Attorney-Approved Real Estate Purchase Agreement Form for Florida

Dos and Don'ts

When filling out the Florida Real Estate Purchase Agreement form, it’s important to be thorough and careful. Here are five things you should do and five things you should avoid.

Things You Should Do:

- Read the entire form carefully before filling it out.

- Provide accurate information about the property, including the address and legal description.

- Clearly state the purchase price and any deposit amounts.

- Include any contingencies, such as financing or inspection requirements.

- Sign and date the agreement to make it legally binding.

Things You Shouldn't Do:

- Do not leave any sections blank; incomplete forms can lead to issues.

- Avoid using vague language; be specific about terms and conditions.

- Do not rush through the process; take your time to ensure accuracy.

- Never sign the agreement without fully understanding its terms.

- Do not forget to consult with a real estate professional if you have questions.

Taking these steps can help ensure a smoother transaction and protect your interests.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to confusion and delays. Each section of the agreement must be thoroughly completed.

-

Incorrect Property Description: Providing an inaccurate description of the property can cause legal issues. Ensure that the address, lot number, and any additional identifying information are correct.

-

Missing Signatures: Both parties must sign the agreement. Omitting a signature could render the contract unenforceable.

-

Improper Dates: Entering incorrect or inconsistent dates can create confusion regarding the timeline of the transaction. Always double-check the dates for accuracy.

-

Neglecting Contingencies: Failing to include necessary contingencies, such as financing or inspection, can expose buyers or sellers to unexpected risks.

-

Ignoring Earnest Money Details: Not specifying the amount of earnest money or the conditions for its return can lead to disputes later in the process.

-

Overlooking Closing Costs: Not addressing who will pay for closing costs can result in misunderstandings. Clearly outline these responsibilities in the agreement.

-

Not Disclosing Relevant Information: Sellers must disclose known issues with the property. Failure to do so can lead to legal consequences.

-

Using Outdated Forms: Utilizing an old version of the Real Estate Purchase Agreement can lead to compliance issues. Always use the most current form.

-

Forgetting to Review: Skipping a thorough review of the agreement before signing can lead to overlooking critical details. Both parties should read the document carefully.

Documents used along the form

When engaging in a real estate transaction in Florida, several key documents often accompany the Florida Real Estate Purchase Agreement. Each of these documents plays a vital role in ensuring a smooth and legally sound process. Here’s a brief overview of some essential forms you may encounter.

- Seller's Disclosure Statement: This document requires the seller to disclose any known defects or issues with the property. It helps buyers make informed decisions based on the property's condition.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about the potential risks of lead-based paint. It ensures that buyers understand the hazards and their rights regarding inspections.

- Financing Addendum: This document outlines the terms of financing for the purchase. It details the buyer's loan type, amount, and any conditions that must be met for the sale to proceed.

- Title Commitment: A title commitment is a document from a title company that outlines the terms under which they will issue a title insurance policy. It ensures that the property title is clear of any liens or disputes.

- Closing Statement: This document summarizes the financial details of the transaction at closing. It includes all costs associated with the sale, such as closing costs, taxes, and fees, ensuring transparency for both parties.

- Bill of Sale: This document transfers ownership of personal property included in the sale, such as appliances or fixtures. It provides a clear record of what is included in the transaction.

Understanding these documents is crucial for both buyers and sellers. They ensure that all parties are on the same page and help prevent misunderstandings during the real estate transaction process.

File Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The Florida Real Estate Purchase Agreement is governed by the laws of the State of Florida. |

| Purpose | This form outlines the terms and conditions for the sale of real estate between a buyer and a seller. |

| Key Components | It typically includes details such as purchase price, financing terms, and contingencies. |

| Signatures Required | Both the buyer and seller must sign the agreement for it to be legally binding. |

Key takeaways

When it comes to buying or selling property in Florida, understanding the Real Estate Purchase Agreement form is crucial. Here are some key takeaways to keep in mind:

- Clarity is Key: Ensure that all terms are clearly defined. Ambiguities can lead to disputes later on.

- Understand Contingencies: Familiarize yourself with common contingencies such as financing, inspections, and appraisal. These protect both the buyer and seller.

- Deadlines Matter: Pay close attention to all deadlines for inspections, financing, and closing. Missing a deadline can jeopardize the deal.

- Disclosure Requirements: Sellers must disclose known issues with the property. Failure to do so can lead to legal consequences.

- Seek Professional Guidance: Consider working with a real estate agent or attorney to navigate the complexities of the agreement.

Being informed and proactive can make a significant difference in your real estate transaction. Take the time to review the agreement thoroughly and don’t hesitate to ask questions if something isn’t clear.

