Attorney-Approved Real Estate Purchase Agreement Form for District of Columbia

Dos and Don'ts

When filling out the District of Columbia Real Estate Purchase Agreement form, it is important to approach the process with care. This document is crucial in the buying and selling of property, and ensuring accuracy can help avoid potential disputes. Below is a list of things you should and shouldn't do.

- Do read the entire agreement carefully before filling it out.

- Do provide accurate and complete information for all parties involved.

- Do include all necessary terms, such as purchase price and closing date.

- Do consult with a real estate agent or attorney if you have questions.

- Do keep a copy of the signed agreement for your records.

- Don't rush through the form; take your time to ensure accuracy.

- Don't leave any blank spaces; fill in all required fields.

- Don't make assumptions about terms; clarify any uncertainties.

- Don't forget to sign and date the agreement before submission.

Common mistakes

-

Incomplete Information: One common mistake is failing to fill out all required fields. Every section of the form must be completed to ensure clarity and prevent delays in the transaction.

-

Incorrect Property Description: Accurately describing the property is crucial. Errors in the address or legal description can lead to confusion and potential legal issues later on.

-

Not Including Contingencies: Buyers often forget to include important contingencies, such as financing or inspection clauses. These contingencies protect the buyer's interests and should not be overlooked.

-

Missing Signatures: All parties involved in the transaction must sign the agreement. Omitting a signature can invalidate the contract, so double-checking for completeness is essential.

-

Ignoring Deadlines: The agreement includes various deadlines for inspections, financing, and other contingencies. Failing to adhere to these timelines can jeopardize the purchase.

-

Overlooking Earnest Money Details: Buyers sometimes neglect to specify the amount of earnest money or the terms for its return. Clear terms regarding earnest money help avoid disputes later.

-

Not Consulting Professionals: Some individuals fill out the form without seeking advice from real estate agents or attorneys. Professional guidance can help clarify terms and ensure compliance with local laws.

-

Failure to Review the Agreement: After filling out the form, it is vital to review the entire document for accuracy. Mistakes can easily be missed, so a careful review can save time and trouble.

Documents used along the form

When engaging in real estate transactions in the District of Columbia, several key documents accompany the Real Estate Purchase Agreement. Each of these documents plays a vital role in ensuring that the transaction is smooth and legally sound. Here’s a brief overview of five important forms often used alongside the purchase agreement.

- Property Disclosure Statement: This document provides essential information about the property's condition. Sellers are required to disclose any known issues, such as structural problems or past pest infestations, allowing buyers to make informed decisions.

- Lead-Based Paint Disclosure: For homes built before 1978, this form is crucial. It informs buyers about the potential presence of lead-based paint, which can pose health risks, especially to children. Sellers must provide this disclosure to ensure buyer awareness.

- Financing Addendum: This document outlines the terms of financing for the purchase. It specifies whether the buyer will be using a mortgage, cash, or other means to fund the purchase, helping to clarify the financial obligations involved.

- Home Inspection Contingency: Buyers often include this contingency to allow for a professional inspection of the property. If significant issues are discovered, buyers can negotiate repairs or even withdraw from the agreement without penalty.

- Settlement Statement: Also known as the HUD-1 form, this document is provided at closing. It details all financial transactions involved in the sale, including the purchase price, closing costs, and any adjustments, ensuring transparency for both parties.

Understanding these documents is essential for anyone involved in a real estate transaction. They help protect the interests of both buyers and sellers, ensuring a smoother and more transparent process. Familiarizing yourself with these forms can empower you to navigate the complexities of real estate with confidence.

File Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | The District of Columbia real estate transactions are governed by the D.C. Code Title 42. |

| Parties Involved | The agreement involves a buyer and a seller, each identified by their legal names. |

| Property Description | A clear description of the property, including the address and legal description, must be provided. |

| Purchase Price | The total purchase price of the property must be stated in the agreement. |

| Earnest Money Deposit | The agreement typically requires an earnest money deposit to demonstrate the buyer's commitment. |

| Closing Date | The agreement specifies a closing date, which is when the property transfer occurs. |

| Contingencies | Common contingencies may include financing, inspections, and appraisal conditions. |

| Disclosure Requirements | Sellers must disclose known defects and other material facts about the property. |

Key takeaways

Filling out the District of Columbia Real Estate Purchase Agreement form can seem daunting, but understanding its key elements can make the process smoother. Here are some important takeaways to keep in mind:

- Accuracy is Crucial: Ensure that all information is filled out correctly. This includes the names of the buyer and seller, property details, and any terms of the sale. Errors can lead to complications down the line.

