Attorney-Approved Real Estate Purchase Agreement Form for Kansas

Dos and Don'ts

When filling out the Kansas Real Estate Purchase Agreement form, it's essential to approach the task with care and attention to detail. Here are four important things to keep in mind:

- Do read the entire agreement thoroughly before filling it out. Understanding the terms and conditions is crucial.

- Don't leave any blank spaces. Every section should be filled out to avoid confusion or misinterpretation later.

- Do consult with a real estate professional or attorney if you have questions. Their expertise can guide you through complex areas.

- Don't rush through the process. Take your time to ensure accuracy and clarity in your responses.

By following these guidelines, you can navigate the Kansas Real Estate Purchase Agreement form with confidence and clarity. Remember, this document is a significant step in the real estate transaction process, so it deserves your full attention.

Common mistakes

-

Incorrect Property Description: Failing to provide a complete and accurate description of the property can lead to confusion. Ensure that the legal description matches public records.

-

Missing Signatures: Both the buyer and seller must sign the agreement. Omitting a signature can render the contract unenforceable.

-

Not Specifying Contingencies: Buyers often forget to include contingencies, such as financing or inspection. These protect the buyer if certain conditions aren’t met.

-

Incorrect Dates: Filling in wrong dates for the closing or inspection can create legal complications. Double-check all dates for accuracy.

-

Ignoring Earnest Money Details: Failing to specify the amount and terms of the earnest money deposit can lead to misunderstandings. Clearly outline this to avoid disputes.

-

Not Understanding the Terms: Some individuals sign without fully understanding the terms. Take the time to read and comprehend all sections of the agreement.

-

Inadequate Communication: Poor communication between the buyer and seller can lead to errors. Maintain open lines of communication throughout the process.

Documents used along the form

When engaging in a real estate transaction in Kansas, the Real Estate Purchase Agreement is just one piece of the puzzle. Several other forms and documents complement this agreement, ensuring that both buyers and sellers are protected and informed throughout the process. Here’s a brief overview of seven essential documents commonly used alongside the Kansas Real Estate Purchase Agreement.

- Disclosure Statements: Sellers must provide buyers with information about the property's condition, including any known defects or issues. This transparency helps buyers make informed decisions.

- Lead-Based Paint Disclosure: For homes built before 1978, federal law requires sellers to disclose any known lead-based paint hazards. This document protects buyers, especially families with young children.

- Title Commitment: This document outlines the current ownership of the property and any liens or encumbrances. It ensures that the buyer will receive clear title upon purchase.

- Earnest Money Agreement: This agreement details the deposit made by the buyer to show their commitment to the purchase. It often specifies conditions under which the deposit may be forfeited or returned.

- Closing Statement: Also known as the HUD-1 Settlement Statement, this document itemizes all closing costs and fees associated with the transaction, providing clarity to both parties before finalizing the sale.

- Property Survey: A survey provides a detailed map of the property’s boundaries and any structures. It helps prevent disputes over property lines and ensures compliance with zoning regulations.

- Home Warranty Agreement: This optional document offers protection against unexpected repairs for a specified period after the sale. It can provide peace of mind to buyers, knowing they are covered for certain issues.

Understanding these documents is crucial for anyone involved in a real estate transaction. They not only facilitate a smoother process but also ensure that all parties are aware of their rights and responsibilities. By being informed, buyers and sellers can navigate the complexities of real estate with confidence.

File Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | The Kansas Real Estate Purchase Agreement is governed by Kansas state law. |

| Purpose | This form is used to outline the terms of a real estate transaction between a buyer and a seller. |

| Parties Involved | The agreement includes the buyer and the seller, who are the main parties in the transaction. |

| Property Description | A detailed description of the property being sold must be included in the agreement. |

| Purchase Price | The total purchase price of the property is clearly stated in the agreement. |

| Contingencies | Common contingencies, such as financing or inspection, can be outlined in the agreement. |

| Closing Date | The agreement specifies the closing date when the sale will be finalized. |

| Signatures Required | Both the buyer and seller must sign the agreement for it to be legally binding. |

Key takeaways

Filling out the Kansas Real Estate Purchase Agreement form requires attention to detail and an understanding of key elements. Here are essential takeaways to keep in mind:

- Understand the Parties Involved: Clearly identify the buyer and seller. Include full names and contact information to avoid confusion.

- Property Description: Provide a detailed description of the property. This should include the address, legal description, and any relevant parcel numbers.

- Purchase Price: Specify the total purchase price. Ensure that this amount is clear and agreed upon by both parties.

- Earnest Money: Indicate the amount of earnest money to be deposited. This shows the buyer's commitment and is typically held in escrow.