Example - Florida Real Estate Purchase Agreement Form

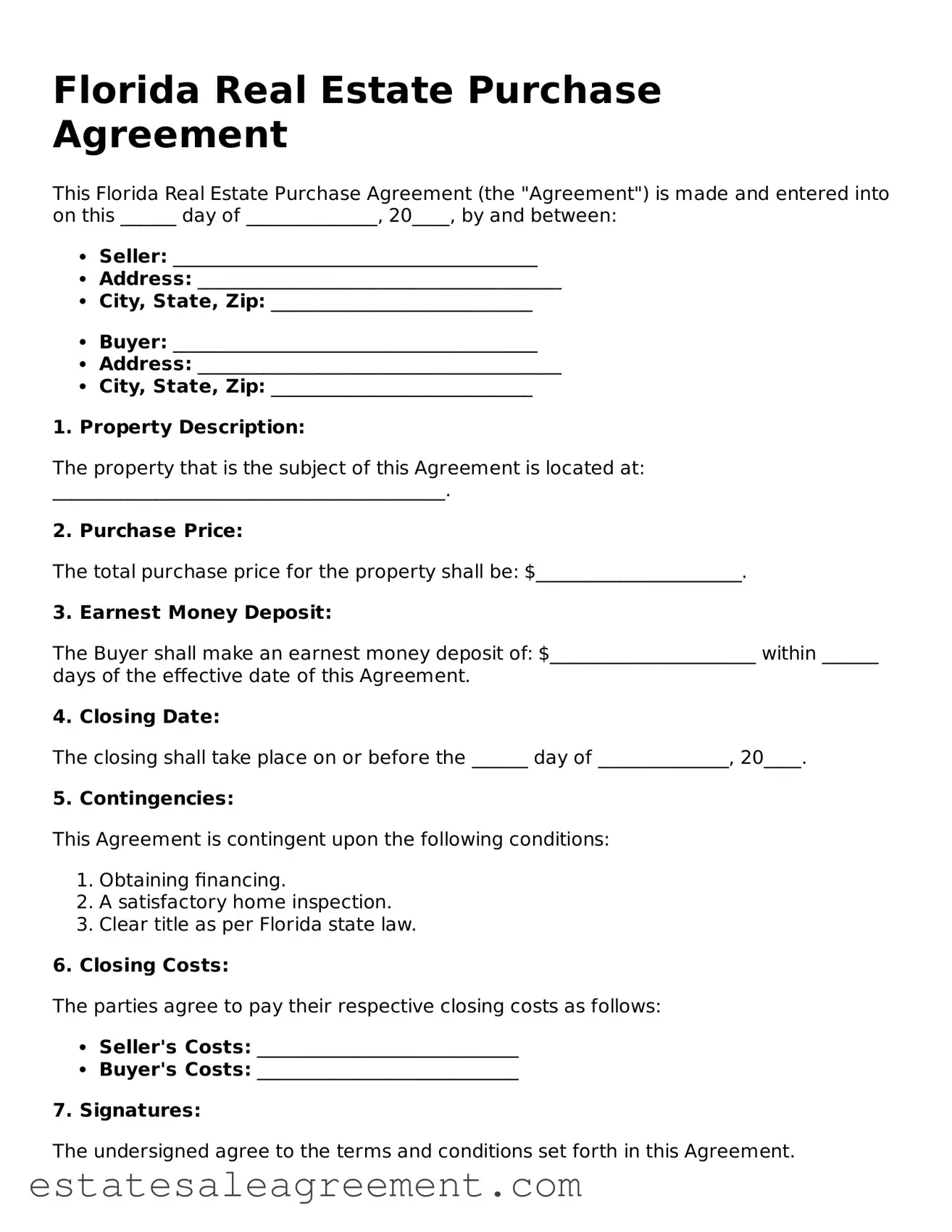

Florida Real Estate Purchase Agreement

This Florida Real Estate Purchase Agreement (the "Agreement") is made and entered into on this ______ day of ______________, 20____, by and between:

- Seller: _______________________________________

- Address: _______________________________________

- City, State, Zip: ____________________________

- Buyer: _______________________________________

- Address: _______________________________________

- City, State, Zip: ____________________________

1. Property Description:

The property that is the subject of this Agreement is located at: __________________________________________.

2. Purchase Price:

The total purchase price for the property shall be: $______________________.

3. Earnest Money Deposit:

The Buyer shall make an earnest money deposit of: $______________________ within ______ days of the effective date of this Agreement.

4. Closing Date:

The closing shall take place on or before the ______ day of ______________, 20____.

5. Contingencies:

This Agreement is contingent upon the following conditions:

- Obtaining financing.

- A satisfactory home inspection.

- Clear title as per Florida state law.

6. Closing Costs:

The parties agree to pay their respective closing costs as follows:

- Seller's Costs: ____________________________

- Buyer's Costs: ____________________________

7. Signatures:

The undersigned agree to the terms and conditions set forth in this Agreement.

- Seller's Signature: ________________________

- Date: ________________________

- Buyer's Signature: ________________________

- Date: ________________________

This Agreement is executed in accordance with the laws of the State of Florida.

What to Know About This Form

What is a Florida Real Estate Purchase Agreement?

The Florida Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions of a real estate transaction in the state of Florida. It serves as a contract between the buyer and seller, detailing the purchase price, property description, and any contingencies that must be met before the sale is finalized. This agreement is essential for ensuring that both parties understand their rights and obligations throughout the transaction process.

What key components should be included in the agreement?

A comprehensive Florida Real Estate Purchase Agreement should include several critical components. These typically consist of the buyer and seller's names, a detailed description of the property, the purchase price, earnest money deposit details, and any contingencies, such as financing or inspection requirements. Additionally, the agreement should specify the closing date, any included fixtures or personal property, and the responsibilities for closing costs. Each of these elements helps to clarify expectations and protect the interests of both parties.

What happens if one party wants to back out of the agreement?

If one party wishes to back out of the agreement, the consequences depend on the terms outlined in the contract and the timing of the withdrawal. If the buyer withdraws before any contingencies are met, they may forfeit their earnest money deposit. However, if the seller attempts to back out, they could face legal repercussions or be required to pay damages. It's crucial for both parties to understand their rights and obligations as outlined in the agreement, and consulting with a legal professional may be advisable in such situations.

Can the agreement be modified after it is signed?

Yes, the Florida Real Estate Purchase Agreement can be modified after it is signed, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both the buyer and seller to ensure that they are legally enforceable. This process helps to maintain clarity and prevent misunderstandings. It’s important to keep a record of all amendments to the agreement to ensure that both parties are on the same page throughout the transaction.

Fill out Other Real Estate Purchase Agreement Templates for Specific States

Home Contract Template - Provides for earnest money to show the buyer's commitment to purchase.

How to Make a Purchase Agreement - The agreement can specify the closing date and location.