Attorney-Approved Real Estate Purchase Agreement Form for California

Dos and Don'ts

When filling out the California Real Estate Purchase Agreement form, it’s important to approach the task carefully. Here are some essential dos and don’ts to keep in mind:

- Do read the entire form thoroughly before starting.

- Do provide accurate information about the property and parties involved.

- Do ensure all required fields are completed.

- Do consult with a real estate agent or attorney if you have questions.

- Don’t leave any blank spaces; use "N/A" if something doesn’t apply.

- Don’t rush through the process; take your time to avoid mistakes.

- Don’t forget to keep a copy of the signed agreement for your records.

Common mistakes

-

Inaccurate Property Description: One common mistake is failing to provide a complete and accurate description of the property. This includes not just the address but also the parcel number and any relevant details about the property boundaries.

-

Missing Signatures: It is essential for all parties involved to sign the agreement. Sometimes, buyers or sellers forget to sign, which can lead to delays or even invalidate the agreement.

-

Incorrect Dates: Another frequent error is not filling in the dates correctly. This includes the date of acceptance and any deadlines for contingencies. Missing or incorrect dates can create confusion and lead to potential legal issues.

-

Neglecting Contingencies: Failing to include necessary contingencies, such as financing or inspection clauses, can be a significant oversight. These contingencies protect buyers and sellers and ensure that both parties have a clear understanding of the agreement's conditions.

Documents used along the form

The California Real Estate Purchase Agreement is a critical document in the home buying process. However, it is often accompanied by several other forms and documents that help facilitate the transaction. Understanding these documents can provide clarity and ensure a smoother experience for both buyers and sellers.

- Disclosure Statement: This document outlines any known issues or defects with the property. Sellers are required to disclose specific information to protect buyers from unexpected problems.

- Pre-Approval Letter: A letter from a lender indicating that a buyer is pre-approved for a mortgage. This shows sellers that the buyer is financially capable of completing the purchase.

- Title Report: A report that details the ownership history of the property. It identifies any liens, easements, or encumbrances that may affect ownership.

- Home Inspection Report: A detailed assessment of the property’s condition conducted by a professional inspector. This report helps buyers understand any necessary repairs or maintenance issues.

- Appraisal Report: An evaluation of the property's market value conducted by a licensed appraiser. Lenders often require this to ensure the property is worth the amount being financed.

- Counteroffer: A response from the seller to the buyer’s initial offer, which may include changes to the price or terms. This document helps facilitate negotiations between both parties.

- Escrow Instructions: Guidelines provided to the escrow company detailing how to handle the transaction. This includes instructions for the disbursement of funds and transfer of property ownership.

- Closing Disclosure: A document that outlines the final terms of the mortgage, including loan costs and closing costs. Buyers must receive this at least three days before closing.

- Deed: A legal document that transfers ownership of the property from the seller to the buyer. It must be signed and recorded to be valid.

These documents collectively contribute to a comprehensive understanding of the real estate transaction process. Familiarity with each form can help ensure that buyers and sellers are well-prepared and informed throughout their journey.

File Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The California Real Estate Purchase Agreement is used to outline the terms and conditions of a real estate transaction between a buyer and a seller. |

| Governing Law | This agreement is governed by the laws of the State of California. |

| Key Components | The form typically includes sections on purchase price, financing, contingencies, and closing dates. |

| Signature Requirement | Both the buyer and seller must sign the agreement for it to be legally binding. |

| Contingencies | Common contingencies may include home inspections, appraisal, and loan approval. |

| Disclosure Obligations | Sellers are required to disclose known defects and issues with the property to the buyer. |

Key takeaways

When engaging in real estate transactions in California, understanding the Real Estate Purchase Agreement (RPA) is crucial. This form outlines the terms and conditions under which a property is bought and sold. Here are some key takeaways to keep in mind when filling out and using this important document:

- Clarity is Essential: Ensure that all terms are clearly defined. Ambiguities can lead to misunderstandings and disputes later on.

