Attorney-Approved Real Estate Purchase Agreement Form for Iowa

Dos and Don'ts

When filling out the Iowa Real Estate Purchase Agreement form, it's essential to approach the task with care and attention to detail. Here are some important do's and don'ts to keep in mind:

- Do read the entire agreement thoroughly before filling it out.

- Do provide accurate and complete information about the property.

- Do include all necessary dates, such as the closing date and offer expiration.

- Do consult with a real estate professional if you have questions.

- Don't leave any sections blank; incomplete forms can lead to delays.

- Don't make assumptions about terms; clarify any uncertainties.

- Don't rush the process; take your time to ensure everything is correct.

By following these guidelines, you can help ensure a smoother transaction and avoid potential pitfalls in the real estate process.

Common mistakes

-

Inaccurate Property Description: One common mistake is failing to provide a precise and complete description of the property. This includes not specifying the correct address, legal description, or parcel number. Such inaccuracies can lead to confusion and potential disputes later on.

-

Missing Signatures: All parties involved in the transaction must sign the agreement. Forgetting to collect signatures from all necessary parties can render the document invalid. It is crucial to ensure that everyone involved has signed before proceeding.

-

Not Including Contingencies: Buyers often neglect to include important contingencies, such as financing or inspection clauses. These contingencies protect the buyer's interests and provide a way out of the agreement if certain conditions are not met.

-

Ignoring Deadlines: Real estate transactions are time-sensitive. Failing to adhere to deadlines for inspections, financing, or other critical dates can jeopardize the deal. Keeping track of these timelines is essential for a smooth transaction.

-

Overlooking Earnest Money Details: The earnest money deposit is a significant aspect of the agreement. Buyers sometimes forget to specify the amount or the conditions under which it will be refunded. Clarity on this point helps avoid misunderstandings.

-

Inadequate Disclosure of Property Condition: Sellers must disclose any known issues with the property. Failing to do so can lead to legal troubles down the line. Transparency about the condition of the property is key to a fair transaction.

-

Neglecting to Review Local Laws: Each state has its own real estate laws. Not being aware of Iowa's specific regulations can result in mistakes on the form. It is advisable to familiarize oneself with local laws to ensure compliance.

-

Rushing the Process: Filling out the agreement in haste often leads to errors. Taking the time to review each section carefully can prevent costly mistakes. A thorough review can save time and trouble in the long run.

Documents used along the form

When engaging in a real estate transaction in Iowa, several documents complement the Iowa Real Estate Purchase Agreement. These forms help clarify the terms of the sale and protect the interests of both buyers and sellers. Below are five essential documents often used alongside the purchase agreement.

- Property Disclosure Statement: This document outlines any known issues with the property, such as structural problems or environmental hazards. Sellers must provide this information to buyers, ensuring transparency in the transaction.

- Title Commitment: A title commitment is a report issued by a title company that outlines the legal status of the property’s title. It identifies any liens or encumbrances that may affect ownership and is crucial for ensuring a clear title transfer.

- Closing Statement: This document summarizes the financial aspects of the transaction at closing. It details all costs, including the purchase price, closing fees, and any credits or debits for both parties.

- Earnest Money Agreement: This agreement specifies the amount of earnest money the buyer will deposit to show their serious intent to purchase the property. It outlines the conditions under which the deposit may be forfeited or returned.

- Home Inspection Report: After a buyer conducts a home inspection, this report provides an assessment of the property’s condition. It can influence negotiations and decisions regarding repairs or price adjustments.

These documents play a vital role in ensuring a smooth real estate transaction. By understanding each form's purpose, buyers and sellers can navigate the process more effectively and make informed decisions.

File Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | The Iowa Real Estate Purchase Agreement is governed by the laws of the State of Iowa. |

| Purpose | This form is used to outline the terms and conditions of a real estate transaction between a buyer and a seller. |

| Parties Involved | The agreement identifies the buyer and seller, including their legal names and contact information. |

| Property Description | A detailed description of the property being sold is included, which may consist of the address and legal description. |

| Purchase Price | The agreed-upon purchase price for the property is clearly stated in the agreement. |

| Earnest Money | The agreement typically specifies the amount of earnest money the buyer must provide to demonstrate serious intent. |

| Contingencies | Common contingencies, such as financing and inspection, can be included to protect the buyer's interests. |

| Closing Date | The agreement outlines the expected closing date, when the transaction will be finalized. |

| Disclosures | Sellers are required to provide certain disclosures about the property’s condition and any known issues. |

| Signatures | Both parties must sign the agreement for it to be legally binding, indicating their acceptance of the terms. |

Key takeaways

When engaging in real estate transactions in Iowa, understanding the Real Estate Purchase Agreement form is crucial. This document serves as a binding contract between the buyer and seller, outlining the terms of the sale. Here are some key takeaways to keep in mind:

- Understand the Basics: The agreement outlines the essential details of the transaction, including the purchase price, property description, and closing date.