- Contingencies: Include any contingencies that must be met for the sale to proceed. Common contingencies involve financing, inspections, and appraisals.

- Closing Date: Set a closing date that works for both parties. This date is crucial for planning the final transaction and transfer of ownership.

- Disclosure Obligations: Be aware of disclosure requirements. Sellers must provide information about the property's condition and any known issues.

- Signatures: Ensure that both parties sign the agreement. Without signatures, the document is not legally binding.

- Review Before Submission: Review the completed form thoroughly. Mistakes or omissions can lead to disputes or delays in the transaction.

These key points serve as a foundation for successfully navigating the Kansas Real Estate Purchase Agreement form. Attention to detail and clear communication are paramount.

Example - Kansas Real Estate Purchase Agreement Form

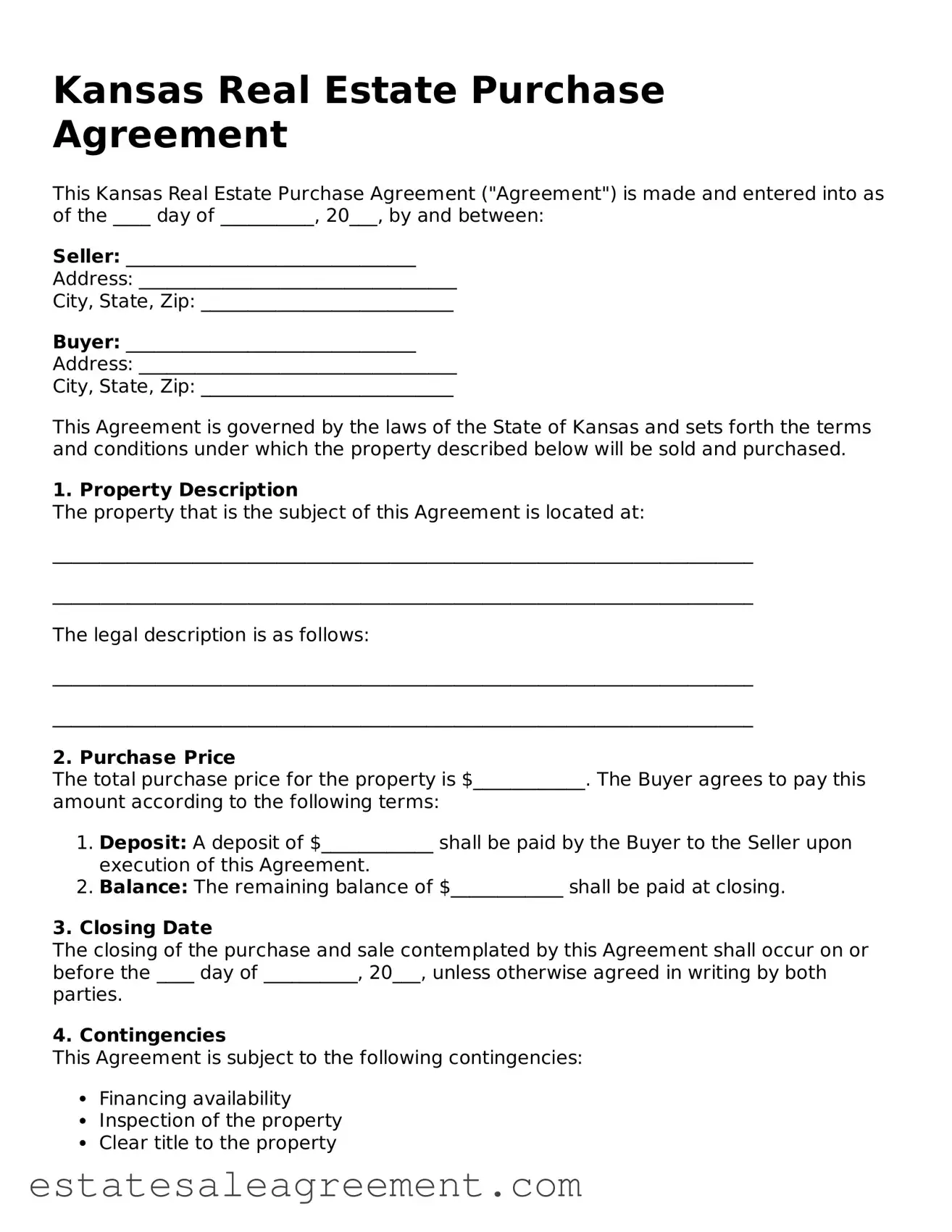

Kansas Real Estate Purchase Agreement

This Kansas Real Estate Purchase Agreement ("Agreement") is made and entered into as of the ____ day of __________, 20___, by and between:

Seller: _______________________________

Address: __________________________________

City, State, Zip: ___________________________

Buyer: _______________________________

Address: __________________________________

City, State, Zip: ___________________________

This Agreement is governed by the laws of the State of Kansas and sets forth the terms and conditions under which the property described below will be sold and purchased.

