Attorney-Approved Real Estate Purchase Agreement Form for Delaware

Dos and Don'ts

When filling out the Delaware Real Estate Purchase Agreement form, it's essential to approach the process with care. Here are some important dos and don’ts to keep in mind:

- Do read the entire agreement carefully before filling it out.

- Do provide accurate and complete information about both the buyer and seller.

- Do consult with a real estate professional if you have any questions.

- Do ensure that all necessary signatures are obtained before submitting the form.

- Do keep a copy of the signed agreement for your records.

- Don’t leave any sections blank unless instructed to do so.

- Don’t rush through the process; take your time to ensure accuracy.

- Don’t make any alterations or changes without consulting a professional.

- Don’t ignore deadlines for submission or contingencies.

- Don’t forget to review any addendums or additional agreements related to the purchase.

Common mistakes

-

Incomplete Information: Buyers and sellers often neglect to fill out all required fields. Missing details such as names, addresses, or property descriptions can lead to confusion and potential legal issues down the line.

-

Incorrect Dates: Failing to specify or incorrectly stating important dates, such as the closing date or the date of acceptance, can create complications. These dates are crucial for ensuring that all parties are aligned on the timeline of the transaction.

-

Ignoring Contingencies: Some individuals overlook the importance of contingencies, such as financing or inspection clauses. These provisions protect buyers and sellers by allowing them to back out of the agreement under certain conditions.

-

Not Consulting Professionals: Many people attempt to fill out the agreement without seeking advice from real estate agents or attorneys. This can lead to misunderstandings about the terms and obligations outlined in the document.

Documents used along the form

When engaging in real estate transactions in Delaware, several forms and documents complement the Real Estate Purchase Agreement. Each of these documents serves a specific purpose in ensuring a smooth and legally sound process. Below is a list of commonly used forms that may be required.

- Property Disclosure Statement: This document outlines any known issues or defects with the property. Sellers are typically required to provide this statement to inform buyers of potential problems.

- Lead-Based Paint Disclosure: For properties built before 1978, this form informs buyers about the potential presence of lead-based paint. It is crucial for protecting the health of occupants, especially children.

- Title Search Report: A title search report verifies the ownership of the property and checks for any liens or encumbrances. This ensures that the seller has the right to sell the property.

- Settlement Statement (HUD-1): This document outlines all costs associated with the real estate transaction, including closing costs and fees. It provides transparency for both buyers and sellers at the time of closing.

- Mortgage Application: If the buyer is financing the purchase, this application is submitted to a lender. It includes personal financial information and details about the property being purchased.

- Home Inspection Report: After a home inspection is conducted, this report details the condition of the property. Buyers often use this information to negotiate repairs or price adjustments.

- Appraisal Report: An appraisal determines the fair market value of the property. Lenders typically require this report to ensure that the loan amount does not exceed the property's value.

- Closing Disclosure: This document is provided to the buyer at least three days before closing. It outlines the final terms of the loan, including interest rates and monthly payments, ensuring that the buyer understands their financial obligations.

These documents are integral to the real estate transaction process in Delaware. Each one plays a role in protecting the interests of both buyers and sellers, promoting transparency and informed decision-making throughout the process.

File Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The Delaware Real Estate Purchase Agreement is governed by the laws of the State of Delaware. |

| Purpose | This form outlines the terms and conditions for the sale of real estate in Delaware. |

| Parties Involved | The agreement involves a buyer and a seller, each identified clearly in the document. |

| Property Description | A detailed description of the property being sold is included to avoid any confusion. |

| Purchase Price | The total purchase price must be stated, along with any deposits made by the buyer. |

| Contingencies | Buyers can include contingencies, such as financing or inspections, to protect their interests. |

| Closing Date | The agreement specifies a closing date when the transaction will be finalized. |

| Default Provisions | It outlines what happens if either party fails to fulfill their obligations under the agreement. |

| Signatures Required | Both the buyer and seller must sign the agreement for it to be legally binding. |

| Dispute Resolution | The agreement may include clauses on how disputes will be resolved, such as mediation or arbitration. |

Key takeaways

When engaging in real estate transactions in Delaware, understanding the Real Estate Purchase Agreement (REPA) form is essential. Here are key takeaways to consider:

- Understand the Purpose: The REPA serves as a legally binding contract outlining the terms of the sale between the buyer and seller.