- Complete All Sections: Every section of the form should be filled out completely. Incomplete agreements may not be enforceable.

- Include Contingencies: Consider adding contingencies that protect your interests, such as financing or inspection clauses. These can provide an exit strategy if certain conditions are not met.

- Review for Accuracy: Double-check all information, including names, addresses, and legal descriptions of the property. Errors can complicate the transaction.

- Seek Professional Guidance: Consulting with a real estate agent or attorney can provide valuable insights and help navigate any complexities in the agreement.

By keeping these points in mind, individuals can approach the Real Estate Purchase Agreement with greater confidence and clarity, ultimately leading to a smoother transaction process.

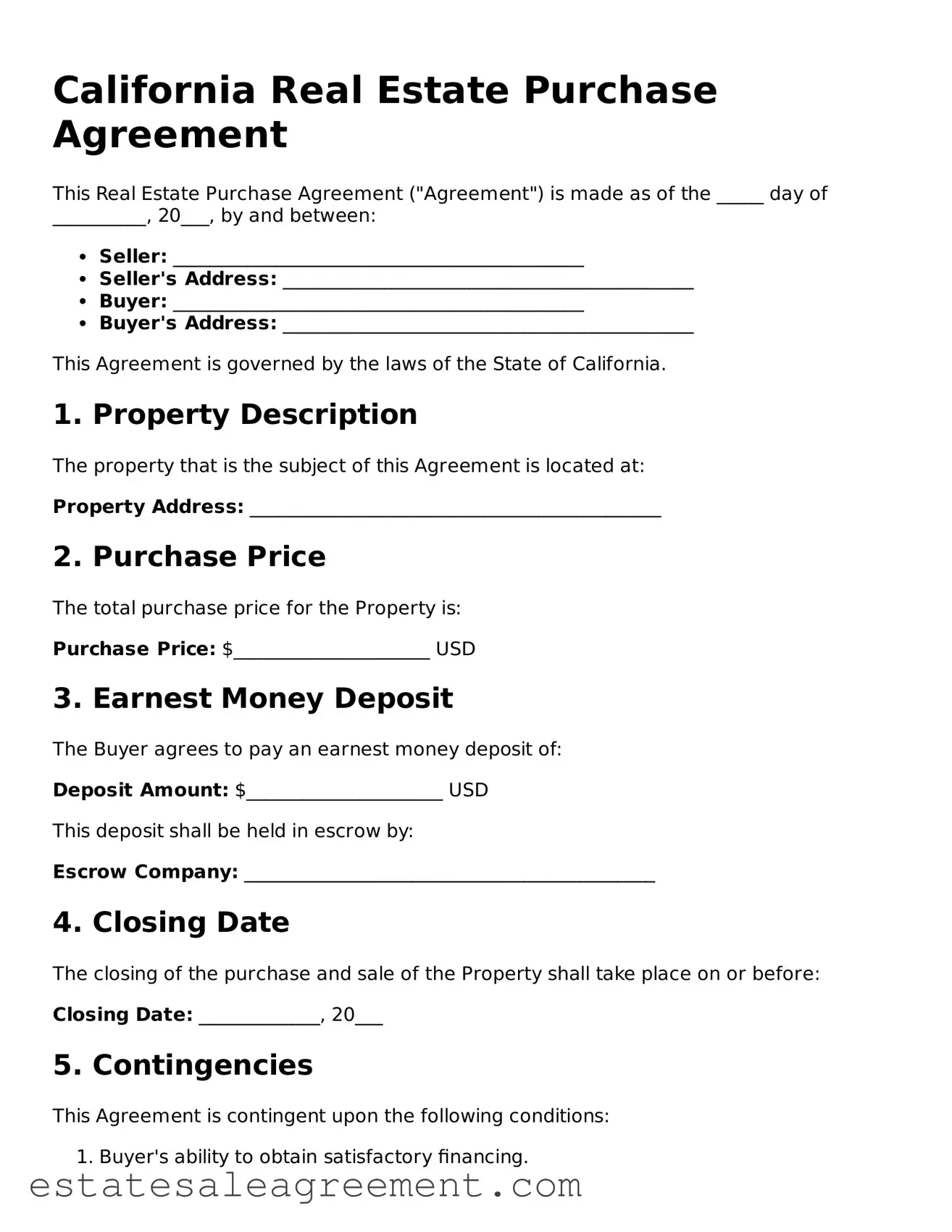

Example - California Real Estate Purchase Agreement Form

California Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made as of the _____ day of __________, 20___, by and between:

- Seller: ____________________________________________

- Seller's Address: ____________________________________________

- Buyer: ____________________________________________

- Buyer's Address: ____________________________________________

This Agreement is governed by the laws of the State of California.

1. Property Description

The property that is the subject of this Agreement is located at:

Property Address: ____________________________________________

2. Purchase Price

The total purchase price for the Property is:

Purchase Price: $_____________________ USD

3. Earnest Money Deposit

The Buyer agrees to pay an earnest money deposit of:

Deposit Amount: $_____________________ USD

This deposit shall be held in escrow by:

Escrow Company: ____________________________________________

4. Closing Date

The closing of the purchase and sale of the Property shall take place on or before:

Closing Date: _____________, 20___

5. Contingencies

This Agreement is contingent upon the following conditions:

- Buyer's ability to obtain satisfactory financing.

- Completion of a satisfactory home inspection.

- Seller providing clear title to the Property.

6. Additional Terms

Additional terms relevant to this Agreement:

________________________________________________________________

________________________________________________________________

7. Signatures

By signing below, both parties agree to the terms stated in this Agreement.

Seller's Signature: _________________________ Date: __________

Buyer's Signature: _________________________ Date: __________

What to Know About This Form

What is a California Real Estate Purchase Agreement?

The California Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a property will be sold. It serves as a binding contract between the buyer and the seller, detailing aspects such as the purchase price, financing terms, and any contingencies that must be met before the sale can be finalized. This agreement is essential for protecting the interests of both parties involved in the transaction.

What key elements are included in the agreement?

Several important components are typically included in a California Real Estate Purchase Agreement. These elements often cover the purchase price, property description, closing date, contingencies (like inspections or financing), and any disclosures required by law. Additionally, it may outline the responsibilities of both the buyer and seller, ensuring clarity throughout the transaction process.

How does the contingency clause work?

A contingency clause in the agreement allows the buyer to back out of the purchase under certain conditions without losing their deposit. Common contingencies include the buyer's ability to secure financing, satisfactory home inspections, and the sale of the buyer's current home. If these conditions are not met, the buyer can withdraw from the agreement without penalties, protecting their interests.

What happens after the agreement is signed?

Once both parties have signed the agreement, it becomes a legally binding contract. The buyer typically submits an earnest money deposit to demonstrate their commitment to the purchase. Following this, the parties will work through the steps outlined in the agreement, including inspections, appraisals, and finalizing financing. The closing process will culminate in the transfer of ownership, usually at a title company or attorney's office.

Can the agreement be modified after signing?

Yes, modifications can be made to the California Real Estate Purchase Agreement after it has been signed, but both parties must agree to any changes. This is usually done through an addendum, which is a separate document that outlines the specific alterations. It’s important to ensure that any modifications are documented in writing to maintain clarity and legal standing.

What should I do if I have questions about the agreement?

If you have questions or concerns about the California Real Estate Purchase Agreement, it is advisable to consult with a real estate agent or an attorney. They can provide guidance specific to your situation and help clarify any aspects of the agreement that may be confusing. Seeking professional advice can help you navigate the complexities of the real estate transaction process with confidence.

Fill out Other Real Estate Purchase Agreement Templates for Specific States

Nebraska Purchase Agreement Pdf - Sets timelines for completing inspections and closing the sale.

Simple Real Estate Sales Contract - Specifies what happens if either party breaches the agreement.