Attorney-Approved Real Estate Purchase Agreement Form for Connecticut

Dos and Don'ts

When filling out the Connecticut Real Estate Purchase Agreement form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here are nine things you should and shouldn't do:

- Do read the entire agreement carefully before filling it out.

- Do provide accurate and complete information about the property and parties involved.

- Do include all necessary contingencies, such as financing and inspections.

- Do consult with a real estate professional if you have questions.

- Do ensure that all signatures are present and dated.

- Don't leave any blanks; fill in every required field.

- Don't use vague language; be specific in your terms and conditions.

- Don't forget to review local laws that may affect the agreement.

- Don't rush through the process; take your time to avoid mistakes.

Common mistakes

-

Inaccurate Property Description: Buyers often fail to provide a complete and precise description of the property. This includes the address, lot number, and any relevant details that define the property boundaries.

-

Missing Signatures: One common oversight is neglecting to sign the agreement. All parties involved must sign to make the document legally binding.

-

Incorrect Dates: Dates are crucial in a purchase agreement. People sometimes enter the wrong closing date or fail to specify important timelines, which can lead to confusion later.

-

Omitting Contingencies: Buyers may forget to include necessary contingencies, such as financing or inspection clauses. These protect the buyer's interests and should not be overlooked.

-

Ignoring Local Laws: Each state has its own regulations regarding real estate transactions. Failing to comply with Connecticut’s specific requirements can invalidate the agreement.

Documents used along the form

When engaging in a real estate transaction in Connecticut, several forms and documents often accompany the Real Estate Purchase Agreement. Each of these documents serves a specific purpose and helps ensure a smooth process for both buyers and sellers. Below is a list of commonly used forms.

- Property Disclosure Statement: This document provides information about the property's condition and any known issues. Sellers must disclose material defects to protect buyers from unexpected problems.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers of potential lead hazards. It helps ensure that buyers are aware of the risks associated with lead paint.

- Home Inspection Report: A home inspection is often conducted to assess the property's condition. The report details findings and can influence negotiations between buyers and sellers.

- Title Search Report: This document verifies the property's ownership and checks for any liens or claims against it. A clear title is essential for a successful transaction.

- Mortgage Application: If the buyer is financing the purchase, they will need to complete a mortgage application. This form collects financial information to help lenders assess creditworthiness.

- Closing Disclosure: This document outlines the final terms of the mortgage, including loan costs and closing costs. It must be provided to the buyer at least three days before closing.

- Bill of Sale: This form transfers ownership of personal property included in the sale, such as appliances or furniture. It ensures clarity on what is included in the transaction.

- Deed: The deed is the legal document that transfers ownership of the property from the seller to the buyer. It must be recorded with the local government to be effective.

- Affidavit of Title: This document is a sworn statement by the seller affirming their ownership and that there are no undisclosed liens or claims against the property.

Understanding these documents can help both buyers and sellers navigate the complexities of real estate transactions in Connecticut. Each form plays a vital role in ensuring that all parties are informed and protected throughout the process.

File Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The Connecticut Real Estate Purchase Agreement is governed by the Connecticut General Statutes, particularly Chapter 825, which outlines real estate transactions. |

| Purpose | This form is used to outline the terms and conditions of a real estate transaction between a buyer and a seller. |

| Essential Components | The agreement typically includes details such as purchase price, property description, and closing date. |

| Contingencies | Buyers may include contingencies, such as financing or inspection, to protect their interests. |

| Signatures Required | Both the buyer and seller must sign the agreement for it to be legally binding. |

| Disclosure Requirements | Connecticut law mandates that sellers provide certain disclosures about the property’s condition to the buyer. |

Key takeaways

When dealing with the Connecticut Real Estate Purchase Agreement form, there are several important aspects to keep in mind. Understanding these key points can help ensure a smooth transaction.

- Clarity is Essential: Fill out the form with clear and precise information. Ambiguities can lead to misunderstandings later on.

- Understand Contingencies: Be aware of the various contingencies included in the agreement, such as financing or inspection clauses. These protect both the buyer and seller.

- Review Terms Thoroughly: Carefully review all terms and conditions before signing. Pay attention to deadlines and obligations to avoid potential disputes.

- Seek Legal Guidance: Consider consulting with a real estate attorney. Their expertise can provide valuable insights and help navigate complex issues.