- Identify Parties: Clearly state the full names and contact information of both the buyer and seller to avoid confusion.

- Property Description: Provide a detailed description of the property, including the address and any specific features that define it.

- Purchase Price: Specify the agreed-upon purchase price and outline any deposit amounts to be paid upfront.

- Contingencies: Include any contingencies, such as financing or inspection, that must be met for the sale to proceed.

- Closing Date: Clearly state the anticipated closing date to ensure both parties are aligned on the timeline.

- Disclosures: Ensure that any required disclosures about the property’s condition are included, as mandated by Delaware law.

- Signatures: Both parties must sign the agreement for it to be valid. Ensure that the date of signing is also noted.

- Legal Review: It is advisable for both parties to have the agreement reviewed by a legal professional to safeguard their interests.

- Record Keeping: Keep a copy of the signed agreement for your records, as it will be important for future reference.

By paying attention to these key elements, individuals can navigate the Delaware Real Estate Purchase Agreement process more effectively and confidently.

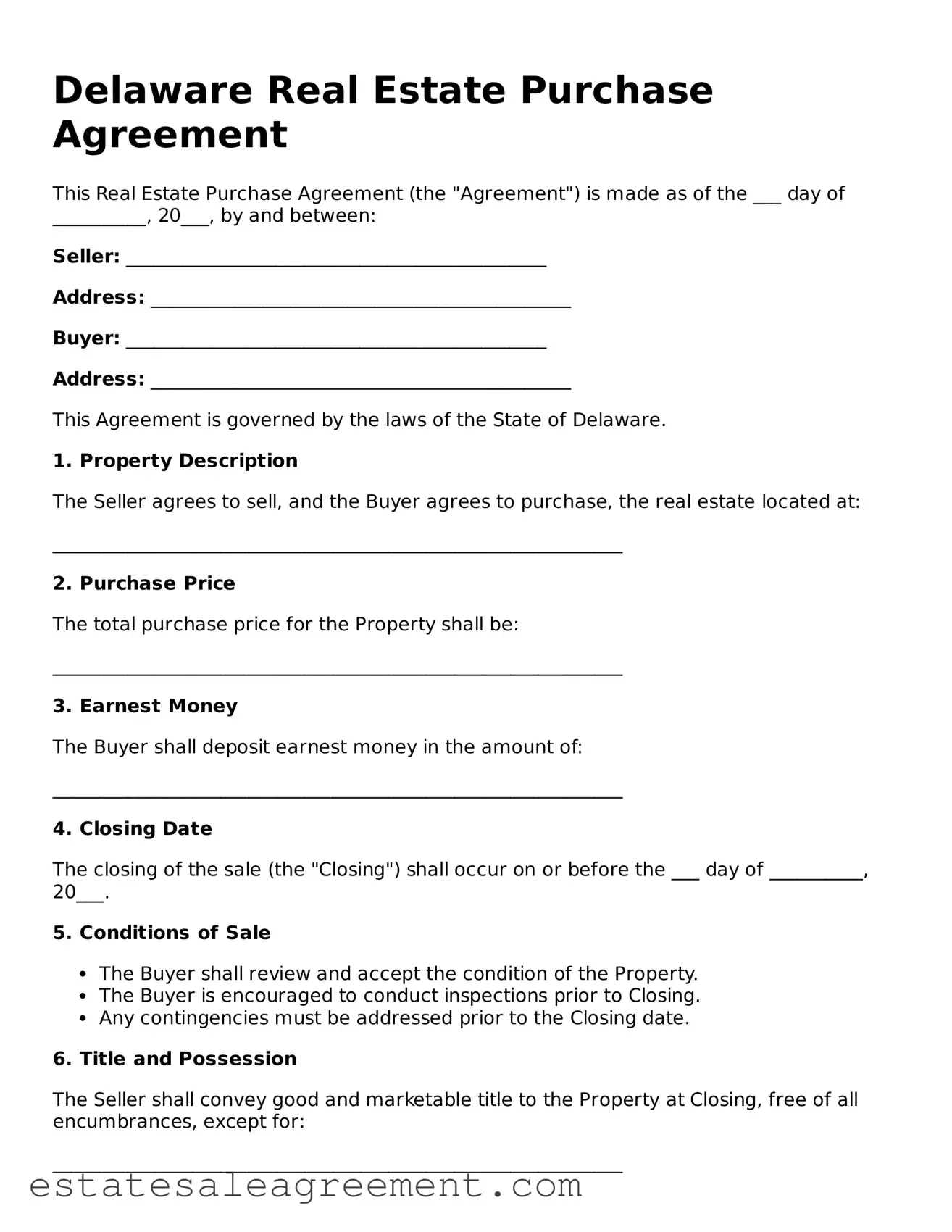

Example - Delaware Real Estate Purchase Agreement Form

Delaware Real Estate Purchase Agreement

This Real Estate Purchase Agreement (the "Agreement") is made as of the ___ day of __________, 20___, by and between:

Seller: _____________________________________________

Address: _____________________________________________

Buyer: _____________________________________________

Address: _____________________________________________

This Agreement is governed by the laws of the State of Delaware.

1. Property Description

The Seller agrees to sell, and the Buyer agrees to purchase, the real estate located at:

_____________________________________________________________

2. Purchase Price

The total purchase price for the Property shall be:

_____________________________________________________________

3. Earnest Money

The Buyer shall deposit earnest money in the amount of:

_____________________________________________________________

4. Closing Date

The closing of the sale (the "Closing") shall occur on or before the ___ day of __________, 20___.

5. Conditions of Sale

- The Buyer shall review and accept the condition of the Property.

- The Buyer is encouraged to conduct inspections prior to Closing.

- Any contingencies must be addressed prior to the Closing date.

6. Title and Possession

The Seller shall convey good and marketable title to the Property at Closing, free of all encumbrances, except for:

_____________________________________________________________

Possession of the Property shall be delivered to the Buyer on the Closing date.

7. Governing Law

This Agreement shall be interpreted in accordance with the laws of the State of Delaware.

8. Signatures

This Agreement may be executed in counterparts and may be executed electronically.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

Seller's Signature: ________________________________

Date: _____________________________________________

Buyer's Signature: ________________________________

Date: _____________________________________________

What to Know About This Form

What is a Delaware Real Estate Purchase Agreement?

A Delaware Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. It includes details such as the purchase price, property description, and any contingencies that must be met before the sale can be finalized.

What are the key components of this agreement?

The key components of a Delaware Real Estate Purchase Agreement include the names of the buyer and seller, a description of the property, the purchase price, earnest money deposit details, contingencies (such as financing or inspections), and the closing date. Each of these elements plays a crucial role in ensuring that both parties understand their obligations.

Is the agreement required to be in writing?

Yes, in Delaware, a Real Estate Purchase Agreement must be in writing to be enforceable. This requirement is in line with the Statute of Frauds, which mandates that contracts for the sale of real estate be documented in written form to protect both parties involved in the transaction.

What are contingencies, and why are they important?

Contingencies are conditions that must be met for the agreement to proceed. Common contingencies include financing approval, satisfactory home inspections, and the sale of the buyer's current home. They are important because they provide a way for the buyer to back out of the agreement without penalty if certain conditions are not satisfied.

How is the purchase price determined?

The purchase price is typically negotiated between the buyer and seller based on various factors, including the property's market value, condition, and comparable sales in the area. It is crucial for both parties to agree on a fair price before signing the agreement.

What happens if either party fails to fulfill their obligations?

If either party fails to meet their obligations as outlined in the agreement, it may result in a breach of contract. The non-breaching party may seek remedies, which could include enforcing the agreement, seeking damages, or terminating the contract. It is essential for both parties to understand their responsibilities to avoid potential disputes.

Can the agreement be modified after it is signed?

Yes, the Delaware Real Estate Purchase Agreement can be modified after it is signed, but any changes must be documented in writing and signed by both parties. This ensures that all modifications are clear and enforceable, protecting the interests of both the buyer and seller.

What is the role of an attorney in this process?

An attorney can provide valuable assistance throughout the real estate transaction process. They can help draft or review the purchase agreement, advise on legal implications, and ensure that all necessary disclosures are made. While not required, having legal representation can help protect the interests of both buyers and sellers.

Fill out Other Real Estate Purchase Agreement Templates for Specific States

House Contract - Included are parties’ legal descriptions and contact information.

Simple Real Estate Sales Contract - Allows for the sale of property as-is or with specific warranties.

How to Write a Purchase and Sale Agreement - The form can include clauses about disclosure obligations related to property condition.

Wisconsin Offer to Purchase Form - Information about property inspections and the negotiation of repair issues are outlined.