Attorney-Approved Real Estate Purchase Agreement Form for Illinois

Dos and Don'ts

When filling out the Illinois Real Estate Purchase Agreement form, it is important to follow certain guidelines. Here are nine things to do and not to do:

- Do read the entire form carefully before starting.

- Do provide accurate information about the property.

- Do include all parties involved in the transaction.

- Do specify the purchase price clearly.

- Do sign and date the agreement where required.

- Don't leave any sections blank unless instructed.

- Don't use abbreviations or shorthand in the form.

- Don't alter the text of the agreement without legal advice.

- Don't forget to keep a copy for your records.

Common mistakes

-

Incomplete Information: Failing to provide all required details can lead to delays or misunderstandings. Ensure that all sections are filled out accurately.

-

Incorrect Property Description: A vague or incorrect description of the property can create confusion. Always double-check the address and legal description.

-

Missing Signatures: All parties involved must sign the agreement. An unsigned document is not legally binding, so make sure every necessary signature is included.

-

Ignoring Contingencies: Not including necessary contingencies, such as financing or inspection, can put you at risk. Clearly state any conditions that must be met for the sale to proceed.

-

Failure to Specify Closing Costs: Not addressing who will pay closing costs can lead to disputes later. Clearly outline these responsibilities in the agreement.

-

Omitting Dates: Important dates, such as the closing date and deadlines for contingencies, should be included. Without these, the timeline of the transaction can become unclear.

-

Neglecting to Include Personal Property: If personal property, like appliances or fixtures, is part of the sale, list them explicitly. This prevents any misunderstandings about what is included.

-

Not Reviewing the Document: Skipping a thorough review of the agreement before signing can lead to serious issues. Take the time to read everything carefully and consult with a professional if needed.

Documents used along the form

When engaging in real estate transactions in Illinois, it's essential to be familiar with various forms and documents that complement the Real Estate Purchase Agreement. Each of these documents plays a crucial role in ensuring a smooth and legally sound process. Here’s a brief overview of six important forms often used alongside the purchase agreement.

- Property Disclosure Statement: This document provides information about the property's condition. Sellers must disclose known issues, helping buyers make informed decisions.

- Lead-Based Paint Disclosure: For homes built before 1978, this form is required to inform buyers about potential lead hazards. It ensures that buyers are aware of the risks associated with lead-based paint.

- Pre-Approval Letter: A letter from a lender confirming that a buyer is pre-approved for a mortgage. This document strengthens the buyer's position when making an offer.

- Earnest Money Agreement: This outlines the amount of earnest money the buyer will deposit to show their commitment. It specifies how the money will be handled if the deal goes through or falls apart.

- Closing Statement: This document details all financial aspects of the transaction at closing. It includes the purchase price, closing costs, and any adjustments, ensuring transparency for both parties.

- Title Insurance Policy: This policy protects buyers and lenders from potential defects in the title. It ensures that the property is free from liens or disputes over ownership.

Understanding these documents will empower you to navigate the real estate process more effectively. Being well-informed can lead to a smoother transaction, minimizing potential issues down the road. Always consider consulting with a real estate professional to ensure that you have all the necessary paperwork in order.

File Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Illinois Real Estate Purchase Agreement is used to outline the terms of a real estate transaction between a buyer and a seller. |

| Governing Law | This agreement is governed by the laws of the State of Illinois. |

| Essential Elements | Key elements include the purchase price, property description, and closing date. |

| Contingencies | Buyers can include contingencies, such as financing or inspection, to protect their interests. |

| Earnest Money | The agreement typically requires an earnest money deposit to show the buyer's commitment. |

| Disclosures | Sellers must provide disclosures about the property, including any known defects. |

| Signatures | Both parties must sign the agreement for it to be legally binding. |

Key takeaways

When filling out and using the Illinois Real Estate Purchase Agreement form, keep these key takeaways in mind:

- Accuracy is Crucial: Ensure that all information, including names, addresses, and property details, is filled out accurately. Mistakes can lead to complications later on.

- Understand Contingencies: Familiarize yourself with the contingencies included in the agreement. These are conditions that must be met for the sale to proceed, such as financing or inspection results.

- Review Terms Thoroughly: Take the time to read and understand all terms and conditions outlined in the agreement. This includes payment terms, closing dates, and any seller concessions.

- Seek Professional Guidance: Consider consulting a real estate agent or attorney. Their expertise can help clarify any questions and ensure that the agreement meets legal requirements.