- Identify Parties Clearly: Both the buyer and seller must be clearly identified, including their full legal names and contact information.

- Property Description: A detailed description of the property is necessary. This includes the address and any specific legal descriptions.

- Contingencies: The agreement often includes contingencies, such as financing or inspection requirements, which must be met for the sale to proceed.

- Earnest Money: Buyers typically submit earnest money to demonstrate their serious intent. The amount and terms for its return should be clearly stated.

- Closing Costs: The agreement should specify who is responsible for various closing costs, which can include fees for inspections, appraisals, and title searches.

- Possession Date: The date when the buyer will take possession of the property should be clearly defined to avoid confusion.

- Disclosures: Sellers are required to disclose certain information about the property, such as known defects or issues that could affect its value.

- Legal Review: It is advisable for both parties to have the agreement reviewed by legal counsel to ensure their rights are protected.

- Signatures: The agreement must be signed by both parties to be enforceable. Ensure that all signatures are obtained before any actions are taken based on the agreement.

By understanding these key elements, both buyers and sellers can navigate the Iowa Real Estate Purchase Agreement with greater confidence and clarity.

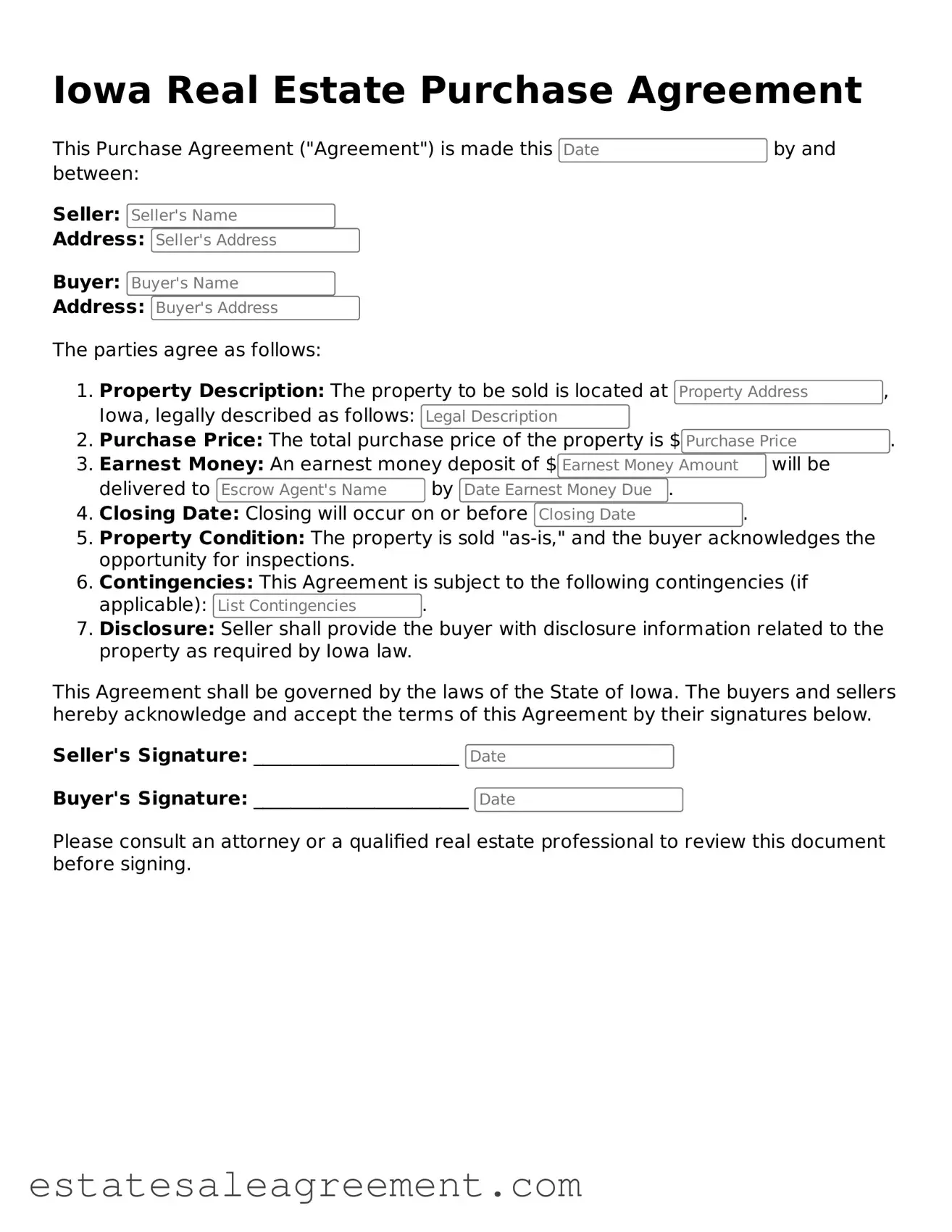

Example - Iowa Real Estate Purchase Agreement Form

Iowa Real Estate Purchase Agreement

This Purchase Agreement ("Agreement") is made this by and between:

Seller:

Address:

Buyer:

Address:

The parties agree as follows:

- Property Description: The property to be sold is located at , Iowa, legally described as follows:

- Purchase Price: The total purchase price of the property is $.

- Earnest Money: An earnest money deposit of $ will be delivered to by .

- Closing Date: Closing will occur on or before .

- Property Condition: The property is sold "as-is," and the buyer acknowledges the opportunity for inspections.

- Contingencies: This Agreement is subject to the following contingencies (if applicable): .

- Disclosure: Seller shall provide the buyer with disclosure information related to the property as required by Iowa law.

This Agreement shall be governed by the laws of the State of Iowa. The buyers and sellers hereby acknowledge and accept the terms of this Agreement by their signatures below.

Seller's Signature: ______________________

Buyer's Signature: _______________________

Please consult an attorney or a qualified real estate professional to review this document before signing.

What to Know About This Form

What is the Iowa Real Estate Purchase Agreement form?

The Iowa Real Estate Purchase Agreement form is a legal document used in real estate transactions within the state of Iowa. It outlines the terms and conditions under which a buyer agrees to purchase property from a seller. This form serves to protect the interests of both parties by clearly defining the obligations and expectations throughout the sale process.

Who should use the Iowa Real Estate Purchase Agreement form?

This form is intended for use by individuals or entities involved in the buying or selling of real estate in Iowa. Buyers and sellers, as well as real estate agents representing either party, can utilize this document to ensure that all necessary details of the transaction are properly recorded and agreed upon.

What key elements are included in the agreement?

The Iowa Real Estate Purchase Agreement typically includes essential details such as the purchase price, property description, closing date, and any contingencies that may apply. It may also outline the responsibilities of both the buyer and seller, including disclosures, inspections, and financing arrangements.

What are contingencies in the context of this agreement?

Contingencies are specific conditions that must be met for the sale to proceed. Common contingencies include financing, home inspections, and appraisal requirements. If a contingency is not satisfied, the buyer may have the right to withdraw from the agreement without penalty.

Is the Iowa Real Estate Purchase Agreement legally binding?

Yes, once both parties sign the Iowa Real Estate Purchase Agreement, it becomes a legally binding contract. This means that both the buyer and seller are obligated to fulfill the terms outlined in the agreement. Failure to comply can result in legal consequences, including potential lawsuits.

Can the agreement be modified after it is signed?

Yes, modifications can be made to the agreement after it is signed, but both parties must agree to any changes. It is advisable to document any amendments in writing and have both parties sign the revised agreement to ensure clarity and enforceability.

What happens if either party fails to fulfill their obligations?

If either party fails to meet their obligations as outlined in the agreement, the other party may have legal recourse. This could include seeking damages or specific performance, which requires the defaulting party to fulfill their contractual duties. It is essential to understand the implications of non-compliance before entering into the agreement.

Are there any fees associated with using this agreement?

While the Iowa Real Estate Purchase Agreement itself may not have a direct cost, there can be associated fees. These may include costs for legal advice, real estate agent commissions, and other transaction-related expenses. It is wise to budget for these costs when planning a real estate transaction.

Where can I obtain the Iowa Real Estate Purchase Agreement form?

The Iowa Real Estate Purchase Agreement form can typically be obtained through various sources, including real estate agents, legal professionals, or online legal document services. It is important to ensure that the form is up-to-date and complies with Iowa state laws.

Is it advisable to seek legal assistance when completing this form?

Yes, seeking legal assistance is often recommended when completing the Iowa Real Estate Purchase Agreement. A qualified attorney can provide guidance on the implications of the agreement, help ensure that all necessary provisions are included, and assist in navigating any potential legal issues that may arise during the transaction.

Fill out Other Real Estate Purchase Agreement Templates for Specific States

Ma Purchase and Sale Agreement - An attorney can assist with negotiating specific terms of the agreement.

Montana Buy Sell Agreement - Provides insight into any zoning laws that could affect property use post-sale.

Real Estate Contract Kansas - Aids in preventing misunderstandings or disputes before closing.