- Contingencies Matter: Be aware of the contingencies included in the agreement. These are conditions that must be met for the sale to proceed, such as financing or home inspections. Clearly outlining these can protect both parties.

- Understand Your Obligations: Each party has specific responsibilities. Familiarize yourself with what is expected of you as either the buyer or seller. This can help avoid misunderstandings and ensure a smoother transaction.

- Seek Professional Guidance: While the form is designed for use by individuals, consulting with a real estate professional or attorney can provide valuable insights. They can help clarify any questions and ensure that your interests are protected.

Example - District of Columbia Real Estate Purchase Agreement Form

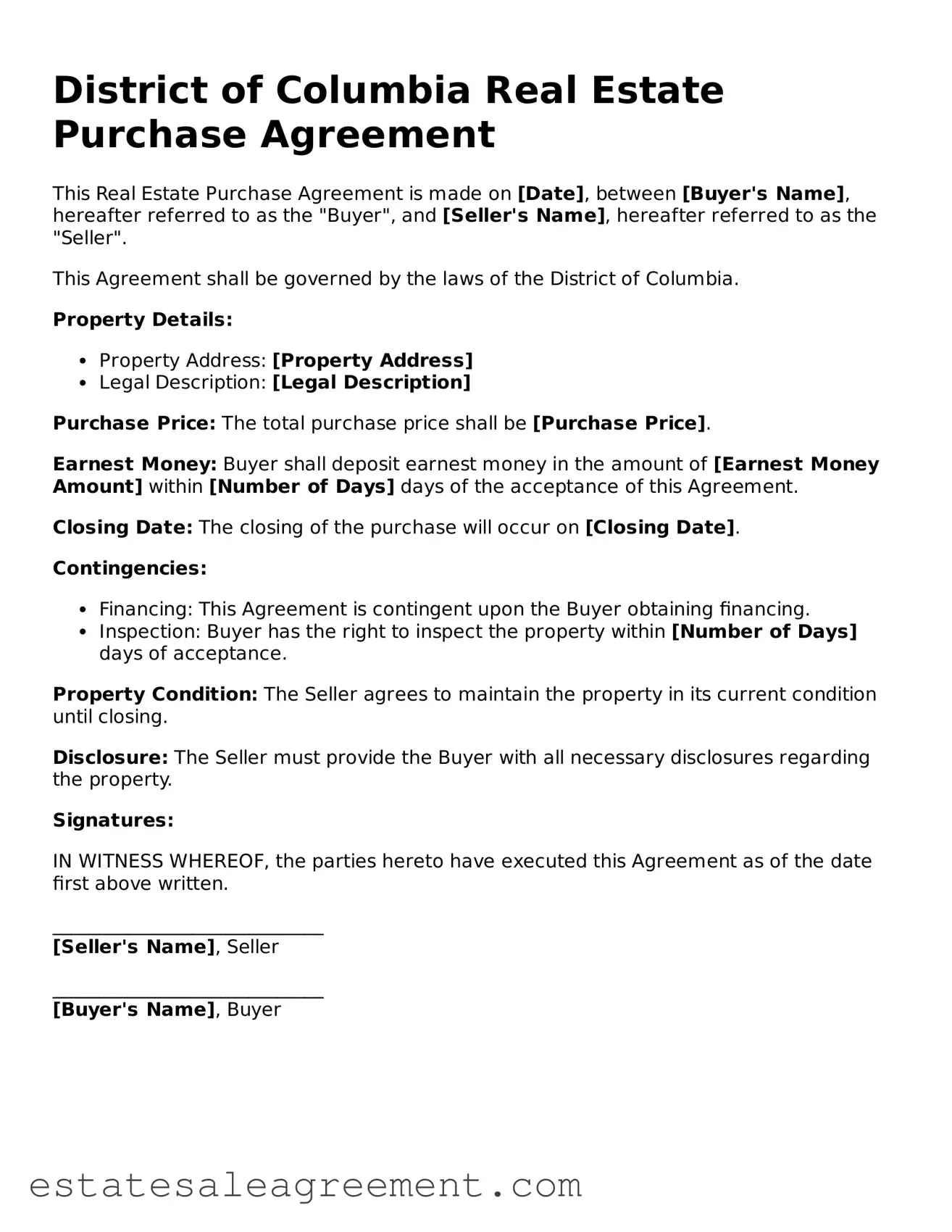

District of Columbia Real Estate Purchase Agreement

This Real Estate Purchase Agreement is made on [Date], between [Buyer's Name], hereafter referred to as the "Buyer", and [Seller's Name], hereafter referred to as the "Seller".

This Agreement shall be governed by the laws of the District of Columbia.

Property Details:

- Property Address: [Property Address]

- Legal Description: [Legal Description]

Purchase Price: The total purchase price shall be [Purchase Price].

Earnest Money: Buyer shall deposit earnest money in the amount of [Earnest Money Amount] within [Number of Days] days of the acceptance of this Agreement.

Closing Date: The closing of the purchase will occur on [Closing Date].

Contingencies:

- Financing: This Agreement is contingent upon the Buyer obtaining financing.

- Inspection: Buyer has the right to inspect the property within [Number of Days] days of acceptance.

Property Condition: The Seller agrees to maintain the property in its current condition until closing.

Disclosure: The Seller must provide the Buyer with all necessary disclosures regarding the property.

Signatures:

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first above written.

_____________________________

[Seller's Name], Seller

_____________________________

[Buyer's Name], Buyer

What to Know About This Form

What is the District of Columbia Real Estate Purchase Agreement form?

The District of Columbia Real Estate Purchase Agreement form is a legal document used to outline the terms and conditions under which a buyer agrees to purchase real estate from a seller. It serves as a binding contract that details the obligations of both parties involved in the transaction.

Who should use this form?

This form is intended for use by individuals or entities looking to buy or sell residential real estate in Washington, D.C. It is suitable for both experienced real estate investors and first-time homebuyers.