1. Property Description

The property that is the subject of this Agreement is located at:

___________________________________________________________________________

___________________________________________________________________________

The legal description is as follows:

___________________________________________________________________________

___________________________________________________________________________

2. Purchase Price

The total purchase price for the property is $____________. The Buyer agrees to pay this amount according to the following terms:

- Deposit: A deposit of $____________ shall be paid by the Buyer to the Seller upon execution of this Agreement.

- Balance: The remaining balance of $____________ shall be paid at closing.

3. Closing Date

The closing of the purchase and sale contemplated by this Agreement shall occur on or before the ____ day of __________, 20___, unless otherwise agreed in writing by both parties.

4. Contingencies

This Agreement is subject to the following contingencies:

- Financing availability

- Inspection of the property

- Clear title to the property

5. Representations and Warranties

The Seller represents and warrants that:

- They are the lawful owner of the property.

- The property is free from all liens and encumbrances, except as disclosed.

- All information provided regarding the property is accurate to the best of their knowledge.

6. Signatures

By signing below, the parties agree to the terms outlined in this Agreement.

_____________________________

Seller’s Signature

Date: _________________________

_____________________________

Buyer’s Signature

Date: _________________________

This Kansas Real Estate Purchase Agreement is intended to ensure clarity and protect the interests of both parties. Careful consideration and potential legal review before execution is advised.

What to Know About This Form

What is a Kansas Real Estate Purchase Agreement?

The Kansas Real Estate Purchase Agreement is a legal document used when buying or selling property in Kansas. It outlines the terms and conditions of the sale, including the purchase price, financing details, and contingencies. This form serves as a binding contract between the buyer and seller, ensuring both parties understand their rights and obligations throughout the transaction.

What key elements should be included in the agreement?

A well-drafted Kansas Real Estate Purchase Agreement should include several essential elements. First, it should clearly identify the parties involved, including their full names and contact information. Next, the property description must be precise, detailing the address and any specific legal identifiers. Additionally, the agreement should outline the purchase price, earnest money deposit, financing arrangements, and any contingencies, such as inspections or appraisals.

Is an attorney required to draft or review the agreement?

While it is not legally required to have an attorney draft or review the Kansas Real Estate Purchase Agreement, it is highly recommended. An attorney can help ensure that the document complies with state laws and protects your interests. They can also provide guidance on any complex terms or conditions that may arise during the transaction.

What happens if one party wants to back out of the agreement?

If one party wishes to back out of the agreement, it can lead to legal consequences. The terms of the agreement should specify the conditions under which either party can cancel the contract. If a party backs out without a valid reason, they may be liable for damages or lose their earnest money deposit. It’s important to understand these implications before signing the agreement.

Can the agreement be modified after it is signed?

Yes, the Kansas Real Estate Purchase Agreement can be modified after it is signed, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both the buyer and seller. Verbal agreements or informal changes are not legally binding, so it’s crucial to keep everything documented.

What are contingencies, and why are they important?

Contingencies are conditions that must be met for the sale to proceed. Common contingencies include home inspections, financing approval, and appraisal results. They are important because they protect the buyer and seller from unforeseen issues. For example, if a home inspection reveals significant repairs are needed, the buyer can negotiate repairs or back out of the deal without penalty.

How does earnest money work in the agreement?

Earnest money is a deposit made by the buyer to demonstrate their serious intent to purchase the property. It is typically held in escrow until the closing of the sale. If the transaction goes through, the earnest money is applied to the purchase price. However, if the buyer backs out without a valid reason, they may forfeit this deposit to the seller as compensation for taking the property off the market.

What should I do if I have questions about the agreement?

If you have questions about the Kansas Real Estate Purchase Agreement, it’s best to consult with a real estate professional or an attorney. They can provide clarity on specific terms and ensure you understand your rights and responsibilities. Additionally, real estate agents can offer insights based on their experience and knowledge of local market conditions.

Fill out Other Real Estate Purchase Agreement Templates for Specific States

Maine Real Estate Purchase and Sale Agreement - Facilitates communication about negotiations and counteroffers.

How to Write a Purchase Agreement - This document is often supported by various disclosures required by law to ensure buyer awareness.

Georgia Purchase and Sale Agreement 2023 - The form may outline the time frame for inspections and repairs needed before closing.

Free Florida Real Estate Forms - The Real Estate Purchase Agreement is essential in fostering trust and cooperation between parties.