Example - Connecticut Real Estate Purchase Agreement Form

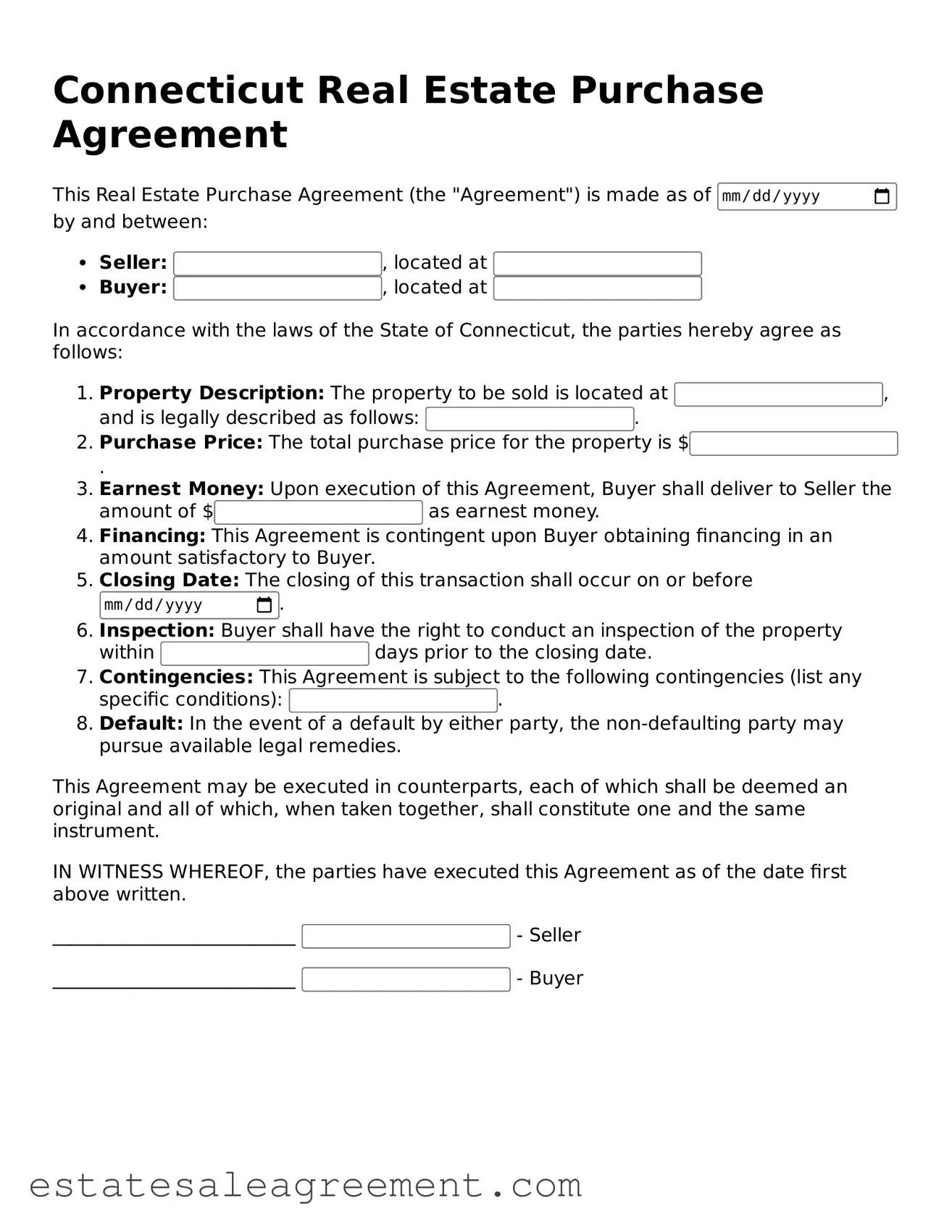

Connecticut Real Estate Purchase Agreement

This Real Estate Purchase Agreement (the "Agreement") is made as of by and between:

- Seller: , located at

- Buyer: , located at

In accordance with the laws of the State of Connecticut, the parties hereby agree as follows:

- Property Description: The property to be sold is located at , and is legally described as follows: .

- Purchase Price: The total purchase price for the property is $.

- Earnest Money: Upon execution of this Agreement, Buyer shall deliver to Seller the amount of $ as earnest money.

- Financing: This Agreement is contingent upon Buyer obtaining financing in an amount satisfactory to Buyer.

- Closing Date: The closing of this transaction shall occur on or before .

- Inspection: Buyer shall have the right to conduct an inspection of the property within days prior to the closing date.

- Contingencies: This Agreement is subject to the following contingencies (list any specific conditions): .

- Default: In the event of a default by either party, the non-defaulting party may pursue available legal remedies.

This Agreement may be executed in counterparts, each of which shall be deemed an original and all of which, when taken together, shall constitute one and the same instrument.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

__________________________ - Seller

__________________________ - Buyer

What to Know About This Form

What is a Connecticut Real Estate Purchase Agreement?

The Connecticut Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This agreement includes essential details such as the purchase price, closing date, and any contingencies that must be met before the sale can be finalized. It serves as a roadmap for both parties, ensuring that everyone is on the same page regarding the transaction.

What key elements should be included in the agreement?

A comprehensive Connecticut Real Estate Purchase Agreement should include several key elements. These typically encompass the names of the buyer and seller, a detailed description of the property, the agreed-upon purchase price, and the method of payment. Additionally, it should outline any contingencies, such as financing or inspection requirements, as well as the closing date and any special provisions that may apply. Clarity in these areas helps prevent misunderstandings later on.

Are there any contingencies I should consider including?

Contingencies are crucial in a real estate purchase agreement as they protect both the buyer and the seller. Common contingencies include financing, where the buyer must secure a mortgage, and home inspection, allowing the buyer to conduct a thorough inspection of the property. Other contingencies might involve the sale of the buyer’s current home or specific repairs that need to be made by the seller. Including these can provide peace of mind and ensure that the transaction proceeds smoothly.

What happens if either party wants to back out of the agreement?

If either party wishes to back out of the Connecticut Real Estate Purchase Agreement, the consequences depend on the terms outlined in the agreement. If the buyer backs out without a valid contingency, they may forfeit their earnest money deposit. Conversely, if the seller tries to withdraw without justification, the buyer may have grounds for legal recourse or could seek damages. It’s essential to understand the implications of withdrawing from the agreement and to communicate openly to avoid potential disputes.

Fill out Other Real Estate Purchase Agreement Templates for Specific States

Gcaar Rental Application - Details how the earnest money will be handled post-agreement.

Purchase Agreement Michigan for Sale by Owner - Can outline the liabilities of each party in transactions.

Montana Buy Sell Agreement - Sets forth conditions for acceptance or rejection of offers and counter-offers.

Maryland Real Estate Contract - Terms related to possession of the property are specified to avoid disputes.