to seek legal counsel.

Are there any fees associated with the purchase agreement?

Yes, there may be various fees associated with the Kentucky Real Estate Purchase Agreement. These can include earnest money deposits, inspection fees, appraisal costs, and closing costs. Both buyers and sellers should be aware of these potential expenses and factor them into their financial planning.

What should I do if I have questions about the agreement?

If you have questions about the Kentucky Real Estate Purchase Agreement, it is best to consult a real estate attorney or a qualified real estate agent. They can provide guidance specific to your situation and help clarify any terms or conditions that may be confusing.

Is it necessary to have a lawyer review the agreement?

While it is not legally required to have a lawyer review the Kentucky Real Estate Purchase Agreement, it is highly recommended. A lawyer can help ensure that your interests are protected and that the agreement complies with state laws. Their expertise can be invaluable in navigating the complexities of real estate transactions.

Fill out Other Real Estate Purchase Agreement Templates for Specific States

Wisconsin Offer to Purchase Form - The agreement can include clauses about the seller’s obligations to maintain the property until the sale.

Free Real Estate Forms - Buyers can use the purchase agreement to ensure that all verbal promises made by the seller are included in writing.

Free South Carolina Real Estate Contract - Details how to handle properties that may have zoning issues.

North Dakota House Purchase Agreement - It includes essential timelines for inspections and closing dates.