Example - Illinois Real Estate Purchase Agreement Form

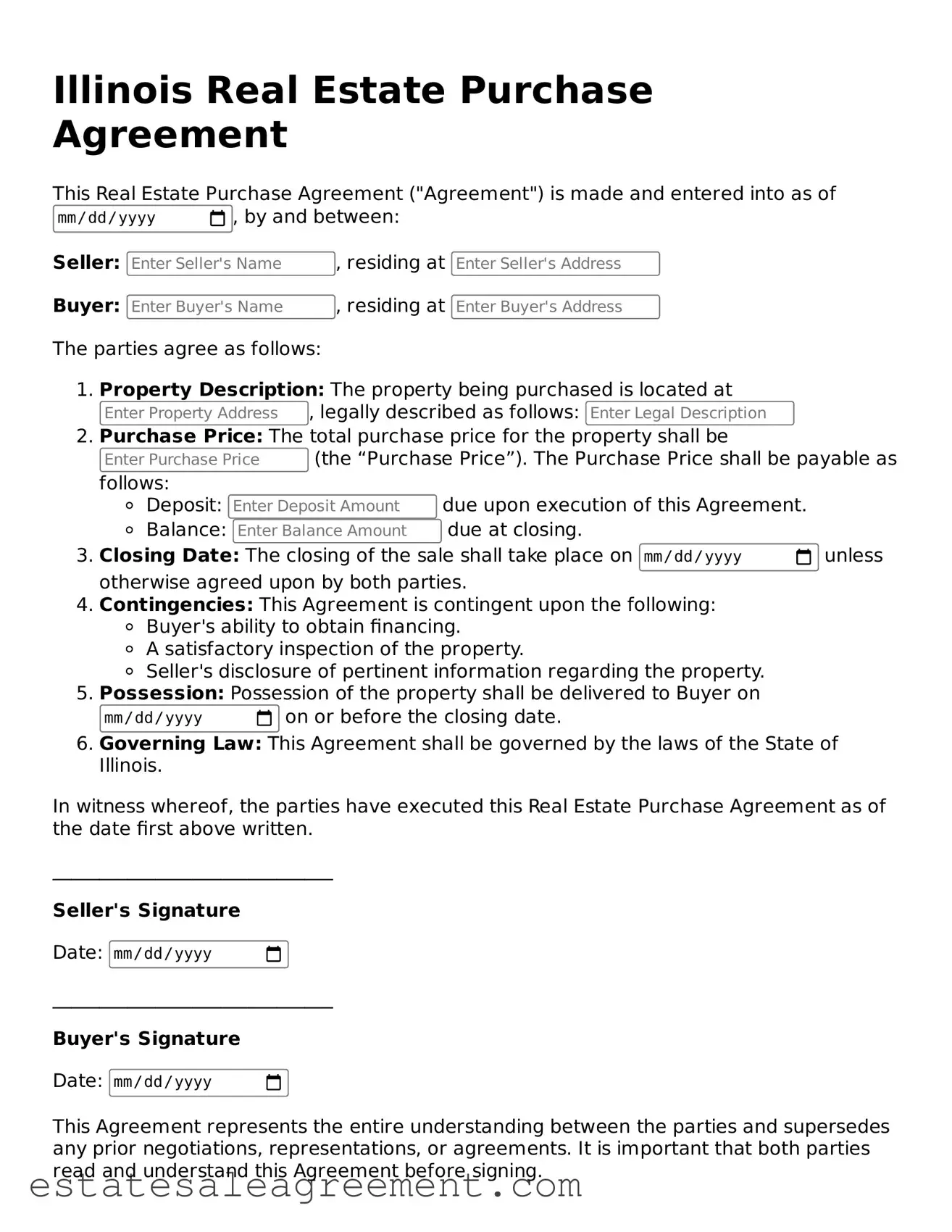

Illinois Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made and entered into as of , by and between:

Seller: , residing at

Buyer: , residing at

The parties agree as follows:

- Property Description: The property being purchased is located at , legally described as follows:

- Purchase Price: The total purchase price for the property shall be (the “Purchase Price”). The Purchase Price shall be payable as follows:

- Deposit: due upon execution of this Agreement.

- Balance: due at closing.

- Closing Date: The closing of the sale shall take place on unless otherwise agreed upon by both parties.

- Contingencies: This Agreement is contingent upon the following:

- Buyer's ability to obtain financing.

- A satisfactory inspection of the property.

- Seller's disclosure of pertinent information regarding the property.

- Possession: Possession of the property shall be delivered to Buyer on on or before the closing date.

- Governing Law: This Agreement shall be governed by the laws of the State of Illinois.

In witness whereof, the parties have executed this Real Estate Purchase Agreement as of the date first above written.

______________________________

Seller's Signature

Date:

______________________________

Buyer's Signature

Date:

This Agreement represents the entire understanding between the parties and supersedes any prior negotiations, representations, or agreements. It is important that both parties read and understand this Agreement before signing.

What to Know About This Form

What is the Illinois Real Estate Purchase Agreement form?

The Illinois Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a buyer agrees to purchase property from a seller. This form serves as a binding contract once both parties sign it. It typically includes essential details such as the purchase price, property description, contingencies, and closing date. By using this form, both buyers and sellers can ensure that their rights and responsibilities are clearly defined and legally enforceable.

What are the key components of the Illinois Real Estate Purchase Agreement?

Several important elements make up the Illinois Real Estate Purchase Agreement. Firstly, it includes the names of the buyer and seller, along with their contact information. Secondly, the property description is crucial, as it identifies the specific real estate being sold. Additionally, the agreement outlines the purchase price and any earnest money deposit. Contingencies, such as financing or inspections, are also included to protect the buyer's interests. Finally, the closing date and any conditions for closing are specified to ensure a smooth transaction.

Do I need a lawyer to complete the Illinois Real Estate Purchase Agreement?

What happens if the terms of the Illinois Real Estate Purchase Agreement are not met?

If either party fails to meet the terms outlined in the Illinois Real Estate Purchase Agreement, it may result in a breach of contract. In such cases, the non-breaching party may have several options. They could choose to seek damages or specific performance, which means requesting the court to enforce the agreement. Alternatively, the parties may negotiate a resolution or amendment to the contract. It is essential to understand the implications of any breach and to consult a legal professional if issues arise.

Fill out Other Real Estate Purchase Agreement Templates for Specific States

Purchase and Sales Agreement Nh - Specifies how and when the closing will be conducted.

Maryland Real Estate Contract - Provisions regarding property taxes may also be included in the agreement.

How to Write a Purchase and Sale Agreement - Provides the closing date, indicating when the transaction will be finalized.