What key information is included in the agreement?

The agreement typically includes essential details such as the purchase price, property description, closing date, contingencies, and any included or excluded items. It also outlines the responsibilities of both the buyer and the seller throughout the transaction process.

Is the form legally binding?

Yes, once both parties sign the District of Columbia Real Estate Purchase Agreement, it becomes a legally binding contract. This means that both the buyer and seller are obligated to adhere to the terms outlined in the agreement unless mutually agreed otherwise.

What are contingencies, and why are they important?

Contingencies are conditions that must be met for the sale to proceed. Common contingencies include financing, home inspections, and appraisals. They are important because they protect the buyer by allowing them to withdraw from the agreement without penalty if certain conditions are not met.

Can the agreement be modified after it is signed?

Yes, the agreement can be modified after it is signed, but any changes must be documented in writing and signed by both parties. This ensures that all parties are aware of and agree to the new terms.

What happens if one party breaches the agreement?

If one party breaches the agreement, the other party may have legal recourse. This could include seeking damages or specific performance, which means requiring the breaching party to fulfill their obligations under the contract. It is advisable to consult with a legal professional in such situations.

Is it necessary to have a real estate agent when using this form?

While it is not mandatory to have a real estate agent, it is often beneficial. An agent can provide valuable guidance through the process, help negotiate terms, and ensure that the agreement is completed correctly.

Where can I obtain the District of Columbia Real Estate Purchase Agreement form?

The form can typically be obtained through real estate professionals, online legal document services, or local real estate associations. It is important to ensure that the version used is current and compliant with local laws.

Are there any fees associated with using this agreement?

While there may not be a fee specifically for using the form itself, there can be associated costs such as real estate agent commissions, inspection fees, and closing costs. It is important for both parties to be aware of these potential expenses when entering into a real estate transaction.

Fill out Other Real Estate Purchase Agreement Templates for Specific States

Delaware Agreement of Sale - This form helps prevent misunderstandings by detailing every aspect of the sale.

Purchase Agreement Michigan for Sale by Owner - A contract outlining the terms for buying real estate.